TL;DR

- Futures: S&P 500 and Nasdaq futures are higher as investors price a potential end to the record‑long federal shutdown. Reuters+1

- Washington: The Senate advanced a House bill that would fund the government into late January; the measure still needs final passage in both chambers. Reuters

- Calendar: No major U.S. data today; NFIB small‑business optimism is due Tuesday and October CPI is set for Thursday. U.S. bond market is closed Tuesday (Veterans Day); equities stay open. Investopedia+3Kiplinger+3Bureau of Labor S…

- Earnings: Tyson Foods reports before the bell; Occidental Petroleum reports after the close; more marquee names come midweek (Cisco, Disney). ir.tyson.com+2Oxy+2

- Moves to watch: AI mega‑caps (Nvidia, Alphabet, Meta) rebound pre‑market; Metsera slumps after Pfizer wins a takeover battle; Visa/Mastercard in focus on fee‑settlement headlines. Reuters+2Reuters+2

- Macro backdrop: Oil and gold are firmer; dollar a touch softer as shutdown resolution bets grow. Reuters+2Reuters+2

Futures and Global Backdrop

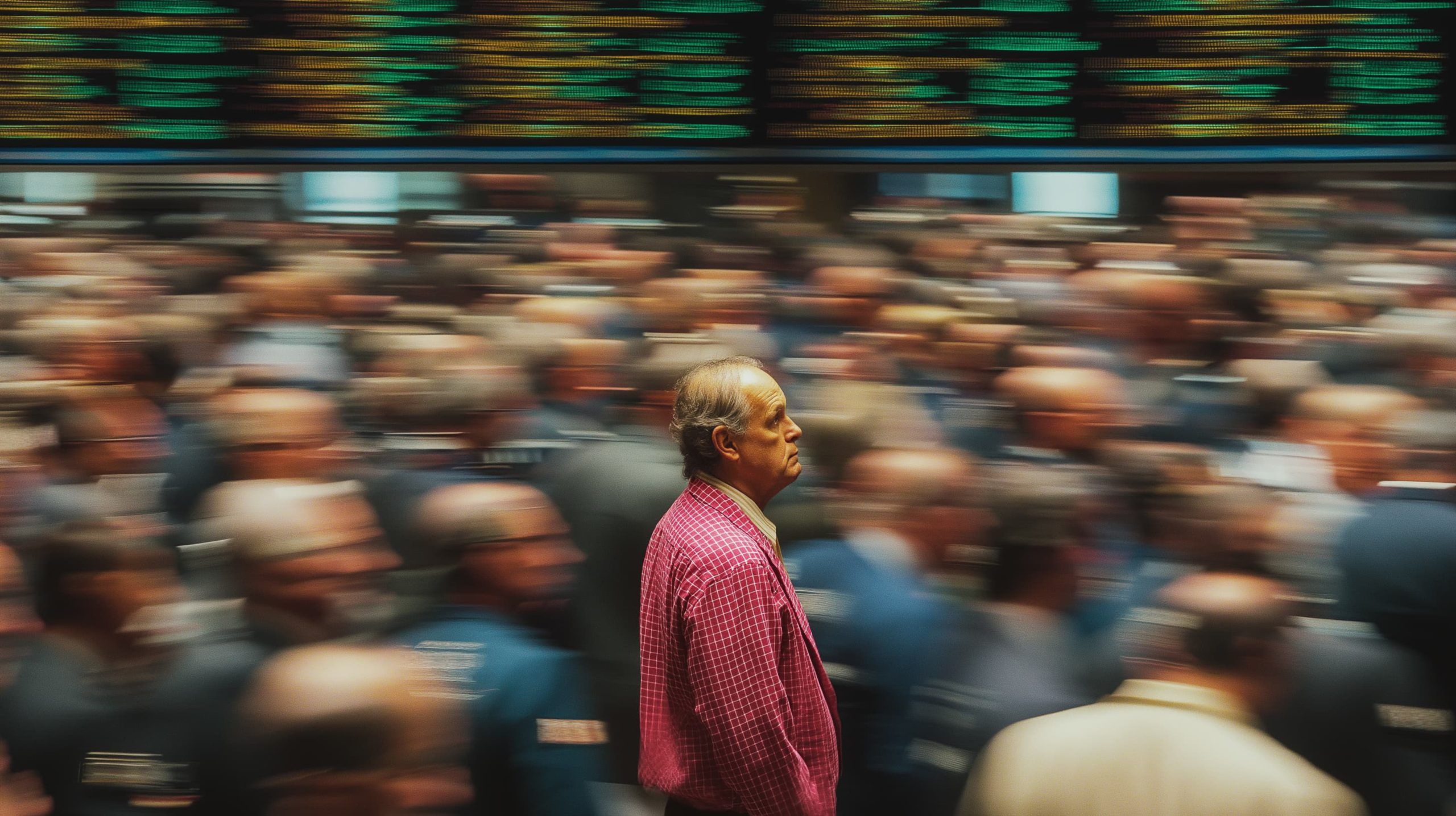

U.S. equities are set to open higher Monday as traders react to signs of progress in Washington. Pre‑market, S&P 500 and Nasdaq‑100 futures rose while Dow futures edged up, tracking a global relief rally after the Senate took a procedural step toward ending the 40‑day federal shutdown. European and Asian bourses also advanced overnight. Reuters+1

The bid for risk assets follows a bruising week for U.S. tech where AI leaders led declines; today’s bounce centers on expectations that reopening the government would remove a growth headwind and reduce near‑term policy uncertainty.

Washington: A Path to Reopen—But Not Done Yet

On Sunday night, the Senate advanced a House‑passed bill intended to fund the government until Jan. 30, alongside a “minibus” of full‑year appropriations. The vote does not by itself reopen the government; the legislation still requires final Senate passage, House concurrence on the amended text, and a presidential signature. Markets are cheering the forward motion nonetheless. Reuters

Today’s Economic Calendar, This Week’s Big Prints & Market Hours

- Monday (Nov. 10): No major U.S. releases scheduled. Kiplinger

- Tuesday (Nov. 11, Veterans Day):NFIB Small Business Optimism for October (morning). Bond market closed; U.S. stock market open. Investing.com+2SIFMA+2

- Thursday (Nov. 13):October CPI at 8:30 a.m. ET (BLS schedule). Bureau of Labor Statistics

- Friday (Nov. 14):October PPI and other releases later in the week per standard schedule; note some data disruptions have persisted during the shutdown. Bureau of Labor Statistics+1

Why it matters: CPI is the week’s main macro catalyst and the first major inflation print since late October. BLS calendars still show CPI slated for Thursday even as other reports faced delays during the shutdown. Bureau of Labor Statistics+1

Earnings to Watch

- Before the bell:Tyson Foods (TSN) – Q4 FY25 results and 9:00 a.m. ET call. Expect focus on chicken strength vs. beef margins. ir.tyson.com

- After the close:Occidental Petroleum (OXY) – Q3 results; call Tuesday 1:00 p.m. ET. The update follows headlines around the OxyChem divestiture and debt reduction strategy. Oxy

- Midweek heavyweights:Cisco (Wed) and Disney (Thu) headline. Cisco Investor Relations+1

A wider slate—including Monday.com, Instacart (Maplebear), Occidental and others—keeps the tape busy even as peak season fades. Barron’s

Stocks Moving Pre‑Market

- AI mega‑caps bounce:Nvidia, Alphabet, Meta gained in early trade as chip and broader tech shares stabilized after last week’s drawdown. Reuters

- M&A shock:Metsera fell sharply after Pfizer won a reported $10B bidding war, prompting profit‑taking in smaller biotech peers. Reuters

- Payments in focus:Visa/Mastercard are on watch after reports they’re nearing a fresh settlement with merchants that would trim certain fees over time. Reuters

Commodities, Dollar & Rates

Oil advances with Brent around the mid‑$60s and WTI near $60, buoyed by hopes a government reopening would aid demand; supply dynamics remain a headwind longer‑term. Reuters

Gold is firmer—touching a two‑week high—as a softer U.S. dollar and lingering growth jitters keep haven bids alive. Reuters+1

The dollar index (DXY) eased as shutdown‑resolution odds improved; Treasury yields were a touch higher to start the week amid shifting rate‑cut probabilities. Reuters+1

Crypto check:Bitcoin hovered above $106,000 in U.S. pre‑market hours, with crypto‑linked equities edging higher. CoinDesk

Logistics Watch: MD‑11 Groundings After UPS Crash

Freight and e‑commerce names are on watch after the FAA barred MD‑11 flights pending inspections in the wake of last week’s deadly UPS crash in Louisville. UPS and FedEx have grounded their MD‑11 fleets, a modest near‑term drag for express cargo routing. Reuters

The Setup at the Opening Bell

- Headline risk: Traders will key on fresh headlines from Capitol Hill as the shutdown bill moves toward final votes. A clear path to reopening would support risk appetite; setbacks could quickly sap futures strength. Reuters

- Micro vs. macro:Tyson (pre) and Occidental (post) bookend the session; midweek Cisco/Disney will steer sector tone (AI infra, media/streaming). The Walt Disney Company+3ir.tyson.com+3Oxy…

- Thursday CPI is the main macro catalyst; today serves as positioning day given a light calendar and the Veterans Day market configuration (bonds closed Tuesday; stocks open). Bureau of Labor Statistics+2SIFMA+2

- Cross‑asset cues: Watch oil (demand optics if shutdown ends), gold (hedging), and dollar/yields (CPI expectations). Reuters+2Reuters+2

Editor’s note

All market levels and company items reflect reporting available early Monday, Nov. 10, 2025 (U.S. pre‑market) and may update intraday. Key sources: Reuters, MarketWatch, BLS, SIFMA, company investor relations and exchange calendars. SIFMA+3Reuters+3Reuters+3

Disclosure: This article is for informational purposes only and does not constitute investment advice.