Singapore, Jan 26, 2026, 15:01 SGT — Regular session

- Shares of Yangzijiang Shipbuilding dropped 1.5% this afternoon, continuing their slide over several sessions

- The stock has dropped roughly 12% from its S$3.75 peak earlier this month, as the STI pulls back

- Traders are eyeing Thursday’s MAS policy review along with the company’s March results as key upcoming indicators

Shares of Yangzijiang Shipbuilding (Holdings) Ltd (SGX: BS6) slipped 1.5% to S$3.29 in Monday afternoon trading, marking their seventh consecutive session of losses. The stock fluctuated between S$3.29 and S$3.34, with roughly 7.9 million shares changing hands. It remains about 12% below its intraday peak of S$3.75 hit on Jan. 14. Investing.com

Singapore shares slid, with the Straits Times Index falling 0.65% in the latest figures. It highlights a shift toward caution as investors brace for a busy central bank schedule this week. Investing.com

Why it matters now: Yangzijiang has long been seen as a straightforward bet on the shipbuilding order cycle. The recent drop in its shares is putting buyer appetite to the test amid market jitters. Investors keep a close eye on shipbuilders’ order books — the backlog of contracted but undelivered work — since that underpins revenue forecasts.

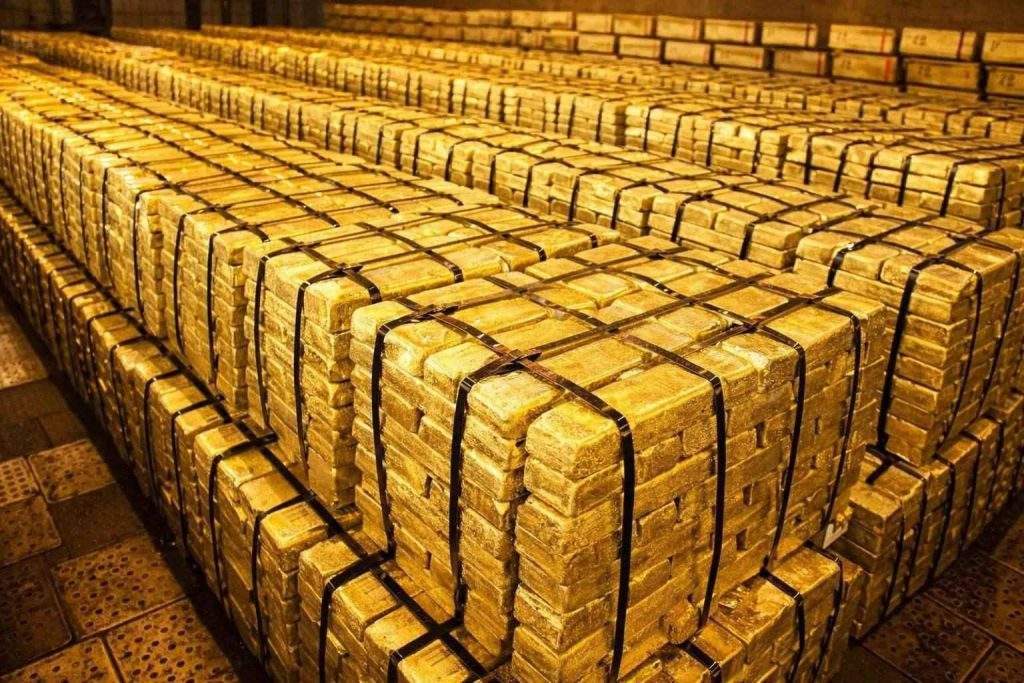

Markets around the world are jittery. Gold shot past $5,000 an ounce Monday as investors piled into havens. The yen spiked on worries about intervention, while Japan’s Nikkei slipped. Traders are eyeing the U.S. Federal Reserve’s policy meeting later this week. “The market’s inclination is to short the yen but the possibility of co-ordination means it no longer is a one-way bet,” said Prashant Newnaha, senior rates strategist at TD Securities in Singapore. Reuters

Economists at home anticipate the Monetary Authority of Singapore will hold monetary policy steady in Thursday’s review, backed by stronger growth and easing inflation. Edward Lee, chief economist at Standard Chartered, noted there’s “no urgency to act this month.” Reuters

Yangzijiang reported a 36.7% jump in net profit to a record RMB 4.2 billion for the half-year ending June 30, 2025, according to its August update. The shipbuilder’s margin reached a new peak at 35%, while its order book stood at $23.2 billion, with deliveries lined up through 2029 and beyond. “We remain focused on executing our robust orderbook,” said executive chairman and CEO Ren Letian. SGX Links

But these risks are concrete. In a filing last September, the company revealed that its subsidiaries ended contracts for four 50,000 DWT MR oil tankers valued at around $180 million. The move followed allegations against the buyer related to sanctions evasion. Still, the group said this termination shouldn’t significantly affect its 2025 earnings per share. SGX Links

Yangzijiang is set to announce its next earnings on March 4. Investors will be watching closely for updates on new order intake, profit margins, and any remarks about delivery schedules. Investing.com