Published: November 7, 2025

What happened today

A wave of coverage on Friday highlighted a new Nature Astronomy study that sets a concrete target for the next generation of black hole images: if upcoming telescopes can reach percent‑level fidelity, they could tell Einstein’s black holes apart from a range of look‑alikes predicted by alternative theories of gravity. The paper—published November 5—uses advanced simulations to show that when the mismatch between images exceeds roughly 2–5%, future instruments should be able to rule out many non‑Einstein models. 1

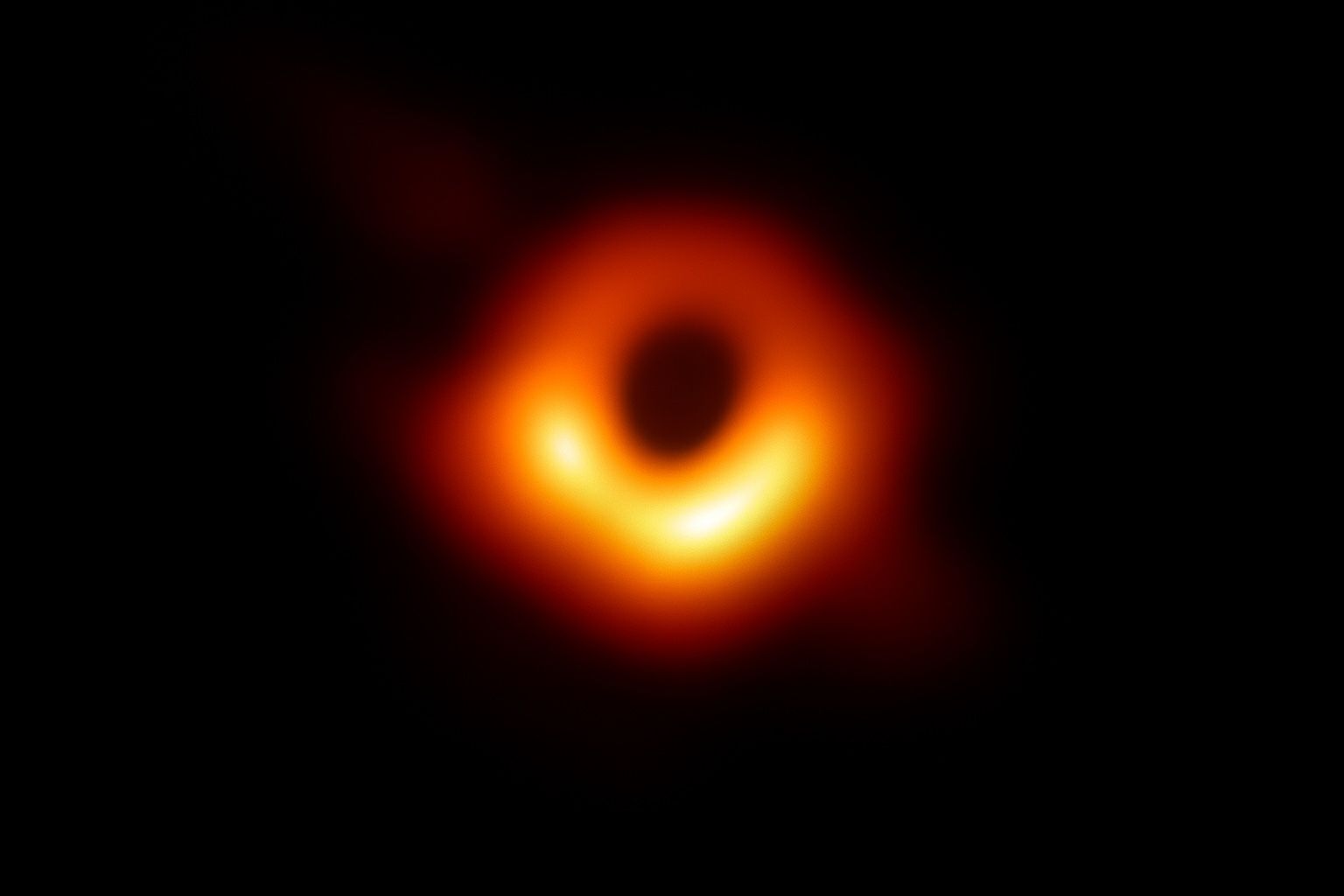

Today’s recaps emphasize what this means in practice: sharper “shadow” images—the dark silhouette encircled by a bright ring of superheated gas—can become precision tests of gravity itself, not just cosmic postcards. Coverage connects the study to near‑term upgrades of the Event Horizon Telescope (EHT) and proposed missions like the next‑generation EHT (ngEHT) and Black Hole Explorer (BHEX). 2

Why this matters

For more than a century, general relativity has survived every experimental challenge. But black holes push the theory into its strong‑field extreme, where even tiny deviations could reveal new physics. The new work quantifies how different gravity theories would alter a black hole’s appearance, giving observers a clear checklist: reach percent‑level imaging accuracy and compare the data to simulated “shadows.” If observed images diverge by more than a few percent from Einstein’s Kerr solution, some rival models can be ruled out. 1

Crucially, scientists stress that current observations remain consistent with Einstein, though they already constrain exotic possibilities. Analyses tied to the EHT images of M87 and Sagittarius A disfavour extreme alternatives such as wormholes or naked singularities, but tighter tests require sharper imaging. 3

How the new method works (in plain language)

- Start with physics‑rich simulations. Researchers run GRMHD simulations (general‑relativistic magnetohydrodynamics) to model plasma and magnetic fields swirling near a black hole’s event horizon. They then perform radiative‑transfer calculations to create “synthetic” images at radio wavelengths. 1

- Compare Einstein vs. alternatives. The team generated images for a standard Kerr black hole and for parameterized deviations (for example, using the KRZ framework) that stand in for entire families of non‑Einstein theories. 1

- Measure the difference. Using established image‑comparison metrics, they ask: how dissimilar are the two pictures as the telescope resolution improves? The answer sets the 2–5% threshold that next‑gen instruments must beat to cleanly separate theories. 1

What telescopes need to deliver

Reaching these tests requires finer angular resolution and cleaner calibration than today’s EHT. Teams point to three paths:

- Densify and upgrade the EHT array on Earth (more stations, better receivers, multi‑frequency coverage) to sharpen images and stabilize reconstructions over time. 1

- Build ngEHT, designed specifically to push horizon‑scale imaging into the percent‑fidelity regime and to monitor black holes more continuously. 1

- Add space‑based radio antennas for space‑VLBI baselines; a single dish in orbit would boost resolution dramatically. University communications accompanying the study estimate the target as better than one‑millionth of an arcsecond—akin to spotting a coin on the Moon from Earth. 3

Where things stand today (7 Nov 2025)

- Nature Astronomy published the study on November 5, laying out the simulation framework, the image‑mismatch metric, and the percent‑level fidelity target for theory testing. 1

- Phys.org and a Goethe University Frankfurt release amplified the results mid‑week, underscoring that while current EHT images favor Einstein’s model, only the most exotic alternatives are excluded so far. 4

- Today (Nov 7), additional coverage highlighted the “challenge Einstein—by testing him better” angle, translating the technical thresholds into a clear roadmap for upcoming telescopes. 2

- Ars Technica’s write‑up this week framed the same core idea: next‑generation black hole imaging can help rule out specific gravity models, moving beyond pretty pictures to precision tests. 5

Key takeaways

- The bar is set: achieve 2–5% image fidelity at the event‑horizon scale to decisively distinguish Einstein’s Kerr black holes from many alternatives. 1

- Einstein still fits: present EHT images are consistent with general relativity, though only some extreme models are ruled out; better data are needed for sharper tests. 4

- Hardware roadmap:ngEHT on the ground plus space‑VLBI (e.g., BHEX concepts) are the most direct routes to the required resolution and calibration. 1

Background: What is a black hole “shadow”?

The shadow is the dark central region in a horizon‑scale image where light paths are captured by the black hole. It’s bordered by a bright ring where hot plasma glows as it orbits the event horizon. That ring’s size and shape encode the underlying spacetime geometry—precisely what differs across gravity theories—making the shadow a powerful observational test rather than a mere visual. 4

FAQ

Does this mean Einstein was wrong?

No. Current observations support general relativity. The new work explains how to look harder: reach percent‑level imaging precision and the data themselves will decide. 4

What, exactly, will researchers compare?

They’ll compare full images—not just ring diameters—using quantitative image‑comparison metrics sensitive to brightness patterns, asymmetries, and ring structure. 1

Which black holes are prime targets?

The nearby supermassive black holes M87 and Sagittarius A remain the workhorses for horizon‑scale imaging and time‑resolved monitoring. 1

How soon could this happen?

Planning and prototyping for ngEHT and space‑VLBI concepts are underway; the study shows that once percent‑level fidelity is achieved, strong‑field gravity tests become decisive. 1

The bottom line

Today’s coverage marks a pivot: black hole pictures are graduating from awe to audit. With 2–5% image fidelity on the horizon, the next snapshots of M87 and Sgr A won’t just be iconic—they’ll be verdicts on how gravity really works near a black hole’s edge. 1

Sources: Nature Astronomy; Goethe University Frankfurt; Phys.org; Ars Technica; The Brighter Side of News. 1