NEW YORK, January 3, 2026, 12:47 ET — Market closed

- Pure-play quantum computing stocks finished Friday up 4%–8%, outpacing broader U.S. benchmarks.

- The jump tracked a renewed bid for smaller, higher-risk names as 2026 trading opened.

- Focus turns to next week’s U.S. jobs report and CES 2026 demos for fresh catalysts.

Pure-play quantum computing stocks closed sharply higher on Friday, kicking off the first trading day of 2026 with outsized gains as investors returned to higher-risk corners of the market.

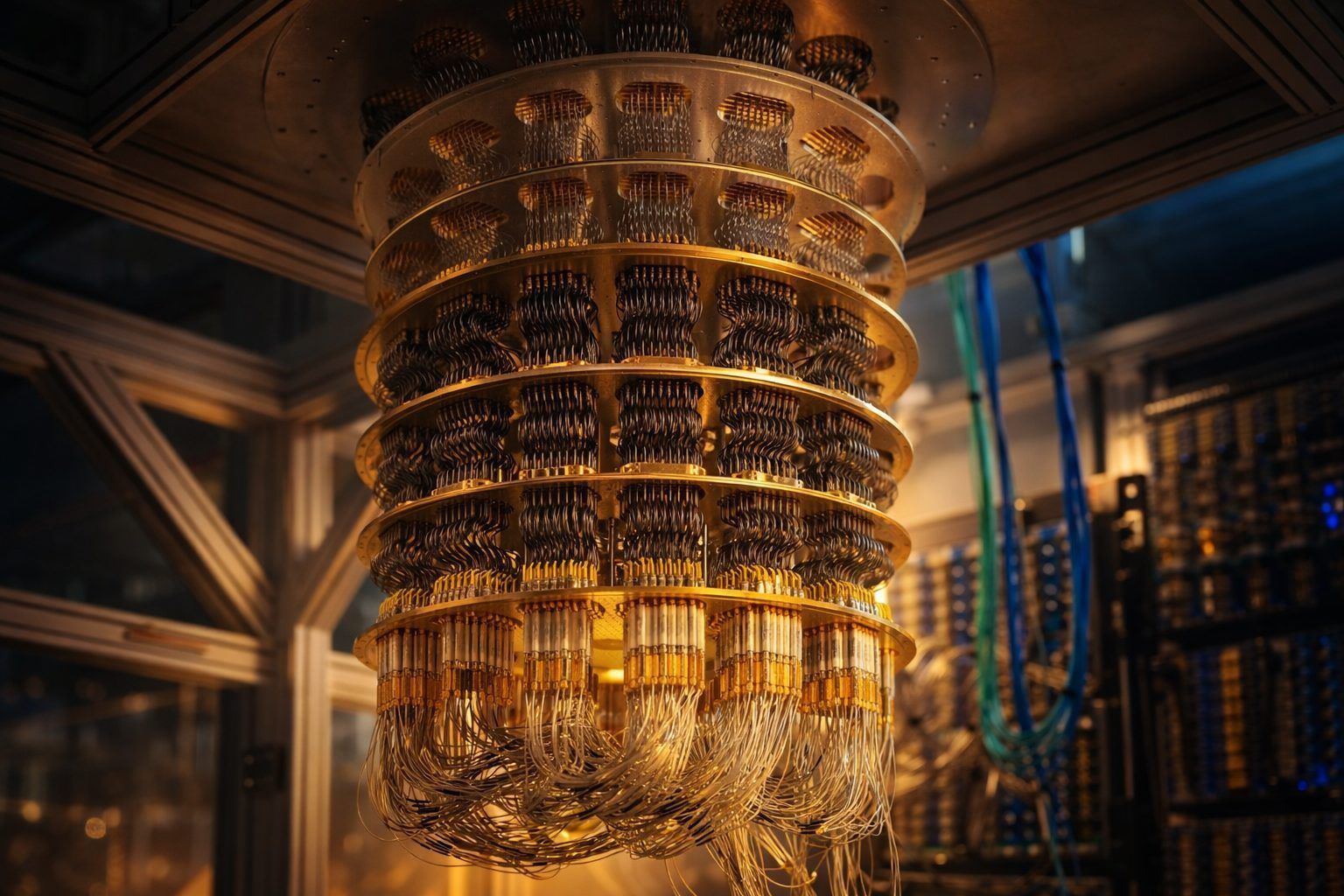

The move matters because the group has become a barometer for “risk-on” appetite in smaller, thematic technology names. Quantum computing aims to use quantum bits, or qubits, to process certain calculations differently than classical computers, but most listed pure-plays are still early-stage businesses.

The rally came as small caps rebounded in the broader market. “The market is seeing a ‘buy the dip, sell the rip,’ trading mentality,” Joe Mazzola, head of trading & derivatives strategist at Charles Schwab, told Reuters. (Source)

D-Wave Quantum rose 7.6% to $28.13, Quantum Computing Inc gained 7.3% to $11.01, Rigetti Computing climbed 6.6% to $23.60, and IonQ added 4.3% to $46.77 at the close.

By comparison, the iShares Russell 2000 ETF gained about 1.1% on Friday, while the S&P 500 tracker edged higher and the Nasdaq-100 tracker slipped.

With CES 2026 days away, some investors are also watching whether product demos and customer case studies can translate into fresh commercial traction headlines for the sector. The annual Las Vegas trade show runs Jan. 6–9.

D-Wave said it will participate in CES Foundry — a two-day event on Jan. 7–8 at Fontainebleau Las Vegas — and that an executive will present a masterclass and demo. 1

Quantum Computing Inc said it plans live demonstrations at CES Foundry, also scheduled for Jan. 7–8, as part of its debut at CES 2026. 2

The four names tend to trade together even though their technologies differ. D-Wave sells “annealing” systems, typically used for optimization problems, while IonQ and Rigetti are developing “gate-model” systems, a more general approach that resembles how conventional computers run logic operations.

Macro catalysts are also back in focus after the holiday lull. Reuters said investors are looking to the U.S. employment report due Jan. 9 and a CPI inflation update due Jan. 13 for clues on interest-rate expectations and risk appetite. (Source)

For the quantum pure-plays, the next hard catalysts are quarterly results and cash-burn updates. Public earnings calendars list expected earnings calls on Feb. 25 for IonQ, March 4 for Rigetti, March 12 for D-Wave, and March 19 for Quantum Computing, though companies can change dates.

Before the next session, traders will be watching whether Friday’s momentum holds when liquidity returns, especially after a sharp move that pushed all four stocks well ahead of broad benchmarks.

Round-number levels are likely to act as the first speed bumps: $50 for IonQ, $25 for Rigetti, $30 for D-Wave and $12 for Quantum Computing. A failure to hold those areas can invite fast profit-taking in high-beta names; a clean break higher can draw in trend-following bids.

Beyond company-specific headlines, the sector remains tethered to the rate and growth outlook. Next week’s labor and inflation data will help set the tone for speculative technology trades that can swing quickly when expectations for interest rates shift.