NEW YORK, December 29, 2025, 06:40 ET

- Benchmark LME copper hit a record $12,960 a metric ton before easing back in holiday-thinned trade. 1

- Prices in Shanghai and New York set records while London was shut, with a U.S. tariff review next year pulling metal toward U.S. warehouses. 1

- China’s copper contract touched a record after news Beijing would rein in copper capacity growth in its next five-year plan. 1

Benchmark copper on the London Metal Exchange jumped to a record $12,960 a metric ton on Monday before paring gains to $12,415, up 2.1%, by 1030 GMT, as London trading resumed after a UK holiday. 1

The London market raced to catch up after being shut on Friday for Britain’s Boxing Day holiday, while copper in China and the United States rallied. 1

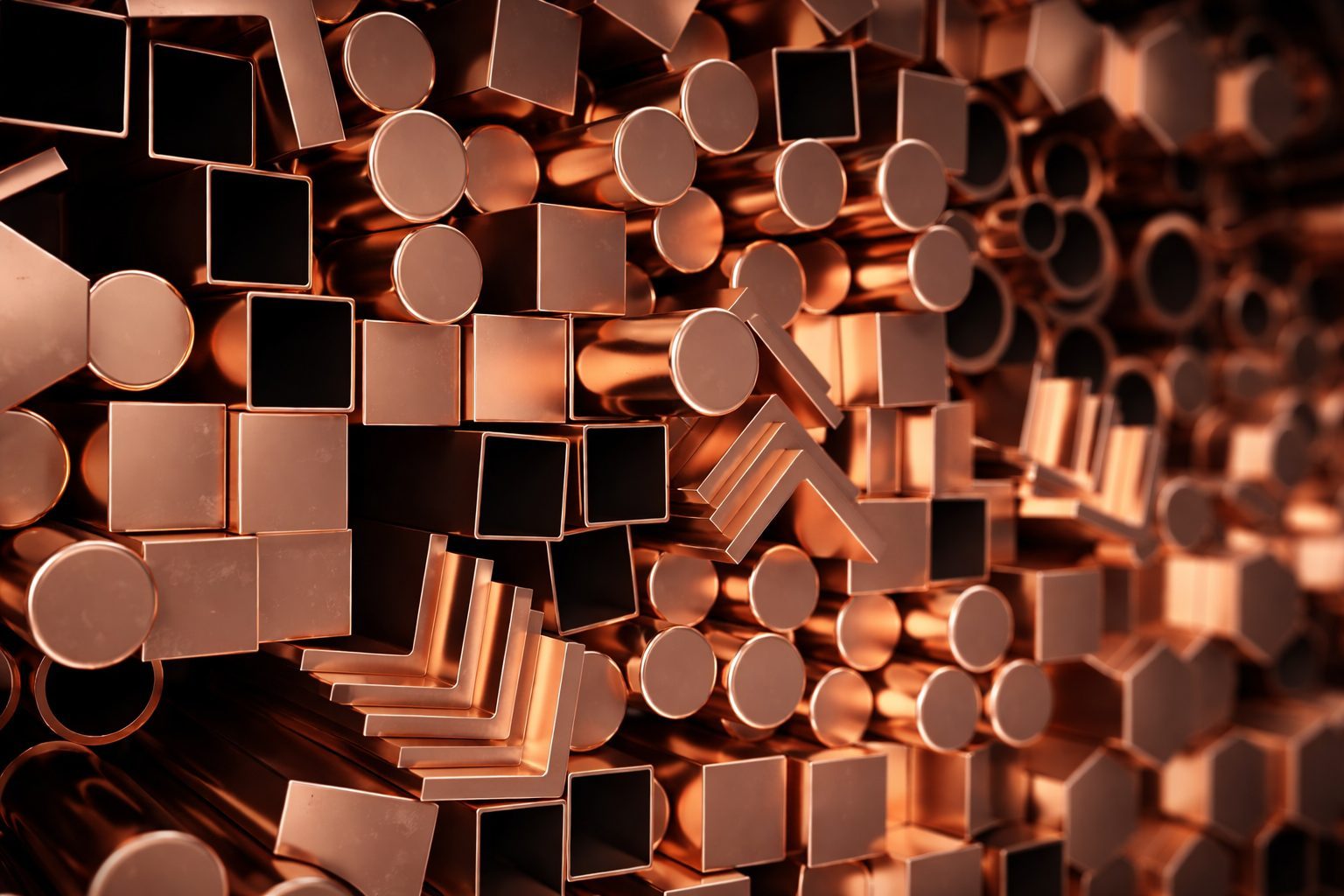

The sharp move matters for manufacturers because copper is used widely in wiring and industrial equipment and is a core input for power grids and renewable-energy infrastructure. 2

Analysts and traders have also pointed to trade dislocations linked to possible U.S. import tariffs, which have encouraged shipments of metal into the United States and tightened supply elsewhere. 2

“Comex led on Boxing Day,” said Robert Montefusco at broker Sucden Financial, referring to the U.S. copper market’s rally while London was closed. 1

U.S. Comex copper futures jumped to $5.8395 per lb on Friday, surpassing a record touched on July 23 when a planned date for U.S. tariffs approached, Reuters reported. 1

Reuters said U.S. tariffs imposed this year did not affect refined copper, but the decision will be revisited next year, prompting a fresh flow of copper into the United States to capture higher prices there. 1

That stock build has tightened markets elsewhere, while mine disruptions have led many analysts to forecast copper deficits next year, Reuters reported. 1

Copper on the LME is up about 41% for the year, supported by worries about shortages, a weaker dollar and a broader “risk-on” mood — stronger appetite for risk — across markets, according to Reuters. 1

The Financial Times reported copper is on track for its largest annual rise in more than a decade, after prices pushed above $12,000 a ton in December as the year-end rally intensified. 3

Demand is rising with the build-out of wind and solar power, electrification of vehicles and a boom in data centers that power artificial intelligence, while ageing mines are becoming less productive and new mines are costly and slow to develop, the Financial Times said. 3

The newspaper also said sustained high prices could push some manufacturers toward cheaper substitutes and hit less essential demand such as decarbonisation — cutting carbon emissions. 3

Copper stocks in Comex warehouses have reached a record 400,000 tonnes, while LME inventories have fallen, especially in Europe, the Financial Times reported, highlighting how the U.S. draw has reshaped physical supply. 3

Bloomberg said copper has gained more than 15% in December as investors bet a rush to get metal into the United States ahead of possible import tariffs will force buyers elsewhere to pay more. 2

In China, the most-active copper contract on the Shanghai Futures Exchange touched a record 102,660 yuan a ton and ended daytime trading at 98,860 yuan ($14,105.33), up 0.8%, after news China would rein in copper capacity growth in its next five-year plan, Reuters reported. 1

Other base metals mostly rose, with LME aluminium edging up to $2,963.50 a ton and zinc gaining to $3,112, while tin slipped to $42,600, Reuters said. 1

A Forex.com note dated Dec. 28 flagged copper as a trade to watch for 2026, as the market looks ahead to next year’s tariff decisions and an increasingly tight supply picture. 4