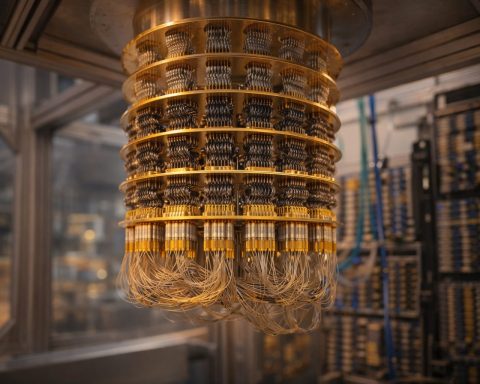

Quantum computing stocks: IonQ, Rigetti Computing, D-Wave Quantum slide 7%-9% — what to watch next week

Quantum computing stocks fell sharply Friday, with IonQ down 7.5%, Rigetti 8.4%, D-Wave 8.6%, Quantum Computing Inc 9.0%, and Arqit Quantum 8.9%. IonQ disclosed share issuances tied to its Skyloom and Seed Innovations acquisitions in a recent SEC filing. U.S. markets are closed for the weekend. The Feb. 6 jobs report and Big Tech earnings are the next major events.