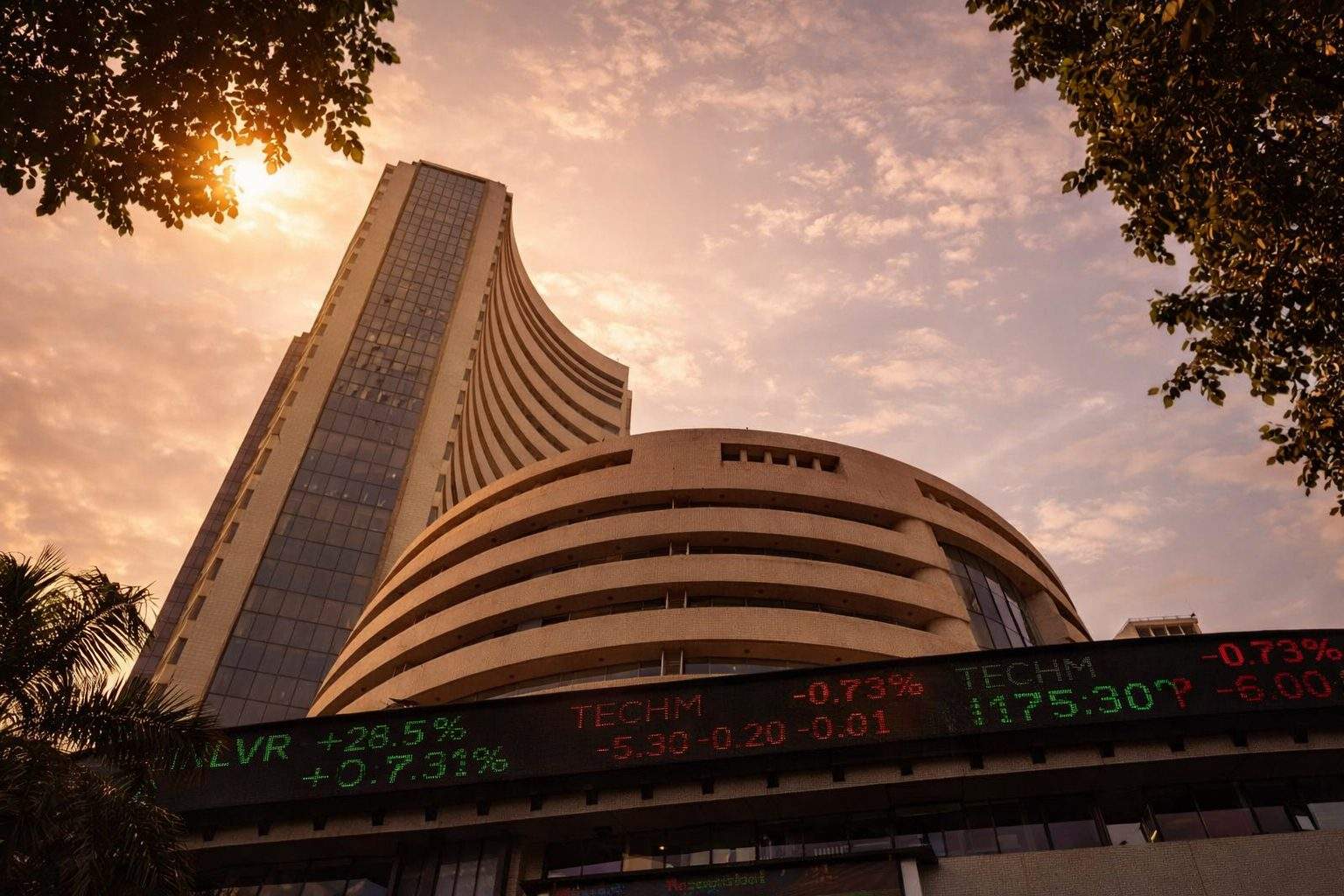

Mumbai, Feb 22, 2026, 12:19 IST — The session ended with markets closed.

- Sensex wrapped up Friday with a 0.38% gain at 82,814.71, while the Nifty 50 edged up 0.46% to close at 25,571.25. (Moneycontrol)

- India is rolling out its updated GDP series on Feb. 27, introducing tweaks to the calculation of “real” growth. (Forbes India)

- Four mainboard IPOs are hitting the market from Feb. 23–27, with Clean Max Enviro and Omnitech Engineering topping the list. (The Financial Express)

Stocks in Mumbai opened again on Monday, with traders eyeing oil and geopolitics after benchmarks eked out only small gains last week. On Friday, the Nifty 50 closed up 0.46% and the BSE Sensex added 0.38%. That puts the week’s moves at just 0.4% for the Nifty and 0.2% for the Sensex. “PSU banks have been beating expectations while private sector banks have been lagging,” said Suresh Ganapathy, managing director and head of financial services research at Macquarie Capital. (Reuters)

Even on days when the market closed higher, trading stayed volatile. Last week, the Nifty ranged from 25,372.70 up to 25,885.30. India VIX, which tracks expected 30-day volatility from options prices, jumped 8.05% to 14.36, according to Economic Times. (The Economic Times)

Why does it matter? Higher hedging costs make traders more likely to reduce risk fast. With a slim lead and choppy signals from abroad, even modest shifts start to look outsized.

The rupee finished Friday at 90.9825 against the U.S. dollar, slipping 0.3% for the day and 0.4% this week, according to Reuters. Pressure came from suspected portfolio outflows and persistent U.S.-Iran tensions. ING analysts commented, “the dollar acts more efficiently as a safe haven when geopolitical risk lifts crude prices.” (Reuters)

Foreign portfolio investors (FII/FPI) pulled out 947.57 crore rupees from the cash market on Feb. 20, provisional NSE data showed, while domestic institutions (DII) picked up a net 2,479.99 crore. (NSE India)

Oil’s right in the thick of the action. Brent crude wrapped up Friday at $71.76 a barrel, logging a weekly climb north of 5%, with traders jittery over supply risks as the U.S.-Iran standoff heats up, according to Reuters. (Reuters)

Rates remain in flux. According to minutes from the Reserve Bank of India’s February meeting, most members consider the current policy rate to be about right. Governor Sanjay Malhotra noted that “growth prospects are looking up while inflation outlook remains broadly unchanged.” Deputy Governor Poonam Gupta pointed to last year’s 125 basis points of cuts—remember, a basis point is 0.01 percentage point—then added, “another rate cut does not seem warranted at this point in time.” (Reuters)

Not every local indicator has disappointed. Government figures released Friday showed India’s infrastructure output climbed 4% in January compared with a year earlier. Cement output jumped 10.7%, while steel rose 9.9%. (Reuters)

The RBI is emphasizing that “flows are improving.” According to its monthly bulletin, foreign portfolio flows swung back into positive territory in February, following India’s trade agreements with both the European Union and the United States. The bulletin also points to the government’s push: a plan to trim the fiscal deficit target to 4.3% of GDP and ramp up capital expenditure to 12.2 trillion rupees. (Reuters)

This week, the primary market is set for a scramble for both investor focus and liquidity. Clean Max Enviro Energy Solutions is eyeing a raise of roughly 3,100 crore rupees through a blend of freshly issued shares and an offer-for-sale—meaning some current shareholders plan to offload part of their stakes. NDTV Profit also flagged IPO plans from Shree Ram Twistex, PNGS Reva Diamond Jewellery, and Omnitech Engineering, all gearing up to hit the market. (NDTV Profit)

Earnings season may be winding down, yet a few names could still see action. Schaeffler India lines up its numbers for Feb. 24. Sanofi India and Sanofi Consumer Healthcare India are both set to report on Feb. 25. Rain Industries, meanwhile, is on deck for Feb. 27, per Mint’s results calendar. (mint)

This week could end up at the mercy of headlines, not hard data. According to Economic Times, U.S. tariff news, ongoing U.S.-Iran friction, crude price moves, the rupee’s shifts, and shifting institutional flows are all shaping up as key volatility triggers for Dalal Street. (The Economic Times)

Eyes are on Friday, when the statistics ministry drops a new national accounts series using 2022–23 as the base year. That revamp, out Feb. 27, will tweak the math behind price-adjusted output. Markets will be quick to dissect what this framework shakeup means for growth perception and the path for rate moves. (Stats Ministry)