NEW YORK, Jan 3, 2026, 1:42 PM ET — Market closed

U.S. basic materials stocks ended the first session of 2026 higher, lifting the Materials Select Sector SPDR Fund (XLB) — an exchange-traded fund that tracks a basket of large U.S. materials companies — 1.7% to $46.12 at Friday’s close. MarketWatch

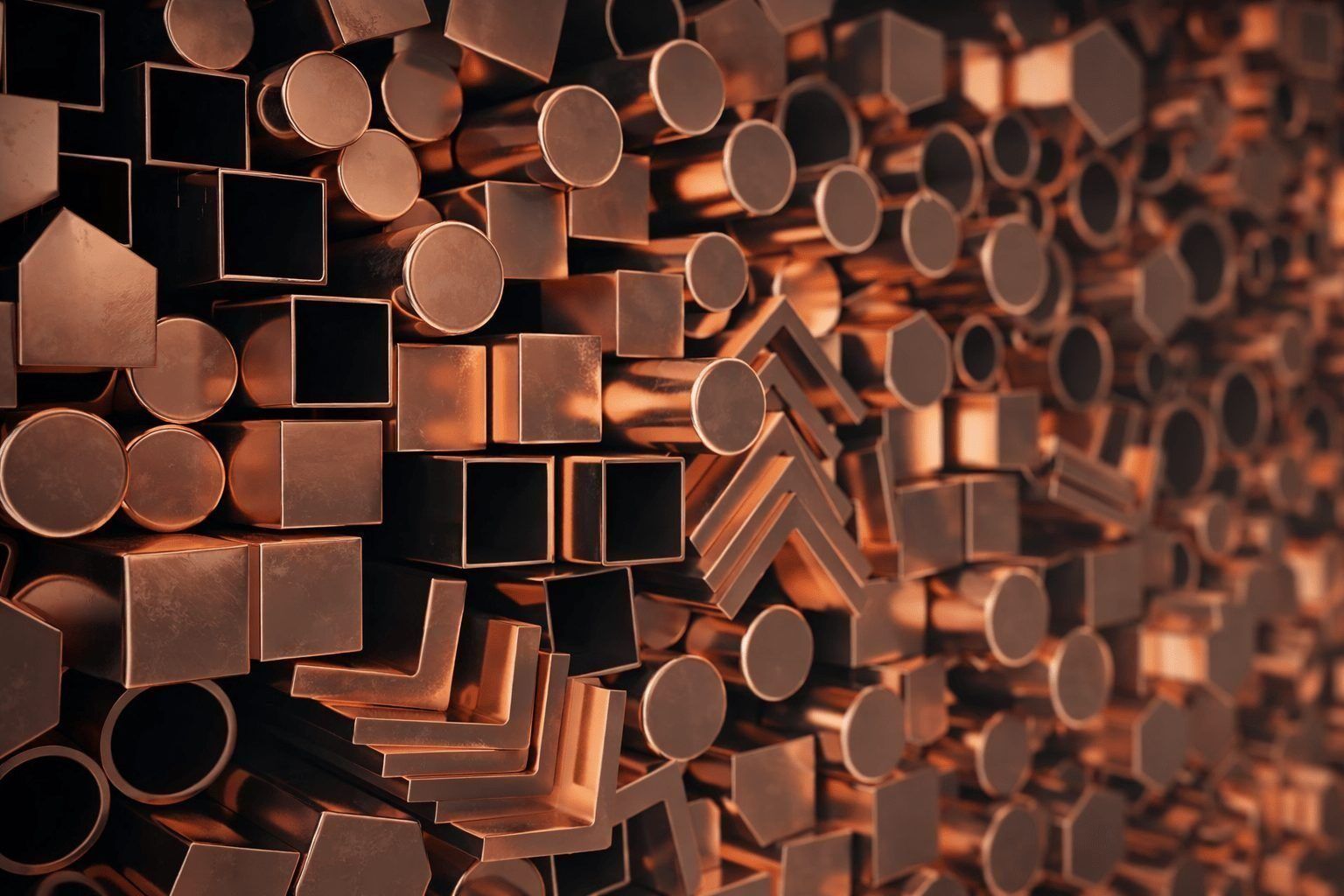

The basic materials group spans miners, chemical makers and building-material producers, leaving it especially sensitive to swings in metals prices and shifts in the economic outlook. With markets reopening after the holiday lull, investors are using early-January trading to recalibrate exposure to cyclical sectors tied to growth. Yahoo Finance

That sensitivity showed up in rates and currency markets. The dollar index rose 0.19% on Friday and the benchmark 10-year U.S. Treasury yield climbed to 4.191%, moves that can pressure dollar-priced commodities and, by extension, materials shares, Reuters reported. Reuters

Copper, often treated as a barometer for industrial demand, closed slightly higher. Front-month Comex copper futures — a key U.S. benchmark contract — gained 0.18% to settle at $5.64 a pound, with Dow Jones Market Data showing copper has risen in eight of the past 11 sessions. Morningstar

Mining shares tracked the firmer tone. Freeport-McMoRan rose 2.25% to $51.93 at the 4 p.m. ET close, according to the company’s investor quote page, while Newmont gained about 1.4% to $101.22. Freeport-McMoRan Investors

Chemicals and industrial gases also participated. Dow Inc climbed 3.81% to $24.27, while Linde added 0.64% and Air Products rose 2.14%, MarketWatch data showed. MarketWatch

Building-material names were firmer as well. Vulcan Materials gained 2.61% and Martin Marietta advanced 1.89%, MarketWatch reported. MarketWatch

The broader tape was supportive, though not decisive. The Dow Jones Industrial Average rose 0.66% and the S&P 500 ended up 0.19% on Friday, according to MarketWatch’s session recap. MarketWatch

Before the next session on Monday, investors are watching next week’s U.S. labor-market data for clues on whether the Federal Reserve — the U.S. central bank — stays cautious on further rate cuts. Tariff headlines also remain on the radar after President Donald Trump’s early moves signaled trade policy could be a key market driver in 2026, Reuters reported. Reuters

Earnings are another near-term catalyst for the sector. Dow is scheduled to report fourth-quarter results on Jan. 29 at 8:00 a.m. ET, according to the company’s events calendar — a readout traders often use to gauge pricing power and end-market demand in chemicals and packaging. Dow Investor Relations

Commodities remain the swing factor for materials shares. Spot gold — the cash price — was $4,313.29 an ounce in mid-afternoon New York trading on Friday after touching $4,402.06 earlier, and traders were pricing at least two quarter-point Fed cuts this year, Reuters reported. “Talk about cuts in March, tariffs risk and U.S. debt are moving gold, silver, platinum and palladium higher,” TD Securities strategist Bart Melek said. Kitco Metals analyst Jim Wyckoff separately pointed to $4,584 as a key resistance level for February gold futures. Reuters