NEW YORK, January 1, 2026, 13:54 ET — Market closed

- The Materials Select Sector SPDR Fund (XLB) fell 0.83% on Dec. 31, while iShares U.S. Basic Materials ETF (IYM) lost 0.98%.

- Precious metals pulled back into year-end, with spot silver down 7.1% and spot gold off 0.78% on Wednesday.

- Traders are weighing a China PMI rebound against the next U.S. data prints and January earnings catalysts.

U.S. basic materials stocks ended 2025 on a softer note, with sector ETFs slipping on Wednesday as investors took profits in metals and kept risk light into the New Year holiday. U.S. equity markets are closed on Thursday for New Year’s Day. 1

Why it matters now: materials shares tend to track swings in commodity prices and expectations for global growth, leaving them sensitive to fresh signals from China and the U.S. economy at the start of 2026. The sector is also coming off a year in which industrial metals rallied sharply, raising the bar for earnings and guidance updates this month. 2

Wall Street’s main indexes finished the last session of 2025 lower in thin trading, and key commodity benchmarks also retreated. The S&P 500 fell 0.74% on Wednesday, while spot gold slipped 0.78% and spot silver dropped 7.1%; U.S. crude settled down 0.91%. 3

The Materials Select Sector SPDR Fund (XLB) — an exchange-traded fund, or ETF, that tracks a basket of U.S. materials companies — closed down 0.83% at $45.35 on Dec. 31, according to StockAnalysis data. iShares U.S. Basic Materials ETF (IYM) ended at $153.96, down 0.98% on the day. 4

Among widely held names, Freeport-McMoRan fell 1.21% to close at $50.79, while gold miner Newmont slid 1.97% to $99.85, MarketWatch data showed. In construction materials, Martin Marietta Materials dropped 1.39% and Vulcan Materials lost 1.27%. 5

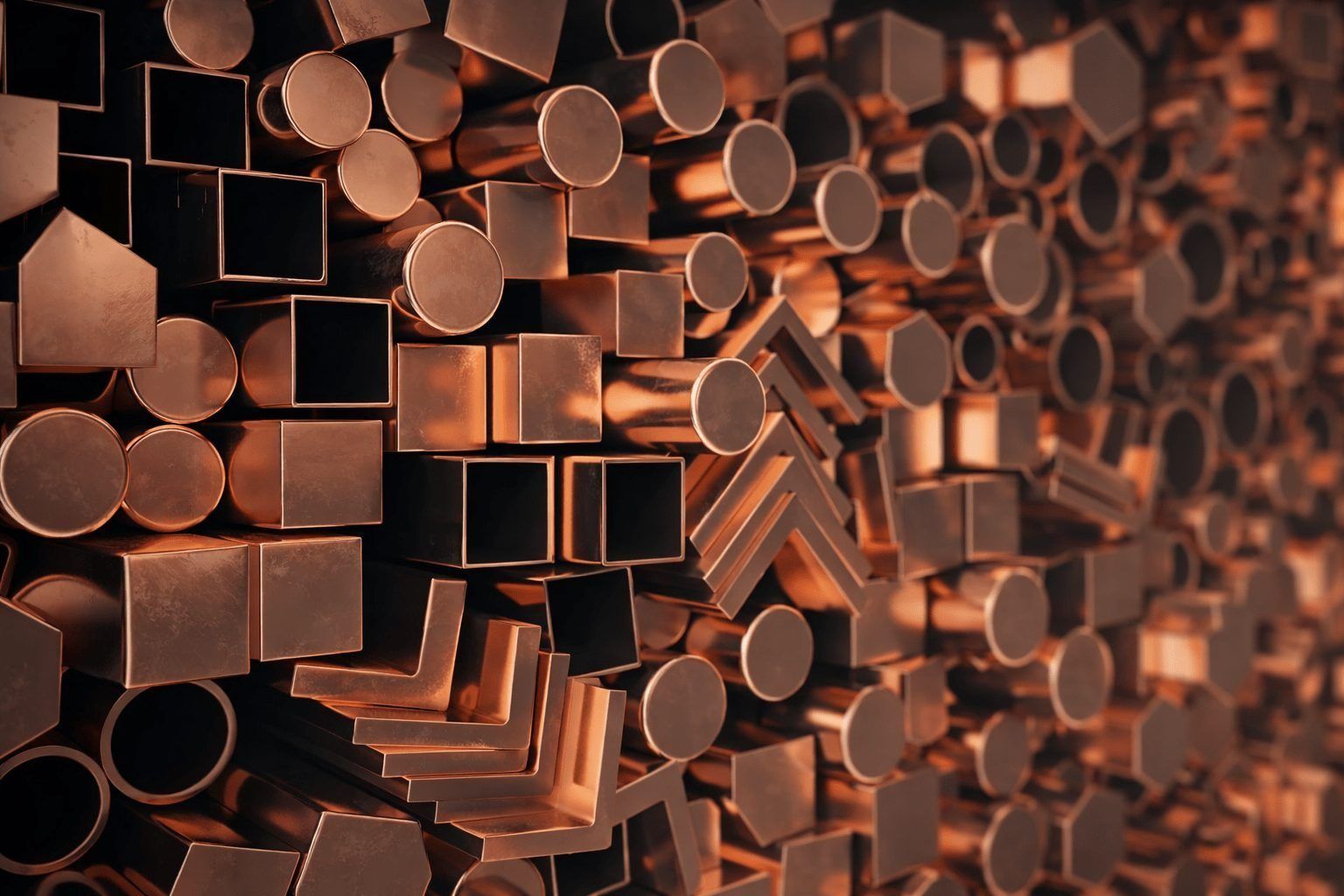

The sector’s dip came despite a broader backdrop of strong annual gains in parts of the commodity complex. Reuters reported copper hit an all-time high of $12,960 on the London Metal Exchange this week, while silver gained 161% in 2025 and gold climbed 66%. 2

“Demand for metals is looking solid from both an industrial and retail perspective,” Tim Waterer, chief market analyst at KCM Trade, said in a Reuters commodity wrap. 2

Overnight macro signals out of China were more supportive for industrial metals demand. China’s official purchasing managers’ index (PMI) — a survey-based gauge where 50 marks the line between expansion and contraction — rose to 50.1 in December from 49.2, snapping an eight-month run below 50, Reuters reported. 6

China also moved to front-load some investment planning for 2026, approving a 295 billion yuan ($42 billion) plan tied to major projects and ecological initiatives, a development that materials traders often watch as a proxy for construction- and infrastructure-linked demand. 7

In the U.S., traders are also watching the interest-rate narrative, which can feed directly into metals pricing through the dollar and real yields. Reuters flagged that investors were looking ahead for clearer signals on the Federal Reserve’s policy path as economic releases normalize after the federal government shutdown. 3

From a chart perspective, XLB remains near the top of its past-year range: Investing.com lists a 52-week span of $36.56 to $46.43. IYM’s iShares fact sheet shows a 52-week range of $116.26 to $157.62, leaving both funds within a few percentage points of their highs going into 2026. 8

Before the next session, investors will parse weekly jobless claims on Friday, a holiday-shifted release that can move Treasury yields and the dollar — key inputs for metals pricing. 9

The next major U.S. growth read on the calendar is the ISM Manufacturing PMI for December, due at 10:00 a.m. ET on Monday, Jan. 5, ISM said. 10

Earnings season catalysts start to reassert themselves later in January, led in materials by Alcoa, which said it will report fourth-quarter and full-year 2025 results on Jan. 22 after the market close. Investors are also bracing for the December employment report on Friday, Jan. 9, which can reset expectations for rates and, by extension, commodity-sensitive shares. 11