NEW YORK, Jan 4, 2026, 13:56 ET — Market closed

- Materials Select Sector SPDR ETF (XLB) ended Friday up 1.7% as the year opened.

- Gold held near $4,300 an ounce, keeping miners in focus.

- U.S. jobs data on Jan. 9 and inflation on Jan. 13 are the next tests for rate-cut bets.

The Materials Select Sector SPDR ETF (XLB), a widely watched proxy for U.S. basic materials stocks, rose 0.77, or 1.7%, to $46.12 in the first session of 2026, ending within 31 cents of its 52-week high. 1

That early bid matters because materials are one of the market’s cleanest reads on inflation and global demand. When metals and chemicals move, investors are usually responding to a mix of growth expectations and the path for U.S. interest rates.

The calendar turns quickly from holiday trading to hard data. The U.S. employment report for December is due on Jan. 9, and the December consumer price index follows on Jan. 13, both at 8:30 a.m. ET; the Federal Reserve’s first policy meeting of the year is scheduled for Jan. 27-28. 2

Gold set the tone for commodity-linked trades on Friday, holding around $4,300 an ounce as investors balanced safe-haven demand with expectations for easier policy. “That combination … [is] moving gold, silver, platinum, and palladium higher,” Bart Melek, global head of commodity strategy at TD Securities, said. 3

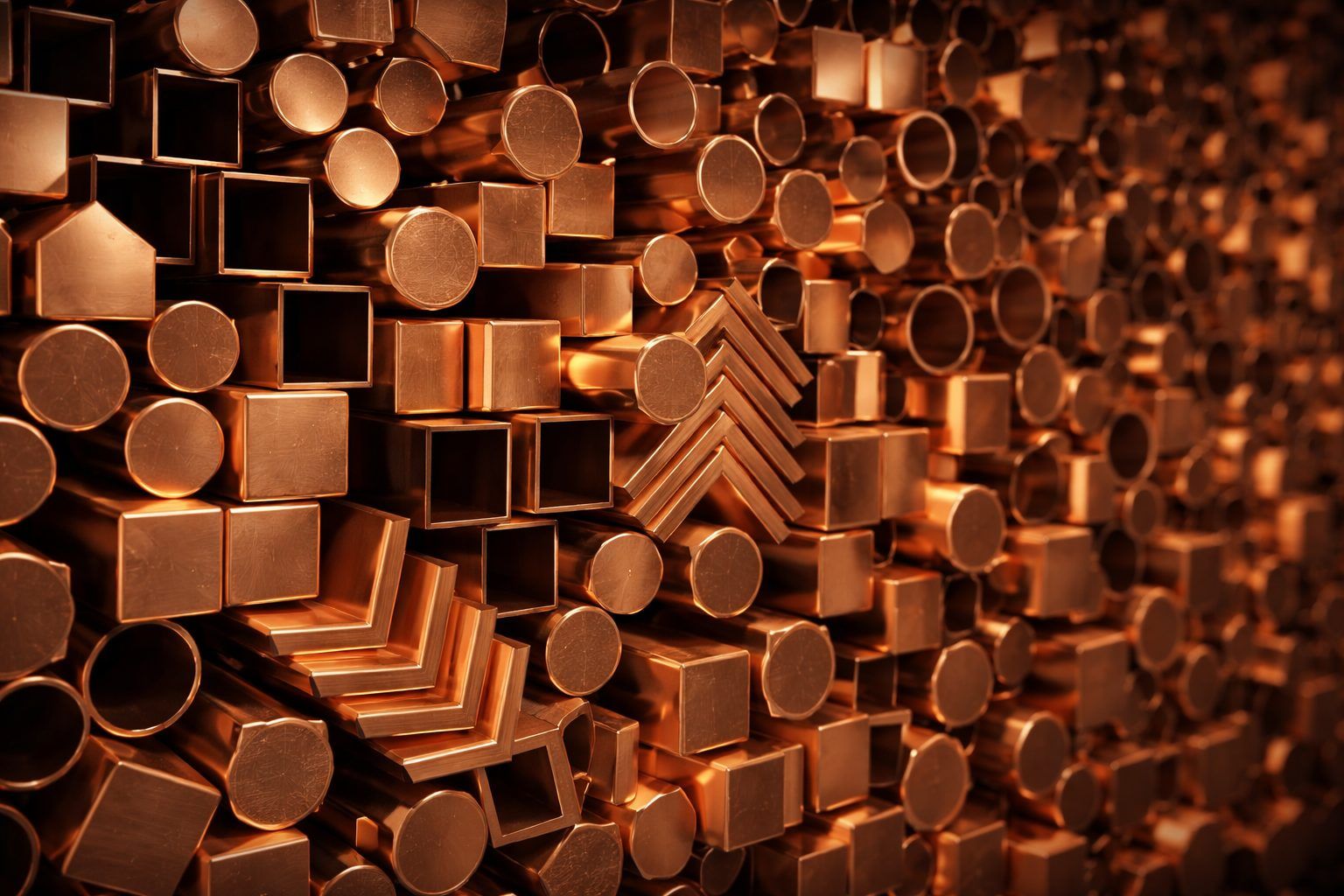

Copper also picked up a supply-side storyline. Capstone Copper said a union representing about half the workers at its Mantoverde copper and gold mine in northern Chile began a strike after contract talks failed; the company said output should run at up to 30% during the stoppage and it remained open to negotiations. 4

The broader market backdrop was less straightforward. U.S. stocks finished mixed on Friday as Treasury yields and the dollar firmed, a combination that often pressures commodity prices by making dollar-denominated metals more expensive for non-U.S. buyers. 5

XLB is an exchange-traded fund — a basket of stocks that trades like a single share — built to track the materials slice of the S&P 500. State Street says the fund targets chemicals, metals and mining, paper and forest products, containers and packaging, and construction materials, and carries a 0.08% expense ratio. 6

From a technical standpoint, traders will be watching whether the fund can clear the $46.43 area that marks its 52-week high, after Friday’s push toward the top of its recent range. The prior close around $45.35 is the first downside level technicians tend to flag when a sector rallies early in January.

But the setup cuts both ways. If incoming jobs and inflation data come in hotter than expected, yields and the dollar could extend their rise, tightening the screws on metals and the stocks tied to them — and some Fed officials have already signaled patience on further cuts. 7

With markets reopening Monday, materials traders head into the week looking for confirmation from macro data and any updates on the Chile strike, while earnings season begins to warm up with JPMorgan Chase set to report on Jan. 13. 8