European stock markets wrapped up Friday’s session in a cautious mood, with major Euronext indices hovering near record highs but lacking the momentum to stage a full‑blown “Santa rally” ahead of next week’s pivotal U.S. Federal Reserve meeting.

Across the region, blue‑chip benchmarks edged sideways to slightly higher, supported by rate‑cut optimism and strong cyclicals, even as fresh earnings worries and stretched valuations kept some investors on the sidelines.

How the main Euronext and EU indices closed

Eurozone blue chips: still near the top of the range

- Euro Stoxx 50 – the key benchmark for the euro area – added about 0.1% to 5,723.93, logging roughly 1% gains for the week and moving to within striking distance of its record high around 5,818 points. 1

- Euronext 100, the flagship index grouping 100 of the largest Euronext‑listed companies, ended the day just above 1,700 points, fractionally lower (around ‑0.2%) but still only a few percent below its mid‑November record near 1,755 points. 2

Euronext country snapshots

- Paris – CAC 40

France’s CAC 40 closed almost flat, down roughly 0.1% around 8,115 points, after spending most of the week grinding sideways near resistance in the 8,160–8,200 zone. 3 - Amsterdam – AEX

The AEX in Amsterdam finished at 947.50, marginally below Thursday’s close, leaving the index up almost 0.5% over the week as the technical picture continues to improve. 4 - Brussels – BEL 20

Belgium’s BEL 20 outperformed, rising about 0.33% to just over 5,029 points, helped by a sharp rally in biopharma group UCB. 5 - Lisbon – PSI (PSI 20)

The Portuguese PSI slipped roughly 0.5% to around 8,198, giving back some of its recent gains but remaining near its 52‑week high range. 6 - Milan – FTSE MIB

On the Italian front, the FTSE MIB hovered near 43,400 points and ended a touch lower (about ‑0.2%), but is still tracking a positive week, supported by banks and industrials. 7

Outside the Euronext family, Germany’s DAX eked out modest gains, while London’s FTSE 100 and Zurich’s SMI diverged, leaving the broader European picture mixed but resilient as investors locked in a solid start to December. 8

Macro backdrop: U.S. PCE, Fed cut bets and a fragile “soft landing”

Friday’s tone on Euronext was largely dictated by macro expectations rather than local corporate headlines.

U.S. PCE inflation and Fed meeting in focus

European traders spent most of the session watching the delayed U.S. Personal Consumption Expenditures (PCE) inflation report for September, seen as the last major data point before next week’s Fed decision. Reuters reported that core PCE inflation is running near 2.8% year‑on‑year, slightly lower than earlier in the year and broadly consistent with a gradual disinflation trend. 9

Dutch investor‑association VEB noted that Fed funds futures now price an 80–90% chance of a 25‑basis‑point rate cut on Wednesday, with traders more focused on Chair Jerome Powell’s tone and the updated “dot plot” than on the cut itself. 10

At the same time, University of Michigan data showed U.S. consumer sentiment improving to 53.3 in early December, with inflation expectations easing, bolstering the narrative of a soft landing rather than an imminent recession. 10

Euro area data: modest growth, better‑than‑feared

European macro headlines took a back seat, but investors were still digesting evidence that the eurozone economy grew slightly faster in Q3 than initially estimated, alongside solid German factory orders and firmer French industrial production. 11

Taken together, the data reinforced the idea that:

- Growth is weak but positive in the euro area.

- Inflation is gradually falling in both the U.S. and Europe.

- Central banks may finally be moving into a rate‑cutting cycle without having broken the labour market.

That macro mix continues to underpin cyclicals, banks and industrials on Euronext, but it also makes markets more sensitive to any earnings disappointment.

Sector moves: miners, autos and industrials vs. insurers and REITs

Cyclicals supported by copper and fiscal hopes

Intraday, basic resources led the STOXX 600, up around 1.1%, with industrials up roughly 0.4%, after copper prices hit a fresh record high. 9

Those gains spilled into Euronext:

- Mining and metals names listed in Paris and Amsterdam benefited from the firmer commodity backdrop.

- Engineering and capital‑goods groups rode the wave of optimism around 2026 fiscal spending and public‑investment programs across the euro area, a theme that Citigroup highlighted in a new strategy note. 12

Autos stay in the fast lane

Autos also remained in favour. Reuters pointed out that European car stocks were among the main gainers on Thursday after a wave of upgrades from Bank of America, and that momentum continued into Friday’s session. 9

Within the Euronext universe:

- Stellantis – traded in Paris and Milan – extended its recent rally, with ABM Financial News and Dutch investor press flagging single‑day gains of around 3–4% earlier in the week, helped by stronger guidance and sector upgrades. 13

Insurers and property lag

On the downside, insurance and real estate names remained under pressure:

- Swiss Re fell about 5% after issuing a cautious 2026 outlook, reminding investors that insurance earnings are still vulnerable to claims volatility and investment‑income swings. 9

- UK self‑storage operator Big Yellow dropped over 5% after ending deal talks with Blackstone, keeping a lid on broader property sentiment. 9

Although these names are not Euronext‑listed, the sector weakness weighed on financials and REIT peers in eurozone benchmarks.

Euronext stock stories to watch

Philips: tentative rebound after a bruising downgrade

One of Friday’s most closely watched Euronext names was Royal Philips (PHIA).

- On Thursday 4 December, Reuters reported that Philips shares plunged more than 7% – their steepest fall in nearly 10 months – after management signalled that 2026 organic sales growth is unlikely to reach the 4.5% that analysts expect, citing tariff headwinds and a more moderate growth trajectory. 14

- Philips reiterated that its 2026 outlook will be formally presented on 10 February 2026, promising sequential sales growth, margin improvement and strong cash generation, but stopping short of endorsing consensus growth numbers. 15

On Friday, Philips staged a modest recovery. Dutch market reports highlighted that the stock rebounded around 2–2.5% during the session, making it one of the better performers in a flat AEX, as bargain hunters stepped in after the sell‑off. 16

UCB lifts Brussels as guidance gets a bump

In Brussels, UCB SA was the star of the day:

- The Belgian biopharma group raised its 2025 revenue guidance to above €7.6 billion from “more than €7 billion”, and lifted its adjusted EBITDA margin target to above 31% from at least 30%. 17

- Reuters noted that UCB shares jumped about 4.5%, topping the BEL 20, after the upgrade underscored the success of newer drugs such as psoriasis treatment Bimzelx. 9

The move helped BEL 20 close roughly 0.3% higher, bucking the more muted tone elsewhere in Europe. 5

Danone: fresh buyback to offset employee plans

Another key Euronext story came from Danone, which launched a share buyback programme of around 3.8 million shares:

- The mandate with a service provider kicked off today, 5 December, with purchases to be executed over the coming weeks. 18

- The goal is to offset dilution from employee share‑ownership schemes and long‑term incentive plans scheduled for 2026, rather than to alter the capital structure dramatically. 19

While the buyback is modest relative to Danone’s market cap, it adds a small technical tailwind for the stock at a time when ESG‑minded consumer staples remain a popular defensive theme among European investors.

ASML, Euronext N.V. and other “quality growth” names stay in focus

Beyond the day‑to‑day moves, investors continue to gravitate toward high‑quality growth stocks on Euronext:

- ASML (Amsterdam) – the semiconductor equipment giant – is still riding structural demand for AI and advanced chips. In Q3 2025 it delivered €7.5 billion in net sales and €2.1 billion in net income, with gross margins above 51%, and management expects 2025 sales to grow around 15% year‑on‑year, with 2026 revenues at least matching 2025. 17

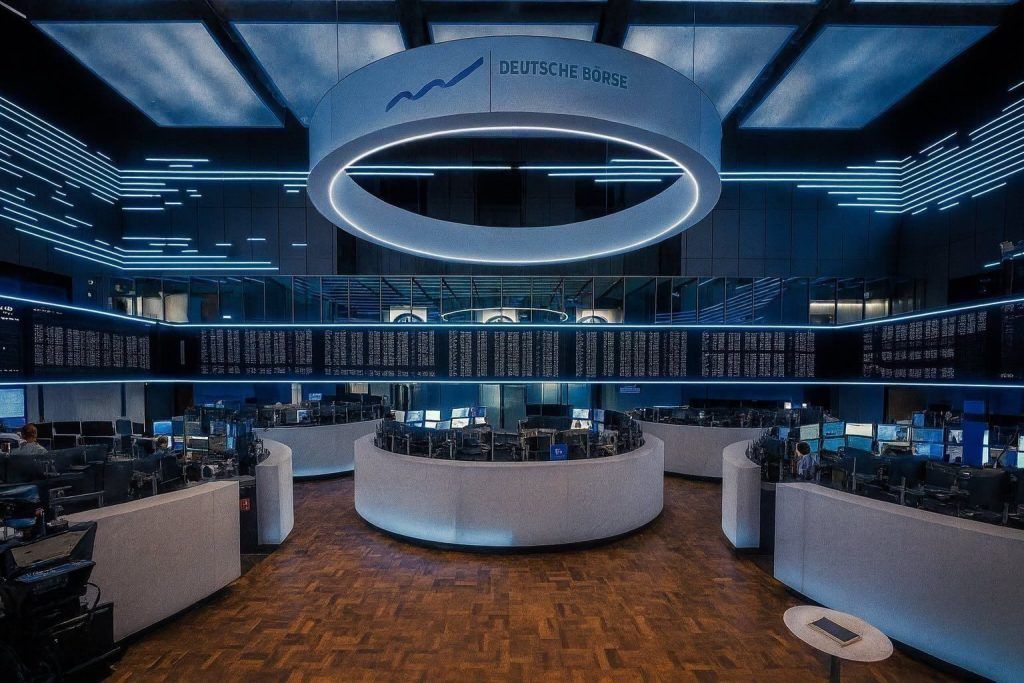

- Euronext N.V. itself, now part of the CAC 40, reported Q3 2025 revenue of €438.1 million (+10.6% YoY) and adjusted EBITDA of €276.7 million (63.2% margin), alongside a share buyback of up to €250 million running through March 2026 and a voluntary offer for the Athens Stock Exchange. 17

These names remain core holdings in many pan‑European portfolios and help explain why indices like the Euronext 100 are so close to record highs despite patchy macro data.

Magnum Ice Cream: a blockbuster spinoff on deck

After the closing bell, investors were also looking ahead to one of the most high‑profile Euronext listings of the year:

- The Magnum Ice Cream Company, spun out of Unilever, will debut on Euronext Amsterdam on Monday 8 December via a direct listing.

- Euronext has set a reference price of €12.80 per share, with trading reservations initially set at ±20% around that level. Unilever will retain 19.9% of the company, but plans to fully exit within five years. 20

The listing, delayed by a month because of the U.S. government shutdown, will create the world’s largest standalone ice‑cream company, with secondary listings in New York and London – and it will be a key test of investor appetite for consumer IPOs heading into 2026. 20

Strategists and valuations: upside remains, but earnings risk is creeping in

Citi sets a 2026 STOXX 600 target with 10%+ upside

In fresh research published Friday, Citigroup set a year‑end 2026 target of 640 for the STOXX 600, implying about 10.5% upside from Thursday’s close. 12

Key points from Citi’s call:

- The broker remains constructive on European equities overall, arguing that fiscal spending and the lagged impact of ECB rate cuts should support earnings into 2026. 12

- It expects EPS growth to pick up to more than 8% next year, after what it describes as a “flat” 2025 weighed down by tariffs and FX. 12

- Sector‑wise, Citi is overweight cyclicals – banks, travel & leisure, basic resources and industrials – and has upgraded both basic resources and industrials to overweight, while downgrading European tech to neutral on valuation grounds. 12

But the same strategist warns of fragile earnings

At the same time, a Bloomberg‑profiled piece on Citi strategist Beata Manthey – the analyst widely credited with correctly calling Europe’s 2024–25 rally – stresses that earnings risk is rising:

- Manthey argues that geopolitical uncertainty, shifting regulation and volatile energy costs leave only a thin margin between earnings growth and contraction for many European companies. 21

- The message: valuation multiples can remain elevated only if EPS continues to deliver, meaning any negative surprises in 2026 could trigger sharp de‑ratings, particularly in expensive growth segments. 22

That combination – constructive index targets but growing concern about profit fragility – helps explain the “hesitant” tone of today’s Euronext session: indices are near records, but buyers are becoming more selective.

Valuation screens still find plenty of “undervalued” names

On the other side of the debate, quantitative screens from Simply Wall St highlight that around 200 European stocks appear to trade below discounted‑cash‑flow‑based fair value estimates, with some names showing implied discounts of 40–50%. 23

These lists feature mostly mid‑ and small‑caps across sectors such as industrials, specialty chemicals and healthcare – a reminder that:

- The headline indices might be near fair value, but

- Stock‑pickers still find pockets of deep value beneath the surface, including on regional Euronext markets.

Technical picture: CAC 40 and Euronext 100 at key resistance

A widely circulated technical note from Ultima Markets on the FRA40 (CAC 40) suggests that bulls remain in control, but upside may be slowing: 24

- On the daily chart, the index has rallied from around 7,900, with immediate resistance at 8,162–8,200 and a major “double‑top” zone at 8,280–8,300.

- Support levels are clustered around 8,025–8,094, then 7,889–7,900 and finally 7,820, defining the bottom of the uptrend channel.

- Shorter‑term (30‑minute and 2‑hour charts) indicators show an overextended but intact uptrend, with strategists favouring “buy‑the‑dip” entries near 8,080–8,100 rather than chasing breakouts.

For the Euronext 100, data from Onvista and other providers show:

- The index’s 1‑month performance is slightly negative, but

- The 12‑month gain stands near 18%, with volatility around 13% and an all‑time high at 1,755.13 points set on 13 November 2025. 25

In other words, momentum remains positive but no longer explosive, and both indices are entering zones where profit‑taking or sideways consolidation would be unsurprising.

What Euronext investors are watching next

With Friday’s mixed close, the spotlight now shifts to a packed macro and corporate calendar:

- Federal Reserve meeting (Wednesday)

- Markets are almost fully pricing a 25 bps cut, but the key questions will be:

- How many cuts does the dot plot signal for 2026?

- Does Powell frame the move as the start of a sustained easing cycle or a “one‑and‑done” insurance cut? 10

- A more dovish tone would likely favour Euronext banks, industrials and small caps, while a hawkish surprise could hit rate‑sensitive names and growth stocks.

- Markets are almost fully pricing a 25 bps cut, but the key questions will be:

- Eurozone data run (next week)

- Final November inflation prints for Germany, France and Spain, plus eurozone industrial production, will help confirm whether the ECB can stay on a cutting path in early 2026. 10

- Magnum Ice Cream’s Euronext debut (Monday)

- The stock’s opening trading around the €12.80 reference price will be closely watched as a barometer of IPO risk appetite – especially for consumer brands and carve‑outs from large multinationals. 20

- Corporate catalysts on Euronext

- Philips’ 2026 outlook event on 10 February could be a major swing factor for the AEX, especially after this week’s sharp guidance‑related sell‑off. 14

- Danone’s ongoing buyback will provide a steady bid under the shares in Paris. 18

- UCB’s upgraded guidance will be tested by how well the company delivers on its new revenue and margin targets, influencing sentiment toward high‑growth healthcare names across Brussels and Paris. 17

Bottom line

At the close of Friday, 5 December 2025, the Euronext and wider EU stock markets:

- Held near all‑time highs on the back of rate‑cut hopes and resilient macro data,

- Showed growing dispersion between winners (UCB, cyclicals, select autos) and laggards (insurers, some rate‑sensitive names), and

- Reflected a tug‑of‑war between supportive monetary/fiscal policy and mounting worries about 2026 earnings.

For investors and traders following Euronext after the bell, the message is clear:

The bull trend is intact, but increasingly selective. Macro tailwinds are carrying indices higher, yet the next leg of the rally will likely depend less on multiple expansion and more on who actually delivers on earnings and cash‑flow promises in 2026.