- Stock Rally: Bitfarms (NASDAQ/TSX: BITF) is up roughly +148% year-to-date by mid-Oct 2025, trading around $4.5 USD (≈C$5.9)ts2.tech and hitting multi-year highs. Heavy volume (e.g. ~150M shares on Oct. 13 vs ~37M average) underscores the surge1 .

- Corporate Moves: On Oct. 14, 2025 Bitfarms announced long-time CFO Jeff Lucas will retire (effective Oct. 27) and Lazard alum Jonathan Mir will succeed himglobenewswire.com. The company also launched a 10% share buyback and is redomiciling to the U.S. (new NY office, switch to U.S. GAAP)ts2.tech2 .

- AI/HPC Pivot: Bitfarms is transitioning from pure Bitcoin mining to data-center “HPC/AI” infrastructure. It converted a $300M Macquarie debt facility into project financing for its 350 MW Panther Creek AI/data center in Pennsylvania, drawing an extra $50M to accelerate buildoutinvestor.bitfarms.com. The company secured 181 acres in PA and acreage in Washington state for its AI campusests2.techinvestor.bitfarms.com. CEO Ben Gagnon says Bitfarms has a 1.3 GW pipeline (80% in U.S.) and aims to “capture significant market share” in the new AI infrastructure hubinvestor.bitfarms.com3 .

- Bitcoin & Crypto Tailwinds: Bitcoin’s rally to ~$125–126K in early Oct 2025 (driven by massive ETF inflows and a weaker dollar) has lifted miner stocks across the boardreuters.comreuters.com. Global crypto ETF flows hit a record $5.95B in late Sep/Octreuters.com, and analysts note Bitfarms’ revenues are very “sensitive to Bitcoin prices”ts2.tech. The surge in crypto markets comes amid friendlier U.S. policy (Trump administration) and institutional demandreuters.com4 .

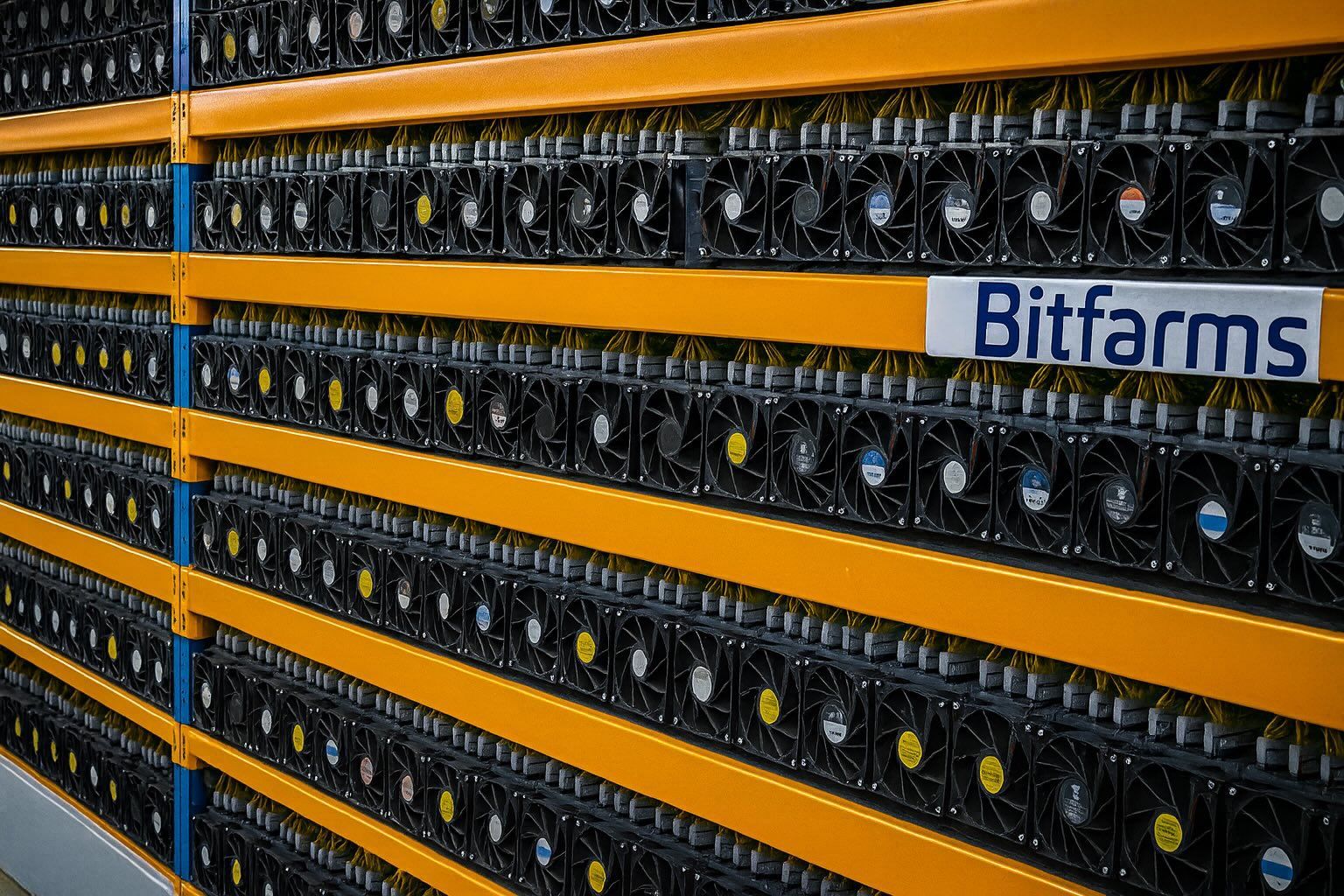

- Infrastructure & Finances: Bitfarms operates ~17.7 EH/s of mining (after exiting Argentina)investor.bitfarms.com and is pausing new miner purchases to focus on HPC projects. It expects Panther Creek to reach 50 MW in 2026 and 300 MW by 2027investor.bitfarms.comcantechletter.com. Mid-2025 liquidity was robust (≈$85M cash + ~1,400 BTC on hand) and net debt is modest5 .

Bitfarms’ recent stock surge has coincided with an explosive rally in cryptocurrencies and a strategic shift toward high-performance computing (HPC) facilities. As of Oct. 14, 2025, Bitfarms shares trade near $4.50 (USD) on Nasdaq, up from about $1.00 at the start of 2025ts2.techts2.tech. This +148% YTD move (≈+440% over 6 months) has been fueled by record Bitcoin prices, aggressive share buybacks, and new project announcements. For example, on October 10 the stock jumped ~16% to a new 52-week high after Bitfarms disclosed the conversion of its $300M financing into a project loan for the Panther Creek HPC/AI campusts2.techinvestor.bitfarms.com. By mid-October, heavy trading volumes and expanded technical indicators show a parabolic uptrendts2.techts2.tech. Bitfarms’ beta is high (~5), so its moves have far outpaced the broader market.

Bitcoin and Crypto Rally Fuel Miners

Bitcoin’s surge to all-time highs above $125–126K in early October 2025 has been a key tailwind for Bitfarms. Reuters reports record inflows into crypto ETFs – nearly $6 billion in the week to Oct. 4 – as institutional investors pile into Bitcoin and Etherreuters.com. “Bitcoin hit a new record high” and remains buoyed by a weak U.S. dollar and supportive policiesreuters.comreuters.com. Analysts note Bitfarms is highly “sensitive to Bitcoin prices,” since most of its revenues come from BTC miningts2.tech. For context, David Morrison of Trade Nation observed Bitcoin had climbed ~13% in two weeks by late Septemberreuters.com. A more bullish thesis comes from CoinShares’ James Butterfill: “This level of investment highlights the growing recognition of digital assets as an alternative in times of uncertainty,” he said of the ETF inflows6 .

The broader crypto and macro environment is currently supportive. As Reuters notes, the rally has been driven by “more supportive policies under U.S. President Donald Trump, demand from institutional investors, and bitcoin’s deepening integration with global financial markets.”reuters.com Even traditional safe-havens like gold have rallied alongside, amid trade tensions and dollar weakness. However, there has also been volatility: for example, on Oct. 10 Bitcoin briefly pulled back to ~$104K after President Trump escalated a trade war with Chinareuters.comreuters.com. This geopolitical jitters hit broad markets, but by mid-October digital assets remained well above pre-surge levels.

Strategic Pivot to AI/HPC Infrastructure

Bitfarms is no longer just a Bitcoin miner. Management is steering the company toward a North American HPC/AI infrastructure play, leveraging its grid power holdings and data-center locations. In Q2 2025 the company outlined partnerships and plans around this strategyinvestor.bitfarms.cominvestor.bitfarms.com. CEO Ben Gagnon emphasized that Bitfarms’ “North American energy portfolio positions [it] to be a leader in HPC and AI infrastructure.” He noted Bitfarms has “over 1 GW in our Pennsylvania pipeline… as a new AI infrastructure hub,” with expansion sites in Washington state and Quebecinvestor.bitfarms.com. To underline this pivot, Bitfarms signed an agreement with T5 Data Centers to design its Panther Creek campus and acquired additional land (181 acres in PA, plus expansion in Washington) for high-performance computing facilitiests2.tech7 .

In October 2025, Bitfarms took a big step by converting its previously announced up-to-$300M loan with Macquarie into project-specific financing for the Panther Creek campusinvestor.bitfarms.com. This allows Bitfarms to draw down the full facility and accelerate equipment purchases and construction. The company immediately drew an extra $50M (bringing $100M total drawn) to jump-start HPC build-outinvestor.bitfarms.com. According to the press release, this “accelerates long-lead time equipment purchases” and aims to capitalize on “substantial demand for HPC/AI infrastructure in Pennsylvania.”investor.bitfarms.com As VP-level analyst Martin Toner (ATB Capital) notes, Bitfarms’ strategy of “securing power in high-demand regions” such as Pennsylvania, Washington and Quebec creates a “competitive moat” given grid constraintscantechletter.com. Toner highlights that the Panther Creek “flagship” site alone could eventually host ~500 MW, with 50 MW online by end-2026 and 300 MW by early 20278 .

Financially, Bitfarms has the balance sheet to pursue this pivot. At mid-2025 the company held about $85M cash plus ~1,402 BTC (~$145M) on its booksts2.tech. It raised capital through equity and debt over the past years (including its merger with Stronghold Digital Mining) and now carries modest net debt (debt/equity ≈0.11)ts2.tech. The CFO Jeff Lucas noted Bitfarms has “never been better capitalized” with ~$330M in cash and Bitcoin and ~$250M available on project facilitiesglobenewswire.com. The company also instituted a 10% share buyback (repurchasing ~4.9M shares by Aug 2025 at ~$1.24 average)ts2.techinvestor.bitfarms.com to signal confidence. Lucas said this and the conversion to U.S. GAAP accounting are part of the “transition to a U.S.-focused energy and digital infrastructure company”investor.bitfarms.com2 .

Corporate & Leadership Updates

On the governance front, Bitfarms confirmed on Oct. 14 that CFO Jeff Lucas will step down on Oct. 27, 2025 and become a strategic advisor through Q1 2026globenewswire.com. Jonathan Mir, a veteran of Lazard and Bank of America’s energy group, will take over as CFOglobenewswire.com. CEO Ben Gagnon praised Lucas’s role in transforming Bitfarms “from an international Bitcoin miner to the U.S.-focused energy and digital infrastructure company we are today,” and expressed excitement about Mir’s capital-markets expertise for the HPC/AI phaseinvestor.bitfarms.com. The Bitfarms press release emphasizes this leadership refresh aligns with the company’s North American growth strategyinvestor.bitfarms.com9 .

Other corporate moves include winding down uneconomic operations. Bitfarms is exiting its Argentina mining site, which has been idle since power was cut off in May 2025. The shutdown (expected by Nov. 11, 2025) will generate about $18M in proceeds (recovering deposits, equipment sales, etc.)investor.bitfarms.com – a welcome boost equivalent to two years of free cash flow from that site. On operations, Bitfarms reported Q2 2025 revenue of $78.0M (+87% YoY) but a net loss of $29M ($0.05/share)investor.bitfarms.cominvestor.bitfarms.com. The loss largely reflects shutdown costs in Argentina and mining depreciation. Still, gross mining margins remain healthy (~45%), and adjusted EBITDA was ~$14M (18% of revenue)ts2.tech. Management stresses that with higher Bitcoin prices, a long runway of growth exists even as it invests in infrastructure.

Regulatory and Macroeconomic Context

Regulatory trends in 2025 have generally favored Bitfarms’ direction. In the U.S., the Trump administration and new regulators have pursued crypto-friendly policies: for example, Congressional bills like the GENIUS Act (stablecoin framework) and digital-asset clarity laws were passed in mid-2025tradingview.comtradingview.com, and the SEC under new leadership is promoting a “Project Crypto” initiative to modernize digital-asset rulestradingview.com. Notably, U.S. regulators have even clarified that proof-of-work mining activity is not considered a securities offering (earlier in 2025). Bitfarms’ HQ states (NY and Toronto) fall in jurisdictions where officials recognize crypto’s potential. In fact, Canada’s Quebec tribunal recently ruled that certain crypto tokens aren’t securities to avoid stifling innovationmcmillan.ca. Meanwhile, geopolitical risks (like tariffs) have caused market swings – e.g., Trump’s announcement of higher China tariffs on Oct. 10 sent Bitcoin tumbling ~8% that dayreuters.comreuters.com – but the overall trend remains up as investors seek diversifying assets.

Inflation and interest rates also impact Bitcoin and mining stocks. Some analysts view Bitcoin as an inflation hedge; for instance, Standard Chartered projects BTC could hit ~$135K if currency volatility continuests2.tech. Macro headwinds (recession fears, Fed rate cuts) have driven gold and Bitcoin to new highs simultaneously, suggesting investors view both as alternatives. Bitfarms’ exposure to power prices and energy markets (via its hydro and gas assets) means electricity costs and U.S. energy policy are also relevant. On the plus side, many of its U.S. sites are in states offering data-center incentives or abundant hydroelectric power (Pennsylvania, Washington). The company has acquired coal refuse plants in PA (ex-Stronghold) and sees long-term fuel support (coal refuse, hydroelectric) for mining if needed.

Analyst Commentary & Outlook

Wall Street analysts are generally bullish on Bitfarms, though price targets are mixed. MarketBeat reports a “Moderate Buy” consensus (6 analysts) with average targets around $3.70–$3.95ts2.tech, which were below the share price at this writing. Northland Capital Markets recently set a $7.00 target, noting Bitfarms’ fast pivot and strong balance sheet. Benzinga’s technical review cites overhead resistance near $6.50–7.00 and even a possible path to ~$12 if the breakout continuests2.tech. However, some quantitative screens warn the stock is overextended (RSI ~80) and fundamentals still lag earningsts2.tech. TipRanks shows an average target ~$3.45, reflecting caution even as analysts acknowledge the momentum.

ATB Capital’s Martin Toner remains one of Bitfarms’ most prominent bull analysts. He emphasizes Bitfarms’ “tremendous inbound interest” from potential customers for its AI data centers and calls the company’s power assets a core competitive advantagecantechletter.comcantechletter.com. Toner notes that with ~$250M in cash/Bitcoin on hand, Bitfarms can finance early phases of Panther Creek and de-risk assets before raising more capitalcantechletter.com. In sum, experts highlight Bitfarms’ early move to serve the growing AI/data center market and its robust U.S. footprint (≈1.3 GW pipeline) as key positives.

Outlook: Bitfarms faces a fast-evolving industry. If Bitcoin stays strong and AI/data center demand materializes, the company’s high-energy pipeline could deliver huge returns. As CEO Gagnon put it, Bitfarms is aiming to “meet surging demand in the AI industrial revolution coast-to-coast”investor.bitfarms.com. However, the stock’s rapid rise leaves little margin for error: future growth hinges on executing complex construction projects on time and securing HPC contracts. As one analyst cautioned, fundamentals like earnings are still catching up with the hypets2.tech. Overall, Bitfarms’ 2025 story is one of aggressive expansion and market optimism – a story likely to keep investors watching closely as crypto markets and tech trends unfold.

Sources: Company press releases and filingsinvestor.bitfarms.comglobenewswire.cominvestor.bitfarms.cominvestor.bitfarms.com; crypto market coverage (Reuters)reuters.comreuters.comreuters.com; industry analysis (TechStock², Cantech Letter)ts2.techcantechletter.com; financial media and analyst reportsts2.techts2.techcantechletter.com. (Bitfarms images are courtesy of company releases.)