- Odin (Brokkr-2) launched on Feb 26, 2025 aboard SpaceX Falcon 9 as part of Intuitive Machines’ IM-2 lunar mission.

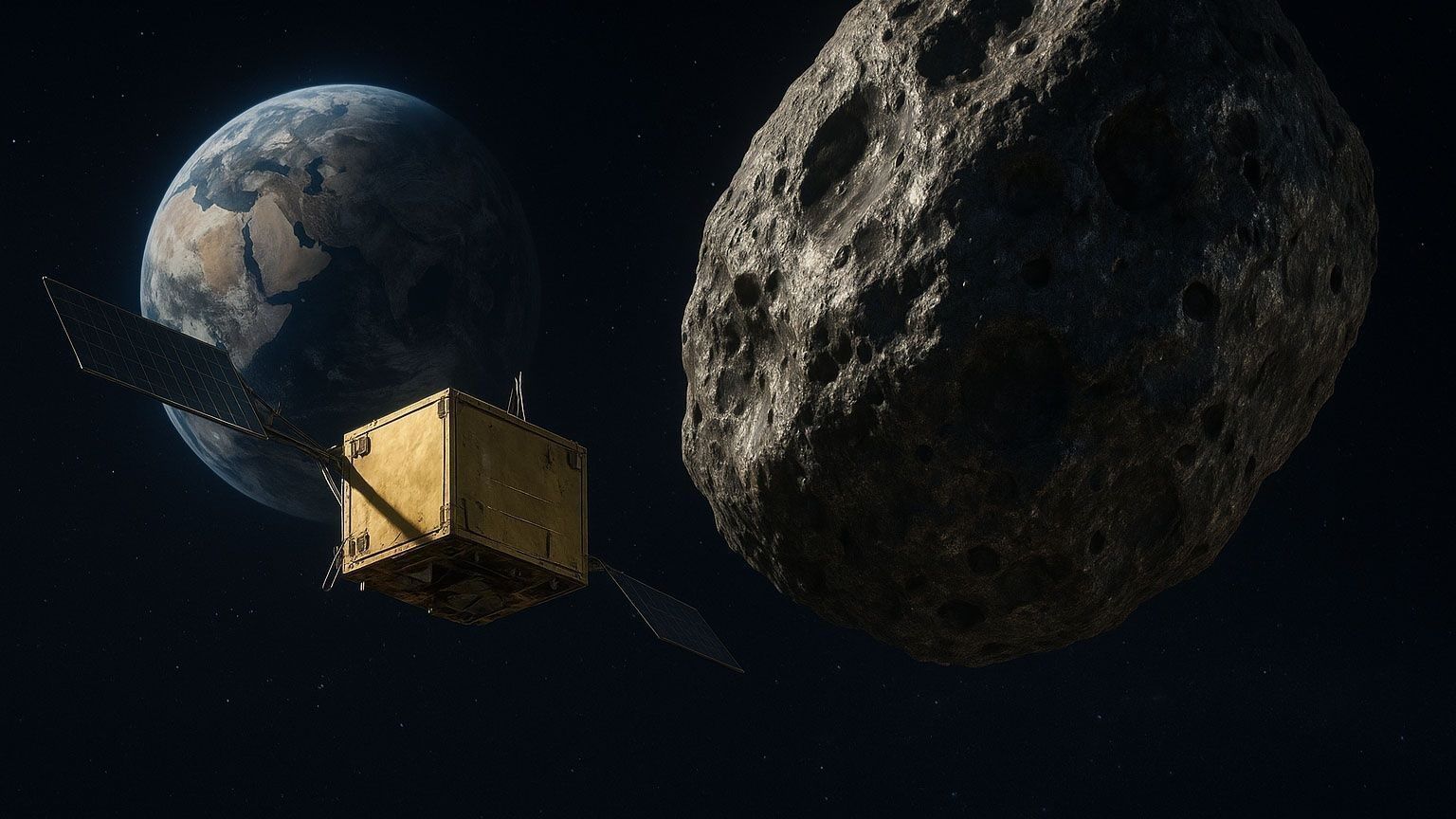

- Its target was near-Earth asteroid 2022 OB5, about 20–30 meters in size (up to ~100 meters diameter) and suspected to be M-type metal-rich, with a flyby planned roughly 300 days after launch to confirm its metallic content.

- Odin is a ~120 kg fully fueled deep-space probe built on Orbital Astronautics’ ORB-50 platform, with about 1×1×0.7 m dimensions and an approximate development cost of US$3.5 million.

- The spacecraft uses electric propulsion with xenon thrusters supplied by Dawn Aerospace, enabling a cruise of about 8–11 months to reach the asteroid.

- Odin carries cameras and spectrometers on a 3-axis stabilized bus, powered by deployable solar arrays to image the asteroid and measure its metal content.

- After launch, Odin experienced persistent ground-station and pointing issues and was declared lost on March 6, 2025.

- Brokkr-1, a 6U cubesat launched on Apr 15, 2023, tested in-space refining but failed due to solar-panel deployment and comms problems, and Odin is intended as the reconnaissance step preceding Vestri, a ~200 kg lander planned for late 2025/26 to return to 2022 OB5.

- On Oct 28, 2024, AstroForge received the first-ever FCC deep-space communications license for a private asteroid mission, enabling Odin’s communications.

- Odin would have been the world’s first privately funded asteroid-survey mission, serving as a de-risking precursor and informing Vestri’s landing and extraction design.

- AstroForge was founded Jan 10, 2022 by Matt Gialich and Jose Acain and had raised about US$55 million by mid-2024 to pursue platinum-group metals from near-Earth asteroids, targeting OB5.

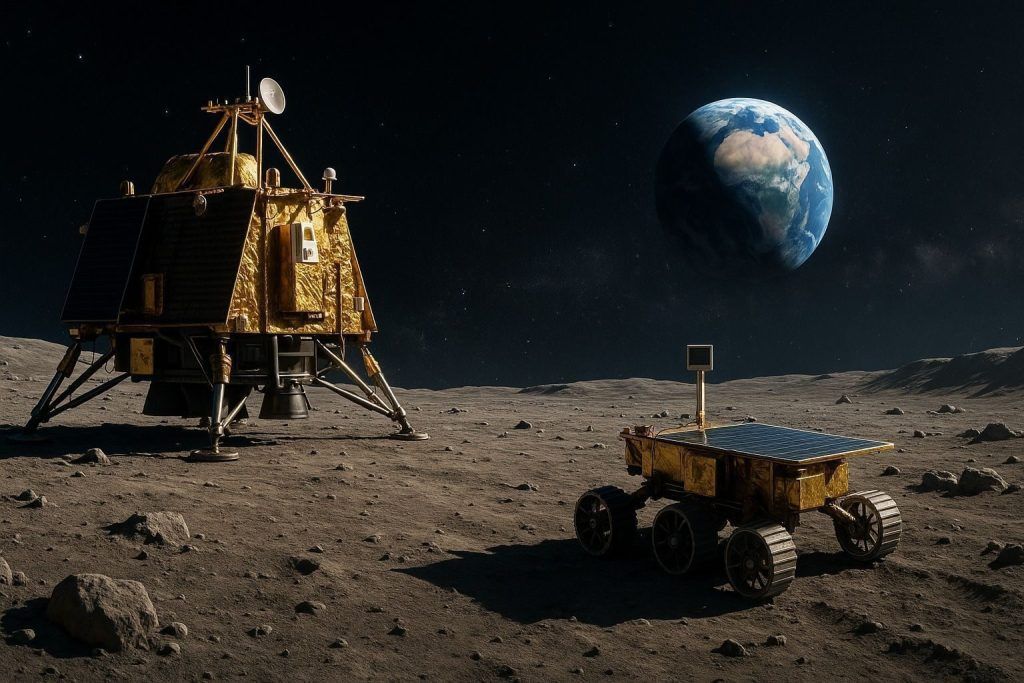

Figure 1: Intuitive Machines’ Athena lunar lander (bronze, top) and its rideshare payloads are shown inside a SpaceX Falcon 9 fairing prior to launch Spaceflightnow. AstroForge’s Brokkr‑2 spacecraft (renamed Odin, gold box at bottom center) was attached beneath Athena for this flight. Odin’s mission was to fly by a near-Earth asteroid to scout its composition, specifically to confirm whether the rock is metal-rich. The objective was to prove core technologies (navigation, communication, imaging, and analysis) for eventual asteroid mining. In particular, AstroForge aims to extract platinum-group metals (PGMs) from small, metal‑rich (M-type) near-Earth asteroids Wikipedia. Odin was designed to gather imagery and sensor data of its target asteroid to determine its metal content, thereby paving the way for a follow-up Vestri mission that would attempt to land on and begin extraction from the same asteroid Space Wikipedia.

AstroForge’s strategy is stepwise:

- Brokkr‑1 (Apr 2023) – A 6U cubesat that tested in-orbit refining hardware (with simulated asteroid material) Wikipedia. It reached orbit but failed to demonstrate refining due to communication/power issues.

- Brokkr‑2 (Odin, Feb 2025) – A ~120 kg deep-space probe (shown above) intended to fly by asteroid 2022 OB5 (a ~100 m M-type near-Earth asteroid) Space Spaceflightnow. Odin’s goal was reconnaissance: image the asteroid and measure its metallic content.

- Vestri (planned late 2025/26) – A ~200 kg lander/docking craft to return to the same asteroid for close-up sampling and partial refining, using magnetic anchors (Odin’s target is expected to be rich in iron) Mining.

- Future Missions – If these succeed, AstroForge envisions a “Brokkr‑4” that would extract, refine and return asteroid materials to Earth Mining.

By first scouting (Odin) and then landing (Vestri), AstroForge hopes to demonstrate a low-cost, iterative route to commercial asteroid mining. Odin’s successful flyby would have been the world’s first privately funded asteroid-survey mission Satnews Space. In October 2024 AstroForge received the first-ever FCC license for a deep‑space mission Mining, authorizing Odin’s communications – a regulatory milestone enabling private-sector asteroid operations.

Technical Specifications and Design of Brokkr‑2 (Odin)

Figure 2: AstroForge’s Odin spacecraft (formerly “Brokkr‑2”) is shown pre‑launch. This deep‑space probe is built on Orbital Astronautics’ ORB-50 platform (UK) and has a dry mass of roughly 100–120 kg Wikipedia Spaceflightnow. Its dimensions are on the order of 1×1×0.7 m. Odin’s design features include:

- Bus and Payload: A 3‑axis stabilized satellite bus (rebuilt in-house after a failed vibration test Wikipedia) carrying cameras and spectrometers to image the asteroid.

- Propulsion: Electric propulsion using xenon thrusters supplied by Dawn Aerospace (New Zealand) Satnews. These high-impulse engines were to enable a lunar gravity-assist and long cruise (~8–11 months to the asteroid) Proactiveinvestors.

- Power: Deployable solar arrays (tested on the ground and in orbit) provide power. (Odin’s designers noted the craft remained power-positive despite communication issues Spaceflightnow.)

- Mass and Cost: The fully fueled spacecraft mass was ~120 kg (265 lb) Spaceflightnow. OrbAstro built Odin for roughly US$3.5 million Wikipedia – a remarkably low cost for a deep-space probe.

In sum, Odin is a small, cost‑optimized survey satellite. Its basic hardware (bus, power, avionics) was a scaled‑up successor to the smaller Brokkr‑1 cubesat, while its propulsion was much greater to reach heliocentric orbit. (In fact, AstroForge noted that after Brokkr‑2 failed initial tests, its bus “was completely rebuilt in-house” to ensure reliability Wikipedia.)

Development Timeline and Launch Details

The key milestones for Brokkr‑2/Odin and related missions are summarized below:

| Date | Event | Details & Outcome |

|---|---|---|

| Jan 10, 2022 | AstroForge founded | Co-founders M. Gialich & J. Acain launch the startup; raised $13 M seed funding Wikipedia. |

| Apr 15, 2023 | Brokkr‑1 launch (6U cubesat) | Launched on a SpaceX Falcon 9 (Transporter-7) from Vandenberg Wikipedia. Intended to test in-space refining (separating platinum from simulant). Failed due to solar-panel deployment and comms problems Wikipedia. |

| Oct 18, 2023 | Odin propulsion test | Successful ground test of Odin’s electric propulsion system Wikipedia, clearing way for deep-space launch. |

| Aug 2024 | Series A funding | Raised $40 million (bringing total funding to ~$55 M) Thespacereview to support asteroid mining development. |

| Oct 28, 2024 | FCC license granted | Received first-ever U.S. deep-space communications license for a commercial asteroid mission Mining. Cleared the way for Odin. |

| Feb 26, 2025 | Odin (Brokkr‑2) launch | Odin deployed on SpaceX Falcon 9 as part of Intuitive Machines’ IM-2 lunar mission (from Cape Canaveral). Odin began its solo journey ~47 minutes after liftoff Spaceflightnow. |

| Mar 2025 | Post-launch anomaly | Odin experienced persistent ground-station and pointing issues. Sporadic contact was made, but on Mar 6, 2025 AstroForge declared the mission lost Wikipedia. |

| Planned 2025/26 | Vestri launch | A ~200 kg lander/docking satellite (Vestri) is slated to fly on Intuitive Machines’ IM-3 mission. Its goal is to return to asteroid 2022 OB5 for a landing and material extraction test Mining Space. |

Each of these milestones is documented by AstroForge and independent news sources. (For example, a Space.com report identifies asteroid 2022 OB5 as Odin’s target Space, and notes that Odin would take ~300 days to reach it.) The above table compresses that public timeline. Notably, AstroForge’s rapid development (building two deep-space probes within ~10 months Space Spaceflightnow) reflects a “fast-fail” approach that keeps costs low.

Companies and Organizations Involved

AstroForge’s mission involved a network of companies and regulators:

- AstroForge, Inc. (USA) – The Huntington Beach, CA startup leading the mission. Founded January 2022 by Matt Gialich and Jose Acain Wikipedia (both Y Combinator W22 alums Satnews). AstroForge raised ~$55 M from venture investors (Initialized Capital, Seven Seven Six, etc.) by mid-2024 Satnews Thespacereview. It sets the mission goals and provides the spacecraft payloads.

- Orbital Astronautics Ltd. (OrbAstro, UK) – A British satellite manufacturer that built the Brokkr‑series spacecraft Satnews. OrbAstro’s ORB-50 platform was used for Odin. CEO Ash Dove-Jay highlighted that this would be “the first fully commercial deep-space mission ever” Satnews.

- Intuitive Machines (USA) – A lunar lander and services company selected by NASA for Moon missions. Intuitive hosted Odin on its IM-2 mission Intuitivemachines, providing launch services (via a SpaceX Falcon 9) and a communications relay. IM-2 (Nova-C “Athena” lander) carried Odin as a secondary payload, then deployed it into heliocentric orbit Spaceflightnow Intuitivemachines.

- SpaceX (USA) – The launch vehicle provider. A SpaceX Falcon 9 rocket launched IM-2 (with Odin onboard) on 26 Feb 2025.

- Dawn Aerospace (New Zealand) – Supplier of the spacecraft’s electric propulsion system. Dawn’s xenon-fueled thrusters gave Odin the ΔV needed for the long trip Satnews.

- U.S. Federal Communications Commission (FCC) – The regulator that granted AstroForge the first commercial deep-space communications license Mining, allowing Odin to transmit data. This marked a key policy milestone for private asteroid missions.

- Investors and Backers – AstroForge was backed by high-profile VCs (Initialized, 776, EarthRise, etc.) Satnews. These firms are investing in the emerging space-resources sector.

- Other Asteroid-Mining Ventures: For context, earlier U.S. startups like Planetary Resources and Deep Space Industries (both founded ~2010) had similar goals but ultimately did not reach an asteroid; they were acquired or folded by 2019 Mining. AstroForge is now widely seen as the “most advanced private asteroid miner to date” Mining.

These partnerships and investments span space-launch companies, satellite manufacturers, propulsion specialists, and regulators. Together they enabled AstroForge to attempt this unprecedented private deep-space mission.

Mission Targets and Destinations

AstroForge has focused on small, metal‑rich near-Earth asteroids (NEAs). For Odin, the specific target was designated 2022 OB5 Space, a near-Earth asteroid roughly 20–30 m in size (up to ~100 m diameter) that is suspected to be M-type (metal-rich) Space Spaceflightnow. A flyby of OB5 (planned ~300 days after launch Space) would have allowed cameras and sensors on Odin to confirm its metallic nature. The choice of OB5 reflects AstroForge’s criteria: their targets are “M-type” NEAs (only ~3–5% of NEAs) of moderate size Wikipedia Spaceflightnow. In fact, AstroForge has identified about five such candidate asteroids as future mining targets Wikipedia.

For perspective, other ongoing or planned asteroid missions (mostly government) include:

- NASA – Psyche (USA): Launched Oct 2023, this mission will orbit the main-belt asteroid 16 Psyche, believed to be a largely metallic core. Its goal is scientific (planet formation studies), not mining, but Psyche underscores interest in metal asteroids Nasa.

- JAXA – Hayabusa Missions (Japan): Hayabusa-1 and Hayabusa2 returned samples from small asteroids (Itokawa and Ryugu, respectively) in 2010 and 2020. Those were stony or carbonaceous targets (not metal), and missions were science-driven.

- CNSA – Tianwen-2 (China): Launched May 2025, this mission will rendezvous with near-Earth asteroid 469219 Kamoʻoalewa and return samples by 2027 Reuters. Kamoʻoalewa is a quasi-satellite of Earth (~40–100 m diameter).

- Planetary Resources/DSI (USA): These companies once planned asteroid missions but never flew them. (No asteroid targeted or reached Mining.)

- Others: Startups like Karman+ (USA) plan a 2026 demo of asteroid surface excavation Undark, and TransAstra (USA) plans telescopes to identify NEOs for mining Undark.

AstroForge’s choice of a near-Earth M-type target (OB5) reflects its commercial goal. Unlike many agency missions that focus on scientific C- or S-type asteroids, AstroForge explicitly seeks asteroids rich in valuable metals Spaceflightnow.

Contribution to Space Mining Commercialization

Brokkr‑2 (Odin) represents a pivotal step toward commercial asteroid mining. By attempting a deep-space mission funded by private capital, it tested the industry model in practice. Key contributions include:

- Technical Validation: Odin would have demonstrated the ability of a low-cost private spacecraft to operate in deep space, navigate to an asteroid, and relay scientific data. It was a de‑risking precursor to actual mining. Brokkr‑1 and Odin together validate technologies (miniaturized refining systems, electric propulsion, high-gain communications) needed for resource extraction Wikipedia Spaceflightnow.

- Regulatory Precedent: The first FCC license for deep-space use Mining signals that governments will sanction commercial mining activities (provided they comply with treaties). This legal groundwork is critical for investors.

- Market Signaling: A mission like Odin draws attention and capital to space resources. AstroForge even live-streamed mission control to involve the public and potential investors. If successful, the data from Odin could confirm or disprove the economic viability of mining target asteroids. (Analysts note that metal asteroids have “very high” PGM concentrations and constitute a “massive market” Spaceflightnow.) In essence, Brokkr‑2 was a reconnaissance mission to verify a multi-billion‑dollar value proposition on a smaller scale.

- Strategic Roadmap: AstroForge’s “crawl-walk-run” approach (refine-in-space → scout asteroid → land and dock → mine and return) provides a template for space-mining ventures. Each mission builds off the last. For example, Odin’s data would guide the design of Vestri’s extraction gear. This iterative, lean approach (rapid development on inexpensive buses) lowers barriers to entry.

In short, Odin was a demonstration of commercial potential. It showed that private companies (with government and industry partners) can project power beyond Earth orbit. The very attempt put asteroid mining into tangible reality rather than speculation. As OrbAstro’s CEO put it, this was set to be “the first fully commercial deep-space mission ever” Satnews – a milestone that helps attract future investment into the field.

Challenges and Risks

Asteroid-mining missions face many hurdles. Key challenges include:

- Technical Risks: Deep-space comms and control are difficult. Brokkr‑1 immediately ran into problems – it could not identify its own identity among orbiters, and a solar-panel deployment failure plus magnetic interference caused a tumble Wikipedia. Odin similarly had communication breakdowns after launch, likely due to ground-station and antenna pointing issues Spaceflightnow. Long-duration missions also risk hardware failures (power systems, thrusters, radiation effects). Precisely navigating to a small, fast-moving asteroid is non-trivial; even a tiny ephemeris error could cause a miss.

- Market & Economic Risks: The cost of reaching and extracting materials is enormous. Only one in five missions plans a return to Earth for profit. If an asteroid’s metals do not fetch high prices, the venture may not break even. In fact, no commercial asteroid-mining market currently exists (some analysts quip it’s effectively $0today Undark). Moreover, delivering large quantities of PGMs to Earth could flood and depress the market, undermining profitability. The venture depends on assumptions about future commodity prices and demand (e.g. for fuel cells, electronics) that may not materialize as expected.

- Legal and Regulatory: The Outer Space Treaty bans national appropriation of celestial bodies, and it’s untested whether private ownership of asteroid resources is universally recognized. (The U.S. and Luxembourg grant ownership after extraction Space, but not all nations endorse this.) Liability rules for debris or accidents are unclear. Regulatory approvals (like the FCC license) help, but an international framework for space resources is still evolving.

- Operational Hazards: Launch failures, delays, or technical glitches (as experienced with Odin) can derail plans. Even after arrival, extracting materials from a microgravity, dust-covered surface poses unknown difficulties. Asteroid surfaces may be too rubble-like or hard to attach to. For example, if Vestri lands, anchoring securely with magnets (as planned) might fail if the metal content is lower than expected.

- Competition and Alternatives: Earth has vast untapped mineral reserves and recycling programs; new terrestrial mines or substitutes could undercut asteroid metals. If space mining cannot match or beat those costs, it won’t find a market. Investors also worry about novel competition (e.g. advanced materials or synthetic alternatives reducing demand for certain metals).

Overall, while Brokkr‑2 aimed to mitigate some of these risks (through low mission cost and insurance via short missions), significant uncertainties remain at every step. As AstroForge’s CEO noted, this class of M‑asteroid is promising for PGMs, “but at the end of the day, we’re a mining company that needs to be able to sell material” on Earth Spaceflightnow – a tall order given the risks.

Comparisons with Other Space Mining Initiatives

Various government and commercial programs have explored asteroid resources. The table below contrasts AstroForge’s approach with some key examples:

| Initiative / Mission | Sector | Resource Focus / Target | Status / Notes |

|---|---|---|---|

| AstroForge (Odin/Vestri) | Private (USA) | Platinum-group metals on NEAs | Brokkr-1 cubesat launched Apr 2023; Odin (Brokkr-2) launched Feb 2025 Spaceflightnow (communications failed). Vestri landing planned late 2025 Mining Space. |

| Planetary Resources (Arkyd) | Private (USA) | Originally asteroid water/ice | Founded 2009 (funded by Larry Page, etc.); pivoted to Earth mining; acquired by ConsenSys in 2018. No asteroid reached Mining. |

| Deep Space Industries | Private (USA) | PGMs from asteroids | Founded 2008; developed small probes (FireFly). Acquired by Bradford Space in 2019 with no asteroid mission Mining. |

| NASA – Psyche | Government (USA) | Science – metal asteroid | Launched Oct 2023 to explore main-belt asteroid 16 Psyche (metallic core). Scientific mission (arrive ~2030) Nasa, not commercial. |

| NASA – OSIRIS-REx / OSIRIS-APEX | Government (USA) | Sample-return (carbonaceous asteroids) | OSIRIS-REx returned Bennu samples in 2023. OSIRIS-APEX (planned launch) will return to Apophis in 2029. |

| JAXA – Hayabusa/Hayabusa2 | Government (Japan) | Sample-return (S- and C-type asteroids) | Hayabusa-1 (Itokawa) returned samples 2010; Hayabusa-2 (Ryugu) returned 2020. Technology demonstration for sample capture. |

| CNSA – Tianwen-2 | Government (China) | Sample-return (NEA sample) | Launched May 2025 toward near-Earth asteroid 469219 Kamoʻoalewa Reuters. Plans to return samples by 2027 (and visit a main-belt comet later). |

| Karman+ (USA) | Private | Mining technology demo | Colorado-based startup. Plans an experimental asteroid mission ~2026 to test excavation tools Undark. |

| TransAstra (USA) | Private | Asteroid detection | Developing Arkyd space telescope to identify NEOs. Founded 2015; marketing asteroid-detection services Undark. |

| Origin Space (China) | Private | Asteroid observation | Chinese startup. Launched small asteroidal observation satellite (demo) Undark. |

Sources: Apollo Asteroid Company and mission documentation; SpaceNews/Space.com reporting (see references).

AstroForge stands out as the first to attempt a private asteroid flyby. Unlike government science missions (NASA, JAXA, CNSA) that target research goals, AstroForge’s ambitions are explicitly commercial – seeking a return on investment in mineral resources. Earlier commercial efforts (Planetary, DSI) folded before flight Mining, but new entrants (Karman+, TransAstra) now join AstroForge. At the same time, national programs like NASA’s Artemis lunar effort and space ISRU studies indirectly complement this field by developing related technologies (e.g. lunar ice mining, propulsion).

Potential Market and Economic Impact

Asteroid mining’s economic promise is often touted but remains speculative. Estimates of resource value can be enormous (e.g. Psyche’s metals have been cited in the quadrillions of dollars), but such figures assume perfect recovery and sale, which is impractical. Market analysts are more conservative. For example, one industry report values the emerging space-resources market at about $2 billion in 2024, with a high projected growth rate (~25% CAGR) over the next decade Gminsights. However, that figure encompasses all space resource activities (including lunar initiatives) and assumes gradual development of infrastructure.

Critically, no real asteroid-mining market exists today. One commentator wryly notes that while the market for inspecting ship hulls (a current Earth-based service) is about $13 billion annually, the “asteroid mining” market is $0 – since no minerals have yet been returned Undark. If a mission like Odin succeeded and delivered PGMs to Earth, it could add new supply to niche markets (platinum, palladium, etc.) used in catalysts, electronics, and clean-energy technology. AstroForge argues that certain asteroids contain concentrations of these metals far above terrestrial ores, which could revolutionize supply Spaceflightnow. They frame this as an “alternative to Earth’s dwindling resources” Mining, noting growing demand for critical minerals in green technologies.

On the other hand, introducing thousands of kilograms of platinum would likely depress prices. Market impacts depend on scale: a few tons of platinum could saturate annual demand, while hundreds of tons would collapse prices. Moreover, Earth still has vast untapped reserves and robust recycling. Therefore, many analysts caution that asteroid mining may be economically feasible only if space logistics costs drop dramatically (e.g. fuel from water ice reducing launch costs) or if entirely new markets emerge (e.g. space-based manufacturing).

In summary, the economic impact of successful asteroid mining could be significant but uncertain. It could lower material costs for specialized industries or, conversely, destabilize commodity markets if not managed carefully. Forecasts like the Global Market Insights report suggest a multi‑billion-dollar market by 2030 Gminsights, but actual outcomes will hinge on technological breakthroughs and sustained demand. For now, missions like Brokkr‑2 serve more as pathfinders than profit centers, demonstrating what might be possible rather than delivering immediate economic returns.

Sources: Mission and company reports Wikipedia Mining Spaceflightnow; industry analyses Gminsights Undark.