New York, Feb 9, 2026, 10:24 EST — Regular session

Gold punched back above $5,000 an ounce early Monday as the dollar lost ground, shifting attention toward upcoming U.S. data after a volatile open to February. By 9:30 a.m. ET, spot gold was higher by 1.2% at $5,018.56 an ounce, with U.S. gold futures for April delivery up 1.3% to $5,042.20. “The big mover today (in gold prices) is the U.S. dollar,” said Bart Melek, global head of commodity strategy at TD Securities. The greenback slid 0.8%, and traders held on to expectations for at least two quarter-point rate cuts this year. 1

Here’s the point: gold tends to shine when money isn’t expensive and currencies are moving in its favor. With no interest coming from bullion, it gets more appealing to investors if rates seem likely to drop or the dollar slips.

So the coming data drops carry extra weight. Traders will zero in on the U.S. consumer price index for January, out Feb. 13, one of the clearest snapshots they have to gauge if the Fed has room to cut rates without stoking inflation again. 2

China’s central bank is still in buying mode. The People’s Bank of China increased its gold reserves for the fifteenth month running in January, nudging holdings to 74.19 million fine troy ounces from 74.15 million, according to Reuters calculations based on central bank data. 3

Traders are used to that quiet but persistent support from central banks. It doesn’t show up every session, but when prices tumble, it’s impossible to miss.

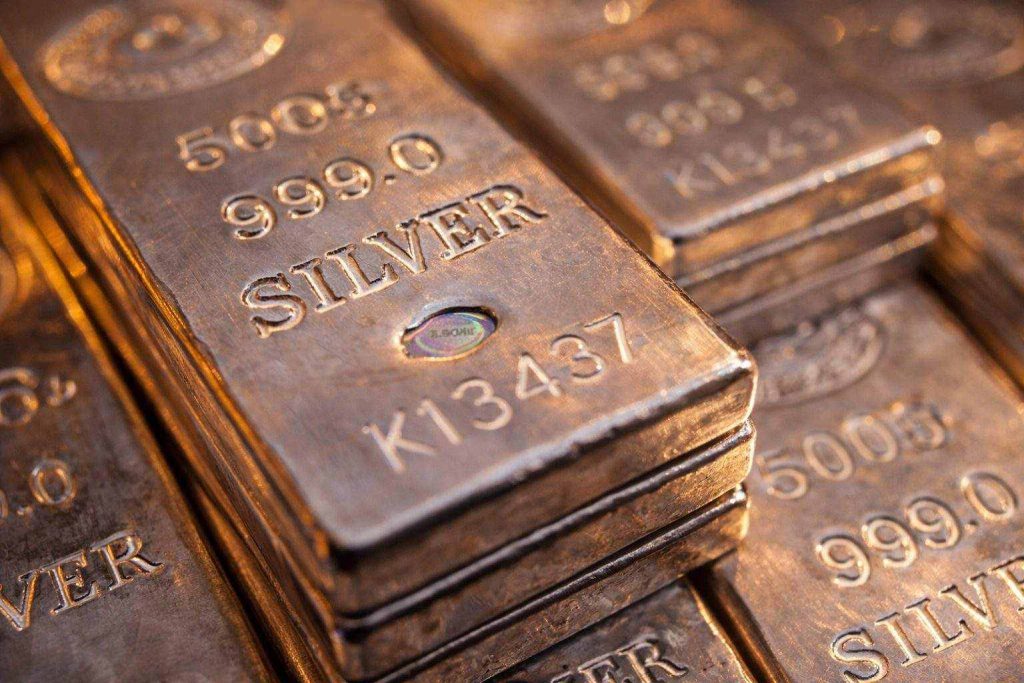

The rebound follows sharp moves in metals and other risk assets. According to a separate Reuters market report, gold gained 1.1% to roughly $5,015, pulling well clear of last week’s $4,403 low. Silver jumped 3.4%, reaching $80.58 an ounce. 4

Even so, the downside risk looms large. A jump in inflation or a stronger jobs print could send yields and the dollar climbing once more—gold, for its part, hasn’t hesitated to retreat under those conditions.

Momentum brings its own risks. Following a stretch like this, prices may just as easily move on traders’ positions and profit grabs as on any big-picture news.

Friday, Feb. 13 is shaping up as the next hurdle: January’s jobs numbers and the CPI both drop at 8:30 a.m. Eastern, a double release with the potential to shift rate-cut bets quickly. 5