NEW YORK — U.S. stocks snapped a four‑day losing streak on Wednesday, November 19, 2025, as Wall Street steadied ahead of — and then reacted to — blockbuster earnings from Nvidia and newly released Federal Reserve minutes that underscored a sharp split over future interest-rate cuts.

The Dow Jones Industrial Average inched up about 0.1%, the S&P 500 gained roughly 0.4%, and the Nasdaq Composite advanced 0.6%, with both the Dow and S&P ending their four-session slides.Investopedia+1

After the closing bell, Nvidia’s Q3 FY2026 earnings came in well above expectations, sending its shares higher in after-hours trading and giving a further boost to tech sentiment and risk assets from equity futures to Bitcoin.GlobeNewswire+2Business Insider+2

Index recap: Wall Street finally breaks its losing streak

During the regular session:

- Dow Jones Industrial Average: +0.1% to around 46,138

- S&P 500: +0.4% to about 6,642

- Nasdaq Composite: +0.6% to roughly 22,564

Both the Dow and S&P 500 broke their four-day runs of losses, while the Nasdaq posted a second day of gains after recent pressure on high‑growth and AI‑linked names.Investopedia+1

Market breadth improved as technology, basic materials and industrials led the advance, while more defensive and rate‑sensitive pockets such as real estate and especially energy lagged.Investing.com+1

The tone was cautious rather than euphoric: intraday moves were choppy, with indexes repeatedly swinging around the flat line as traders waited for Nvidia’s earnings and digested the latest signals from the Federal Reserve.

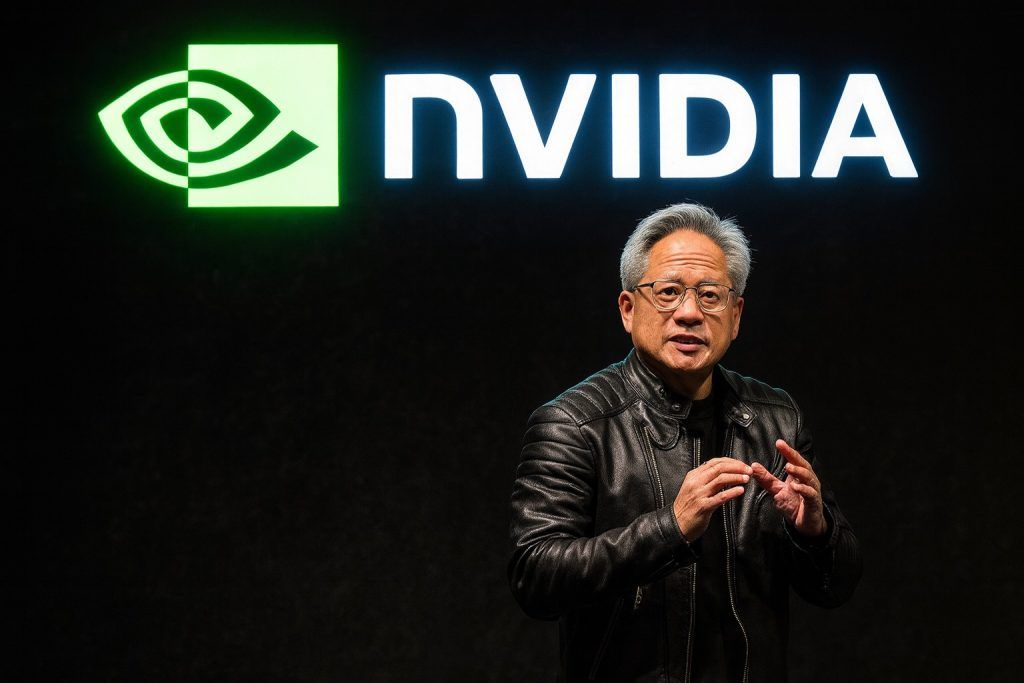

Nvidia earnings: AI bellwether beats big — and lifts the market after hours

The day’s main event came after the closing bell. Nvidia, the world’s most valuable public company and the market’s key proxy for the AI boom, reported record third‑quarter FY2026 results:

- Revenue: about $57.0 billion, up 62% year‑on‑year, topping estimates near $55 billion

- Data center revenue: $51.2 billion, up roughly 66% year‑on‑year, beating expectations around $49–49.5 billion

- Adjusted EPS: $1.30, above consensus forecasts near $1.26

- Adjusted gross margin: about 73.6%

- Q4 revenue guidance: roughly $63.7–$66.3 billion, ahead of Wall Street forecastsGlobeNewswire+2Business Insider+2

Nvidia shares had already climbed around 2.8–3.0% in the regular session, making the stock the top performer in the Dow.Investing.com+1 Early reports show the stock added another 3–4% in after‑hours trading as investors cheered the beat and strong guidance.Business Insider+1

The earnings print lands squarely in the middle of an increasingly heated “AI boom vs. AI bubble” debate. A recent survey of fund managers cited AI as the top tail risk, with nearly half of respondents now calling it a bubble and more than half saying AI stocks are already overvalued.Investopedia

Yet Nvidia’s numbers show demand for high‑end GPUs and data‑center infrastructure remains extremely strong, at least for now — a message likely to reverberate through mega‑cap tech and the broader market in Thursday’s session.

Fed minutes: deep divisions over December rate cut

Earlier in the day, traders pored over the minutes of the Federal Reserve’s October 28–29 meeting, released at 2 p.m. ET.

Key takeaways:

- A majority of Fed policymakers still see room for more rate cuts, but many officials argued it would be appropriate to leave rates unchanged for the rest of the year.AP News

- The Fed cut its benchmark rate to around 3.9% at that meeting, the second reduction this year, but there is no consensus on delivering a third cut in December.AP News

- Policymakers are split between concerns about still‑elevated inflation (around 3%) and a softening labor market, creating a tug‑of‑war over how quickly to keep easing.AP News+1

Interest‑rate futures now price much lower odds of a December rate cut than a month ago, when markets treated it as almost a done deal. Estimates of the probability have fallen from near‑certainty to roughly one‑in‑three, based on CME FedWatch data.Kiplinger+1

Despite the hawkish shift in expectations, markets took the minutes largely in stride. The 10‑year U.S. Treasury yieldedged up to around 4.13%, a gain of about 2 basis points from the prior session, while the U.S. dollar index climbed toward 100.2, up roughly 0.6%.Trading Economics+1

Jobs report finally arrives after shutdown delay

Another macro storyline hanging over markets is the long‑delayed September U.S. jobs report.

Because of the 43‑day federal government shutdown earlier this autumn, the September payrolls data — originally scheduled for October 3 — will be released Thursday morning, while the Bureau of Labor Statistics has warned that full October jobs data will not be published on schedule.Investopedia+1

The unusual gap in labor‑market data complicates the Fed’s job and contributes to uncertainty around its December decision, one reason volatility has picked up even as indexes remain near historic highs.

Sector snapshot: tech leads, energy sinks

Wednesday’s gains were far from evenly distributed across the S&P 500:

- Technology led the advance, helped by the pre‑earnings rally in Nvidia and solid moves in other mega‑cap names.Investing.com+1

- Energy was the worst‑performing S&P 500 sector, sliding about 1.7%, roughly double the drop in the next‑weakest sector, real estate.Investopedia

Among individual stocks:

- Nvidia (NVDA): up about 2.8–2.9% in regular trading, then rising further after hours on earnings.Investing.com+2Business Insider+2

- Eversource Energy plunged roughly 8.5%, making it the single worst performer in the S&P 500; other refiners and energy names, including APA, Valero, Phillips 66 and Marathon Petroleum, also ranked among the biggest decliners.Investopedia

The pressure on energy shares mirrors a continued slide in crude prices. WTI crude futures fell more than 2% on the day to trade near $59.50 per barrel, extending a multi‑week downtrend driven by oversupply worries and rising inventories.Investopedia+2Bloomberg+2

Retail and consumer names: Lowe’s shines, others stumble

Earnings in the consumer and retail space delivered a mixed picture:

- Lowe’s jumped more than 5% after the home‑improvement chain reported better‑than‑expected Q3 profits, modest comparable‑sales growth, and raised its full‑year revenue outlook to about $86 billion, even as it flagged a still‑uncertain macro environment.Investopedia

- A day after rival Home Depot disappointed, the contrast suggested ongoing divergence across housing‑related spending and professional vs. do‑it‑yourself customer trends.Investopedia+1

- Discounters showed a mixed performance, with some retailers under pressure as investors scrutinized margins and guidance into the crucial holiday season.Yahoo Finance+1

These results reinforced the idea of a “two‑track consumer”: resilient spending among higher‑income households, but more cautious behavior in lower‑income segments facing persistent price pressures and higher borrowing costs.

Adobe–Semrush deal and other notable movers

Outside the major indexes, deal news and stock‑specific stories drove outsized moves:

- Adobe announced it will acquire digital‑marketing platform Semrush for $1.9 billion in cash, or $12 per share, a roughly 77% premium to Tuesday’s close. Semrush stock surged about 74% on the news.Kiplinger

- The deal is pitched as a way to integrate generative‑AI‑driven “GEO” (generative engine optimization) tools into Adobe’s marketing suite, underscoring how strategic M&A is being used to accelerate AI capabilities.Kiplinger

Small‑ and mid‑cap price action remained volatile, with some high‑beta names soaring on speculative flows and others selling off sharply on disappointing results or guidance — a pattern consistent with rising overall market anxiety, as reflected in volatility gauges.

Volatility, AI fears and positioning

Under the surface, measures of market stress show investors are still on edge:

- The Cboe Volatility Index (VIX) has recently climbed toward the mid‑20s, near its highest readings since May, after spending much of the second half of the year in the mid‑teens.Investopedia

- CNN’s Fear & Greed Index has dropped into “Extreme Fear” territory across most of its components, reflecting worsening momentum and breadth.Investopedia

Many institutional players have shifted toward defensive sectors such as healthcare while trimming tech exposure, even as some retail investors use the pullback in mega‑cap AI names as a buying opportunity.Investopedia

Nvidia’s earnings beat could challenge that cautious positioning if the market interprets the results as evidence that AI spending is still in a powerful up‑cycle, not the late stages of a bubble. But with Fed policy uncertain and valuations still elevated, any rally may remain vulnerable to disappointments or macro shocks.

Crypto, gold and oil: risk assets react to macro jitters and Nvidia

The risk‑off mood that gripped markets earlier this week has also been evident in cryptocurrencies and commodities:

- Bitcoin fell below $90,000 this week, hitting its lowest level in about seven months amid heavy liquidations and outflows from U.S. spot Bitcoin ETFs, before rebounding.Reuters+2FinanceFeeds+2

- After Nvidia’s earnings beat, Bitcoin reclaimed the $90,000 level during the earnings call, mirroring a bounce in equity futures.Crypto Briefing

- Gold traded in a tight range but drifted higher on Wednesday, with spot and futures prices hovering around $4,070–$4,100 per ounce, up modestly on the day as investors continued to hedge rate and growth risks.150Currency.com+2Trading Economics+2

- WTI crude oil, as noted, slid to around $59.50 per barrel, reflecting concerns about oversupply and softer demand.Investopedia+2VT Markets+2

The combination of falling oil, higher gold, and volatile crypto points to a market that is cautiously reassessing growth, liquidity and risk appetite — exactly the backdrop in which Nvidia’s results take on outsize importance.

What this means for investors heading into Thursday

Going into Thursday’s session, traders and longer‑term investors will be focused on three main threads:

- Nvidia’s after‑hours boost vs. AI bubble fears

- If Thursday’s trading sees broad follow‑through from Nvidia’s beat, it could extend the rebound in tech and AI stocks and ease bubble worries — at least temporarily.

- On the other hand, any quick reversal would reinforce the idea that good news is already priced in and that investors remain wary of stretched valuations.

- Fed path and the data vacuum

- The October minutes confirm a deeply divided Fed, and with key jobs data arriving late, each major economic release between now and mid‑December will matter more than usual.AP News+1

- Breadth and sector rotation

- Wednesday’s action showed improved breadth but also persistent underperformance in energy and rate‑sensitive stocks.

- Investors will be watching to see whether the rally broadens beyond a handful of mega‑cap winners or reverts to the narrow, AI‑centric leadership that has defined much of 2025.

For now, the takeaway from November 19, 2025 is that the U.S. stock market has found at least a temporary foothold, thanks to a much‑anticipated Nvidia beat, even as Fed uncertainty and macro data gaps keep volatility elevated.

How durable that footing proves to be will depend on the next wave of data — and whether the AI trade can keep delivering earnings strong enough to justify its towering expectations.