New York, January 22, 2026, 10:42 EST — Regular session

Spot silver climbed about 2.1% to $95.05 an ounce by 10:37 a.m. EST, after earlier fluctuating between roughly $90.84 and $95.07. The white metal has surged over 200% in the past year, keeping traders ready for volatile moves. 1

The latest surge reflects markets recalibrating the “Greenland premium” after U.S. President Donald Trump stepped back from tariff threats linked to Greenland, while investors swung back toward riskier assets. Silver soared to a record $95.87 on Tuesday, though Bart Melek, global head of commodity strategy at TD Securities, warned, “Silver at this stage is a little overdone and it should start correcting once off the retail pressure.” 2

After weeks of delay caused by last year’s government shutdown, fresh U.S. inflation data has finally arrived. The Commerce Department’s Bureau of Economic Analysis reported consumer spending climbed 0.5% in both October and November. The PCE price index, the Fed’s favored inflation measure, rose 0.2% in November and stood 2.8% higher than a year ago. Core PCE inflation also hit 2.8% year-on-year. Markets now await December’s PCE figures, set for release on February 20. 3

The dollar slipped ahead of crucial data, shifting focus away from the earlier Greenland surprise and back toward interest rates. Bob Savage, head market strategist at BNY, described the move as a “risk-management story,” not a “sell America” one, noting increased hedging amid rising volatility. 4

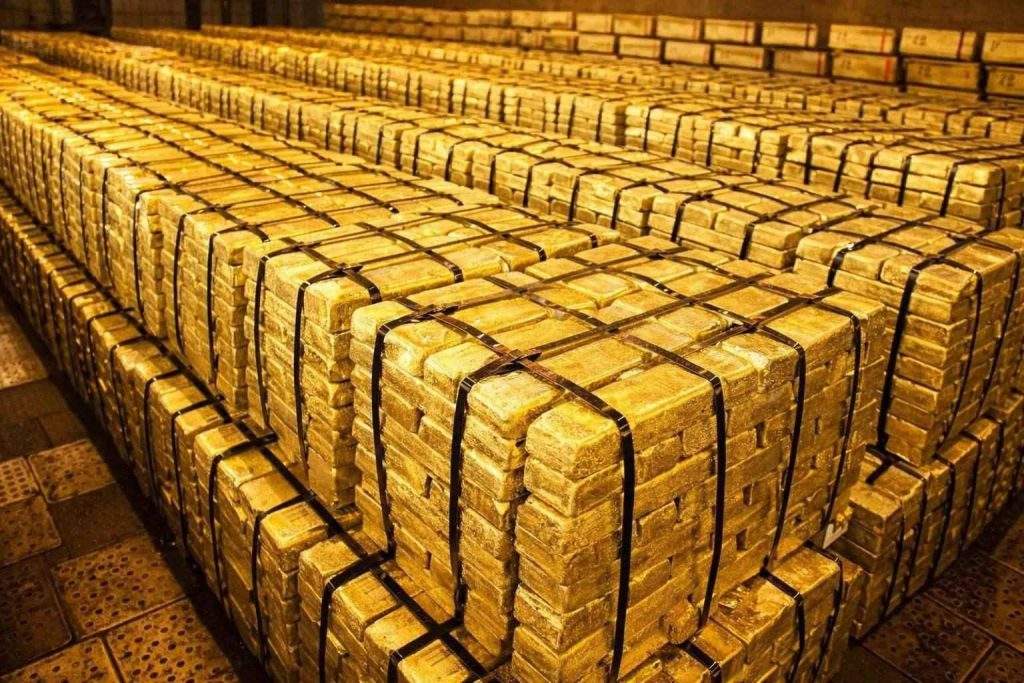

Silver sentiment continues to track gold’s moves, especially as major banks revise their targets upward. Goldman Sachs bumped its end-2026 gold forecast to $5,400 an ounce following spot gold’s record peak at $4,887.82 on Wednesday. 5

During U.S. trading, the iShares Silver Trust ETF climbed $1.68, around 2.0%, reaching $85.64. Pan American Silver added $3.29, about 5.8%, to hit $60.50, and First Majestic Silver jumped $1.55, roughly 7.0%, closing at $23.75.

Gold edged up roughly 0.6% to $4,860 an ounce by 10:41 a.m. EST, lending strength to the wider precious metals sector despite easing geopolitical tensions. 6

Silver remains a smaller, more volatile market compared to gold, with its direction liable to shift if the dollar holds firm or yields climb. Should risk appetite continue to grow and fast money retreat, silver’s recent surge toward its highs might unravel into a sharp pullback.

The Federal Reserve’s policy meeting is set for January 27-28. Investors will zero in on the January 28 statement and press conference, looking for any change in the Fed’s rate outlook. 7