Vicor Corporation (NASDAQ: VICR) shares surged after its Oct. 21 Q3 report, reaching ~$67.82 intraday on Oct. 21 (vs ~$58 the prior close) Marketbeat. The stock is up roughly 30–35% year-to-date (fell to ~$38 low in 2024) and opened Oct 22 near $65–66. Q3 revenue was $110.4 M (up 18.5% YOY) and EPS $0.63, crushing analyst expectations Investing Marketbeat. Analyst firms (Craig-Hallum, Needham) upgraded VICR to Buy with ~$90 price targets, citing strong growth in high-margin IP licensing and next-gen power products Gurufocus Intellectia. Investors are excited by Vicor’s role in AI and data-center power (48V and 800V systems), its recently announced ~$300 M licensing agreements stemming from a U.S. import ban on copycat products Vicorpower Gurufocus, and the launch of new “Vertical Power Delivery” (VPD) modules that cram ~10 kW in an iPhone-sized package Ainvest Gurufocus. Vicor’s market cap is ~$2.9 B, and it maintains a very cash-rich, zero-debt balance sheet with ~$362 M cash (post-buybacks) Investing Gurufocus.

Vicor’s proprietary Power-on-Package AI accelerator card (Hydra II eval board). The 4609 “ChiP-set” powers GPUs/XPUs with up to 1200 A, enabling much higher efficiency in AI servers Vicorpower Vicorpower.

Stock Performance and Recent Rally

Vicor’s stock has exploded higher in the past week. On Oct. 21 it hit a new 52-week high of $67.82 (closing around $65) after its Q3 earnings report Marketbeat. For context, VICR traded in the low $50s just a month ago and even below $40 as recently as early 2024. The jump on Oct. 21 (roughly +17% intraday) reflects a record quarter plus positive company news (see below). Year-to-date VICR is up roughly 35–36%, handily outperforming many peers in the electronics/semiconductor space Finviz Marketbeat. Trading volumes spiked on the news (e.g. ~210K shares on Oct. 21, vs typical 200–300K daily) Marketbeat.

Price action: Over the past year Vicor had been in a steady uptrend, crossing its 50-day moving average (~$51) in September and then breaking out to a 52-week peak on Oct 21 Marketbeat. The five-day and one-month charts both show a sharp uptick coinciding with the Oct 21 earnings release. As of Oct 22 morning, VICR sits around the mid-$60s (within a few dollars of that high). The 50-day moving average (~$51) and 200-day (~$47) are well below current levels, confirming bullish momentum Marketbeat.

Recent News and Catalysts

Several positive developments converged to drive this rally:

- Q3 Earnings Beat (Oct 21): Vicor reported Q3 revenue of $110.4M, up 18.5% year-over-year Investing (vs. ~$93M a year ago). That included ~$110.4M in product sales and IP licensing. GAAP EPS was $0.63 (on 44.93M fully diluted shares) Investing, far above the consensus ~$0.17–$0.18 (and well above $0.10 a year prior). Gross margin was 57.5% in Q3 (down from 65% a year ago, due to a one-time $45M patent settlement in Q2) Investing Investing. Net income was $28.3M, and operating cash flow was a strong ~$38.5M for the quarter Investing. The balance sheet remains very strong: cash jumped to $362.4M (up ~$23.8M sequentially, even after $15.6M of buybacks) Investing, inventory was $92.3M, and Vicor has virtually no debt. Importantly, management said Q3 licensing revenue alone exceeded its R&D spend for the quarter (which is ~18% of revenues) Vicorpower.

- IP Licensing Windfall: Vicor has aggressively defended its patents. Earlier this year a U.S. ITC order banned infringing 48V bus converters made by Chinese copycats (targeting modules without Vicor’s license) Vicorpower. This has forced leading hyperscalers and OEMs to sign licenses with Vicor. The company disclosed that these deals now amount to “nearly $300 million” of expected revenue through 2026 Vicorpower. In other words, over the next 18 months Vicor could collect roughly $300M from license fees and royalties. CEO Patrizio Vinciarelli noted that licensing is now a pillar of growth: “Q3 licensing revenues surpassed Vicor’s quarterly investment in R&D” Vicorpower. With its patents on high-density power delivery, Vicor is effectively charging peers to use critical AI computing technology. This recurring, high-margin license stream has investors very bullish.

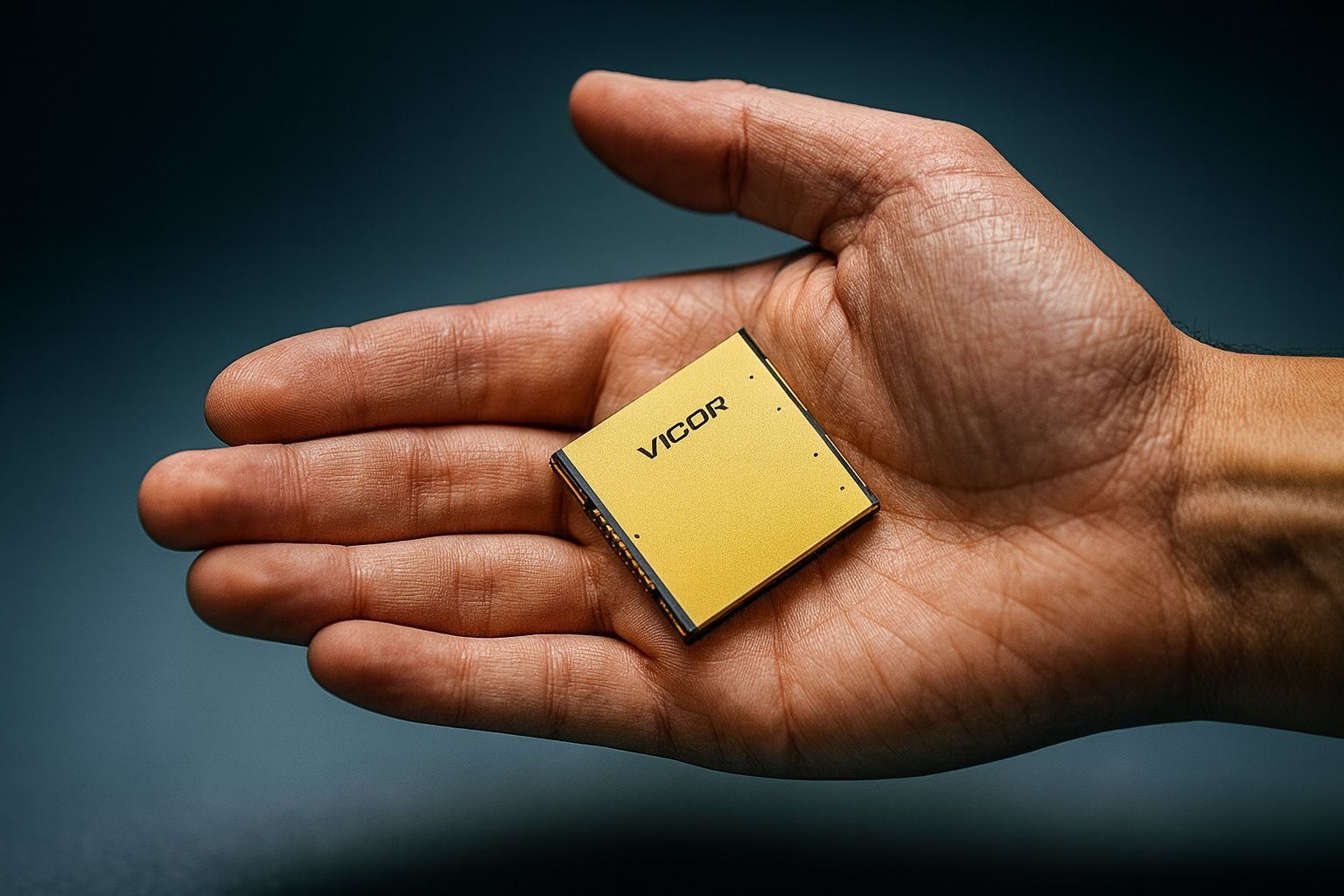

- New Product Rollouts – Gen5 & 800V: Vicor’s roadmap is also exciting. The company is sampling “Gen 5” Vertical Power Delivery (VPD) modules that deliver ~10 kW at 48 V in a tiny form-factor (roughly an iPhone’s size) Ainvest. These new 800 V-to-48 V converters enable ultra-high-power AI racks and future 800V EV systems with much higher efficiency. In fact, Vicor confirmed on its Q2 call that “a new 800-volt power module, which will deliver 10 kilowatts at 48 volts in a package smaller than an iPhone, will begin sampling in Q4” Gurufocus. The total addressable market for these 800V/48V automotive and data-center converters is expected to exceed $5B by 2027 Gurufocus. Such advancements (and a first mover advantage in density) help justify the steep price targets from analysts.

- Analyst Upgrades: In just the past week two firms upgraded Vicor to Buy with $90 targets. Craig-Hallum raised its rating and target (from Hold/55 to Buy/90) citing Vicor’s “royalty potential” and innovative Vertical Power Delivery (VPD) solutions Gurufocus. Needham also bumped Vicor to Buy ($90 PT), noting that Vicor has signed a new two-year license with a large OEM and its high-margin IP licensing “could double over the next few years” Intellectia. Both firms highlighted the patented nature of Vicor’s products: it’s now the only supplier of certain high-current modules, creating a ‘must-license’ moat. These bullish forecasts help explain the late-week buying surge. (By contrast, older consensus targets were in the low-$50s; upgrades now approach $90, reflecting dramatically brighter expectations.)

- Investor Sentiment: Retail interest has picked up. Vicor’s moderate trade volumes now lean heavier, and investor discussion (e.g. on forums and newsletters) is filled with optimism about the AI/auto electrification “power plays.” Insider and institutional ownership is high – directors and founder-CEOs own ~23% of the company Gurufocus, and many analysts and funds are covering it. The “AI/data center power” narrative has made Vicor a micro-cap darling. (Notably, Vicor stock jumped 32% on its Q2 release in July after a patent settlement; the positive Q3 metrics have revived that momentum.)

Vicor’s Business and Market Position

Vicor is a power systems technology company. It designs and manufactures advanced DC-DC converters and power modules for high-performance electronics. Vicor’s products serve datacenter/enterprise computing (think AI servers, GPUs, ASICs), industrial automation, telecom infrastructure, aerospace/defense, automotive electrification, and other markets Vicorpower Gurufocus. The company is best known for its Factorized Power Architecture (FPA) – a modular approach using separate “Brick” and “ChiP” components for flexible, high-efficiency power delivery Gurufocus. In practice, Vicor’s modules plug into cutting-edge systems (e.g. GPU cards, server boards) to enable higher voltages (48 V, 800 V) and power densities than older VRM systems. For example, Vicor has developed a 1200-Amp “ChiP-set” powering AI accelerator cards Vicorpower. Its own Hydra II evaluation board (image below) illustrates these innovations.

Vicor’s Hydra II evaluation board, showcasing its modular power components (image from Vicor). The board carries Vicor MCM/MCD modules that supply very high current (e.g. up to 1200 A) to GPUs and other processors Vicorpower Vicorpower.

Technical strengths: Vicor’s technology is recognized as leading-edge. The company has 15+ US patents on 48V and 800V module designs. It claims to be the only supplier with a foundry-built ChiP™ (5th-generation) converter delivering such currents, and is pioneering Vertical Power Delivery (VPD) where converters sit directly under the CPU/GPU for extreme density Vicorpower Vicorpower. These innovations drive Vicor’s high gross margins (65% in Q2 2025 Ainvest) and justify its premium valuation. By contrast, many competitors’ converters don’t match these specs. This is why Vicor’s patents now yield licensing fees – customers have little choice but to license or risk injunctions.

Market context: Vicor plays in the booming AI/data-center segment and the electrified transportation market. Demand for AI accelerators is surging (hyper-scalers spent billions on AI in 2025), which means more data centers needing denser power. Meanwhile, EV makers are shifting from 400V to 800V battery systems to charge faster – a perfect match for Vicor’s 800V converters. In fact, analysts estimate the combined AI server and EV power market is multi-billions per year. Tech investment commentators call Vicor an “AI power infrastructure” play Techstockinsight, noting its role as a core supplier of key power components.

Financial/Fundamental Analysis

Revenue Growth: Vicor’s top-line has climbed steadily thanks to both product sales and licensing. Q2 2025 revenue was $141.05M (64% YOY growth) Ainvest – a record quarter led by strong demand and a one-time patent settlement. Q3 came in slightly lower (due to easier comps) at $110.4M, but still well above prior years. Analysts expect mid-teens organic growth in the coming quarters, plus the step-up from licensing fees. Over the long run, Wall Street sees Vicor reaching ~$1B in revenue (the CEO says they’re “almost halfway there” Investing) – driven by 48V/800V adoption and licenses.

Profitability: Vicor earns very high margins for a hardware company. Even accounting for recent patent settlements, gross margin has been in the 55–65% range Investing Ainvest. Operating expenses are moderate (~$42M/Q3) and R&D is substantial (about 18% of revenue Vicorpower). The result is healthy net income: Q3 net margin was around 25% (distorted by legal items), while adjusted earnings are still well above breakeven. Vicor’s net margin last year was ~15% Gurufocus, and it projects to improve as volumes rise and legal fees normalize.

Balance sheet & cash: Vicor is extremely cash-rich. It ended Q3 with $362M in cash, no debt, and over 45% current ratio Investing Gurufocus. That is roughly $8 per share in cash on a $65 stock. The company has already repurchased $78M of stock in 2025, signaling confidence. Key ratios from independent analysis: current ratio ~6.9, debt/equity ~0.01 Gurufocus. Altman Z-Score is very high (>20) indicating low bankruptcy risk Gurufocus. Overall financial health is rated strong Gurufocus. Vicor’s P/E is around 44 (trading at a premium), but investors argue this reflects its high-growth prospects and protected tech niche Gurufocus.

Analyst Outlook and Sentiment

Analysts’ consensus is turning bullish. As of Oct 22, one published Strong Buy and two Holds exist, with an average 12-month target around $54 (prior to the latest upgrades) Marketbeat Finviz. However, the two new upgrades to $90 have reset the expectation. Needham’s report emphasizes that Vicor’s IP licensing “is creating significant value for shareholders” and expects licensing revenue to double in the next few years Intellectia. Craig-Hallum similarly cites Vicor’s position in “cutting-edge VPD solutions” and predicts large royalty streams Gurufocus.

On the technical side, Vicor’s stock is somewhat extended: its RSI (14) is above 70 Gurufocus, indicating overbought conditions, and insiders and some funds have locked in gains (e.g. a director sold shares at ~$63 Marketbeat). But for longer-term investors, these analysts argue the secular trend (AI and EV power) and a war chest of patents far outweigh short-term overvaluation concerns Intellectia Gurufocus. (One caution: business is cyclical with tech spending; trade tensions and tariffs briefly caused order pushouts in China earlier this year Gurufocus.)

Product and Partnership Developments

Vicor is not just licensing; it’s also winning design wins with major customers. For example, the company has concluded EV drivetrain pilot projects with large OEMs (Europe and Asia), aiming to supply bidirectional 800V↔48V converters Gurufocus. It is also expanding in data-center sales: Vicor says it’s collaborated with a “high-speed data center” and a major OEM on its Gen5 VPD product, which meets or exceeds their current-density needs Gurufocus. Additionally, Vicor forged a partnership with Kyocera in 2019 on Power-on-Package (embedding Vicor converters in chip packages) – an approach that is gaining attention again now with 5th-gen designs Gurufocus Vicorpower.

On Oct. 20, Vicor announced an expanded IP licensing initiative with General Counsel Andrew D’Amico leading the push Vicorpower. The company is reportedly preparing new legal actions this fall to block import of infringing modules Gurufocus, which could further bolster its royalty pipeline. In short, Vicor’s strategy is to simultaneously grow its high-performance hardware business and monetize its R&D via licensing. As one TechStock insight (Asia) put it, Vicor is a “core supplier of AI power components” with “innovative technology” Techstockinsight – i.e. a key beneficiary of the AI/data-center boom.

Conclusion / Outlook

In summary, Vicor (VICR) has captured investor interest by combining a hot end-market (AI, data centers, EVs) with proprietary power technology and strong financial execution. Its recent quarterly beat and $300M IP licensing windfall have fueled a rally, and leading analysts are upping their targets. That said, the stock is no longer cheap – trading near a 52-week high with a P/E in the mid-40s. The biggest risks remain the cyclicality of tech hardware and the time it takes to collect the licensing payments. But with net cash of over $8/share and multiple future catalysts (Q4 launch of the 800V module, resolution of IP cases, strong AI spending), many investors see further upside over the next 12–24 months.

Sources: Vicor press releases and filings Vicorpower Investing; recent analyst reports Gurufocus Intellectia; market data from MarketBeat Marketbeat, GuruFocus Gurufocus, and Vicor’s investor presentations. All facts and quotes above are drawn from cited sources.