AMC Robotics Corporation stock (Nasdaq: AMCI) heads into December 25, 2025 with the kind of price action that makes both momentum traders and risk managers sit up straighter. The shares last closed Dec. 24 at $9.35, up 47.94% on the day, on roughly 26.5 million shares of volume—an outsized turnover for a newly listed, tightly held name. Finviz

Under the hood, the story is less “steady fundamentals” and more a collision of fresh de‑SPAC mechanics, a concentrated ownership structure, and headline-driven trading—including a Dec. 18 notice telling readers to disregard two Dec. 17 releases tied to Japan. Nasdaq

Below is what’s known as of Dec. 25, 2025 from company filings, press releases, and third‑party analysis—and what to watch as AMCI heads toward 2026.

AMCI stock price today: where shares stand as of Dec. 25, 2025

Because U.S. markets are closed on Christmas Day, the freshest “today” datapoint for AMCI is the Dec. 24 close.

- Last close (Dec. 24):$9.35 (+47.94%) Finviz

- Prior close:$6.32 FinancialContent

- Intraday range (Dec. 24):$5.93 – $12.47 FinancialContent

- Displayed 52‑week range on major quote aggregators:$2.50 – $42.00 Finviz

- Volume (Dec. 24): about 26.5M shares FinancialContent

This is the statistical fingerprint of a stock being “discovered” by the market in real time: wide ranges, violent percentage swings, and liquidity that can appear or vanish depending on the day’s narrative.

What is AMC Robotics Corporation?

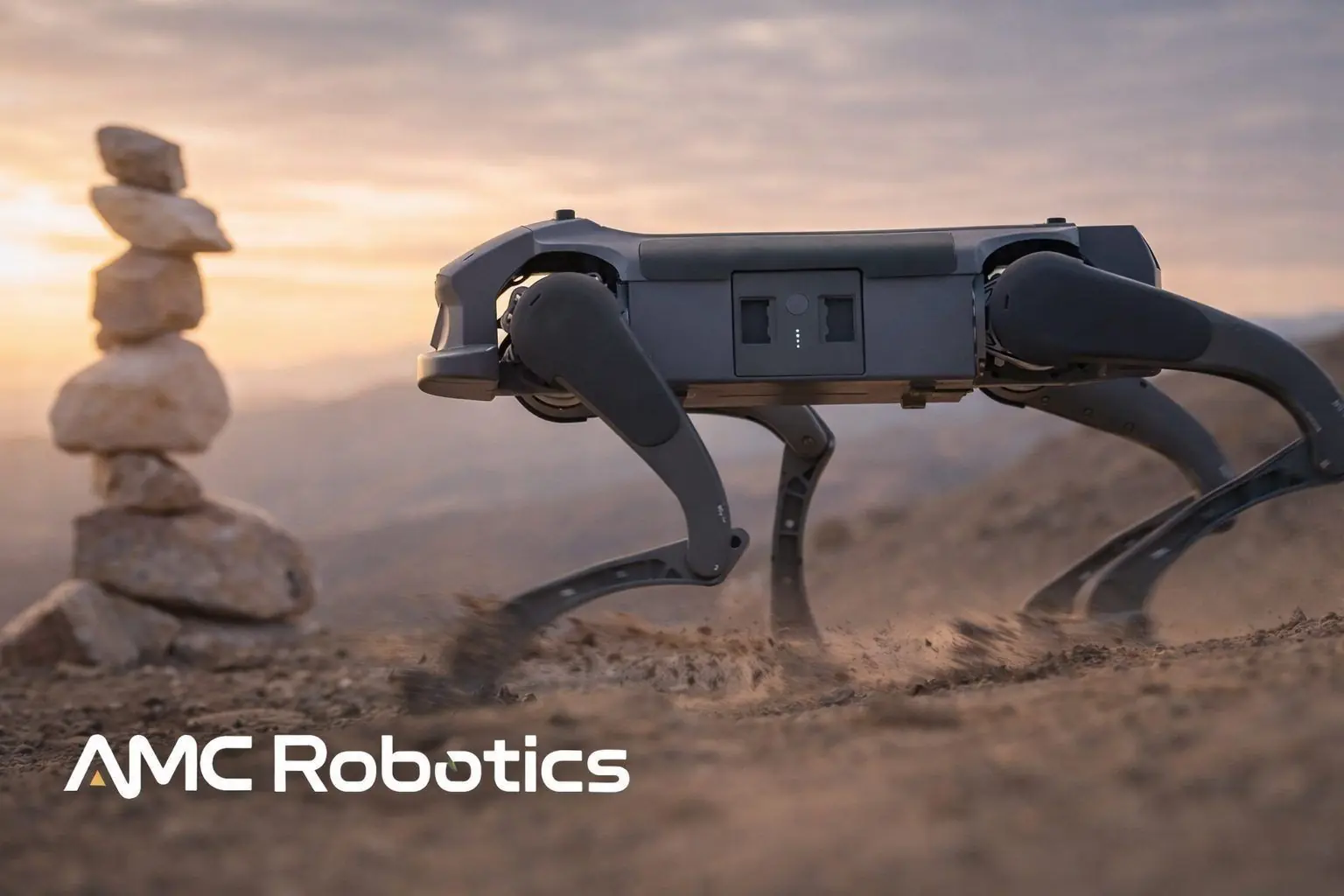

AMC Robotics Corporation presents itself as an AI and robotics business aimed at logistics, warehousing, and security applications. On its investor site, the company frames its mission as building autonomous robots for modern logistics and warehousing. Amcx

In the company’s merger/closing communications, AMC is described as a technology solutions company with an existing smart security portfolio—including YI security cameras—and an AI‑powered quadruped robot positioned for patrol and incident response use cases in warehouse environments. Nasdaq

That mix—security hardware + AI software + robotics—puts AMCI into a crowded theme (automation and AI) where storytelling can move a chart quickly, especially when the tradable float is limited.

The December 2025 timeline: key headlines moving AMC Robotics stock

Dec. 9–10: AMC Robotics becomes a newly listed de‑SPAC (AMCI)

AMC Robotics was formed through the closing of a business combination involving AlphaVest Acquisition Corp and AMC Corporation, with the combined company expected to trade on Nasdaq under “AMCI” around Dec. 10, 2025. Nasdaq

The transaction included an $8 million private financing priced at $10 per share, and the company indicated total available cash (private financing + trust cash released) expected to exceed $10.2 million before closing expenses. Nasdaq

Mid‑December: “low float” trading narrative takes hold

One widely circulated read of AMCI’s early move is that it traded like a low-float momentum vehicle more than a conventional “new robotics investment.” A Seeking Alpha analysis published Dec. 16 argued the rally was driven largely by speculative trading dynamics rather than a clean fundamental catalyst. Seeking Alpha

Dec. 17: Japan framework announcement circulates (then becomes controversial)

On Dec. 17, an article summarizing a company press release said AMC Robotics had established a non-binding supplier framework aimed at supporting deployments in Japan for a government agency, while explicitly noting there was no assurance definitive agreements would be completed. Investing.com India

Dec. 18: Company issues a notice to disregard the Japan releases

On Dec. 18, AMC Robotics published a notice stating that journalists and readers should disregard two GlobeNewswire releases issued Dec. 17 (the Japan supplier framework release and its update). Nasdaq

If you’re trying to explain AMCI’s volatility to a non-trader friend, that pairing—“big international expansion headline” followed by “please disregard”—is basically jet fuel for uncertainty-driven price action.

The filing that matters: what AMCI disclosed in its Form 8‑K

For investors who want to separate signal from vibes, the most important source in this moment is AMC Robotics’ Form 8‑K (reporting the business combination and related agreements).

1) Shares outstanding and redemptions

As of the closing date and after the transaction, the company reported 22,595,384 shares of common stock issued and outstanding. SEC

The 8‑K also disclosed that 848,354 SPAC shares were redeemed for approximately $10.3 million. SEC

2) Private placement and warrant overhang

The filing describes an $8 million private placement at $10.00 per share for 800,000 shares, plus warrants to purchase 2,240,000 shares (initially exercisable at $10.00, subject to adjustment). SEC

Translation: even if the common stock is ripping higher today, the capital structure includes instruments that can become relevant if the stock sustains levels where exercising or monetizing those warrants makes economic sense.

3) Extremely concentrated ownership (and “controlled company” status)

The 8‑K’s beneficial ownership table shows CEO Shengwei (Sean) Da beneficially owning 18,590,000 shares, listed as 77.0% of common stock (as calculated under SEC rules). SEC

The filing also states AMC Robotics is a “controlled company” under Nasdaq rules because the controlling shareholder(s) hold a majority of voting power, and it explains that controlled companies may elect not to comply with certain governance requirements (though AMC said it had not taken advantage of these exemptions as of the closing date). SEC

4) Lock-up and resale registration dynamics

AMC Robotics disclosed a Lock-Up Agreement restricting certain holders from selling during the lock-up period, and also described a Registration Rights Agreement requiring the company to file a registration statement for resale of shares held by specified parties. SEC

These two forces often define the “next chapter” of de‑SPAC trading:

- Lock-ups can tighten float (supporting volatility).

- Resale registration can increase liquidity later (sometimes increasing selling pressure, sometimes simply normalizing trading).

5) Dividend policy: don’t expect one

AMC Robotics stated it has not paid cash dividends and has no current plans to do so for the foreseeable future. SEC

Why AMCI’s “low float” setup can dominate the price

AMCI’s early trading behavior makes more sense when you combine two facts from the 8‑K:

- 22.6M shares outstanding SEC

- 80.7% held by executives/directors as a group (per the disclosed table), with the CEO alone at 77.0% SEC

A simple (imperfect, but useful) way to think about it:

- If insiders control roughly 80%, then only roughly 20% is outside that group—about 4.5M shares based on the reported outstanding count.

- The filing also notes the shares were held “of record” by 36 holders (excluding DTC participants and beneficial owners via nominees), another hint that the shareholder base may be concentrated and market liquidity may be structurally thin. SEC

Then layer on:

- lock-up restrictions SEC

- potential future resale registration SEC

- warrants and other de‑SPAC structure elements SEC

That’s how you end up with a stock that can be up 50% one day and down 30% another with no change in long-term business prospects—because the market microstructure becomes the story.

Forecasts and analyses as of Dec. 25, 2025: what’s actually available?

Traditional Wall Street forecasts: limited (and data can be messy)

Because AMCI is newly listed post‑merger, traditional analyst coverage and clean consensus forecasts can be sparse or inconsistent across platforms right now. As one example of the data messiness, some market pages still label the ticker as “AMCI Acquisition” and even reference an older SPAC-era website—an indication that databases may not have fully harmonized the post‑transaction identity. MarketBeat

Practical takeaway: for “ground truth” on structure, ownership, and governance, SEC filings and the company’s IR site are currently more reliable than generic snapshot cards.

Technical/quant-style “forecasting”: neutral to mixed

TradingView’s technical summary for AMCI (as displayed on its symbol page) reads Neutral on both oscillators and moving averages, and it also flags large volatility metrics on the name. TradingView

This isn’t a prophecy—technical indicators are descriptive, not magical—but it reflects that AMCI’s recent move hasn’t stabilized into a clean trend across common indicators.

Narrative/structural analysis: “momentum first” framing

The most pointed “why is this moving?” analysis in circulation frames AMCI as a low-float momentum trade wearing a robotics label—arguing that the early spike was primarily speculative and not tied to a single new fundamental development. Seeking Alpha

That thesis also fits the ownership math disclosed in the 8‑K. SEC

The Japan headline whiplash: why the retraction matters even without details

The Dec. 18 notice doesn’t provide a replacement announcement, corrections, or financial details—it simply tells readers to disregard the two identified Dec. 17 releases. Nasdaq

From a market standpoint, that matters because it injects three kinds of risk into a young public stock:

- Information risk: traders can’t confidently use the earlier narrative. Nasdaq

- Credibility risk: even if the underlying business is fine, the communication sequence can elevate skepticism. Nasdaq

- Volatility risk: uncertainty widens disagreement on value, and disagreement creates bigger moves.

What to watch next: near-term catalysts that could reshape AMCI’s trading

Here are the “next dominoes” implied by filings and structure—not predictions, but things that commonly move de‑SPAC stocks from chaos toward a more normal market:

Resale registration filings and effective dates

AMC Robotics disclosed registration rights that may lead to resale registration statements for certain holders. When those are filed/effective, liquidity can change fast. SEC

Lock-up milestones

Lock-up provisions can keep float tight initially, then expand supply later. The existence of lock-ups is explicitly disclosed (even if the exact schedules may require reading referenced exhibits). SEC

Commercial proof points (signed contracts vs. frameworks)

Given the Dec. 17/18 episode, investors are likely to discount “framework” language and weight definitive agreements, customer deployments, and measurable recurring software/cloud revenue more heavily. Investing.com India

Ongoing SEC disclosures (ownership changes and insider activity)

AMCI’s concentrated ownership makes any meaningful stake changes more impactful than usual. SEC

Bottom line for Dec. 25, 2025

As of Dec. 25, 2025, AMC Robotics Corporation stock is best understood as a newly public, structurally tight-float de‑SPAC where ownership concentration and trading mechanics may be driving price as much as (or more than) fundamentals—at least in the short run. SEC

The most concrete facts in the public record right now are:

- the company’s post‑merger formation and financing structure Nasdaq

- a high-control governance profile (controlled company; CEO at 77% beneficial ownership) SEC

- and a notable communications reversal (Dec. 18 notice to disregard the Dec. 17 Japan releases) Nasdaq

For investors, the key question going into 2026 is whether AMC Robotics can convert the market’s attention into durable, verifiable commercial traction—and whether the stock’s liquidity profile normalizes as lock-ups and registrations evolve. SEC