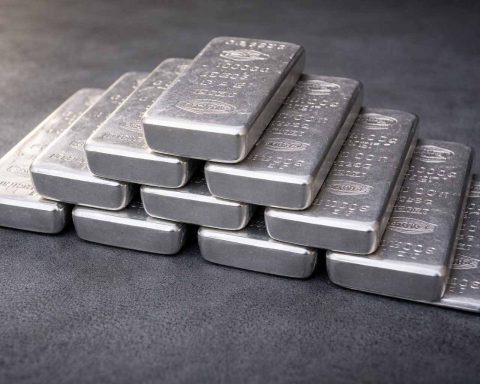

Silver price stock today: SLV jumps as bullion steadies, jobs report set to test rally

NEW YORK, Jan 4, 2026, 12:32 ET — Market closed iShares Silver Trust (SLV), a silver-backed exchange-traded fund that tracks bullion prices, ended Friday at $65.75, up 2.06%, as precious metals opened 2026 on firmer footing. MarketWatch The move matters because silver has become a high-volatility macro trade after a record 2025 run, with price action increasingly tied to U.S. rate expectations and the dollar. Reuters reported silver rose more than 147% in 2025, supported by supply constraints and strong industrial and investment demand. Reuters On Friday, spot silver rose 1.6% to $72.39 an ounce and spot gold gained 0.36%