London, Feb 16, 2026, 17:49 GMT — Regular session

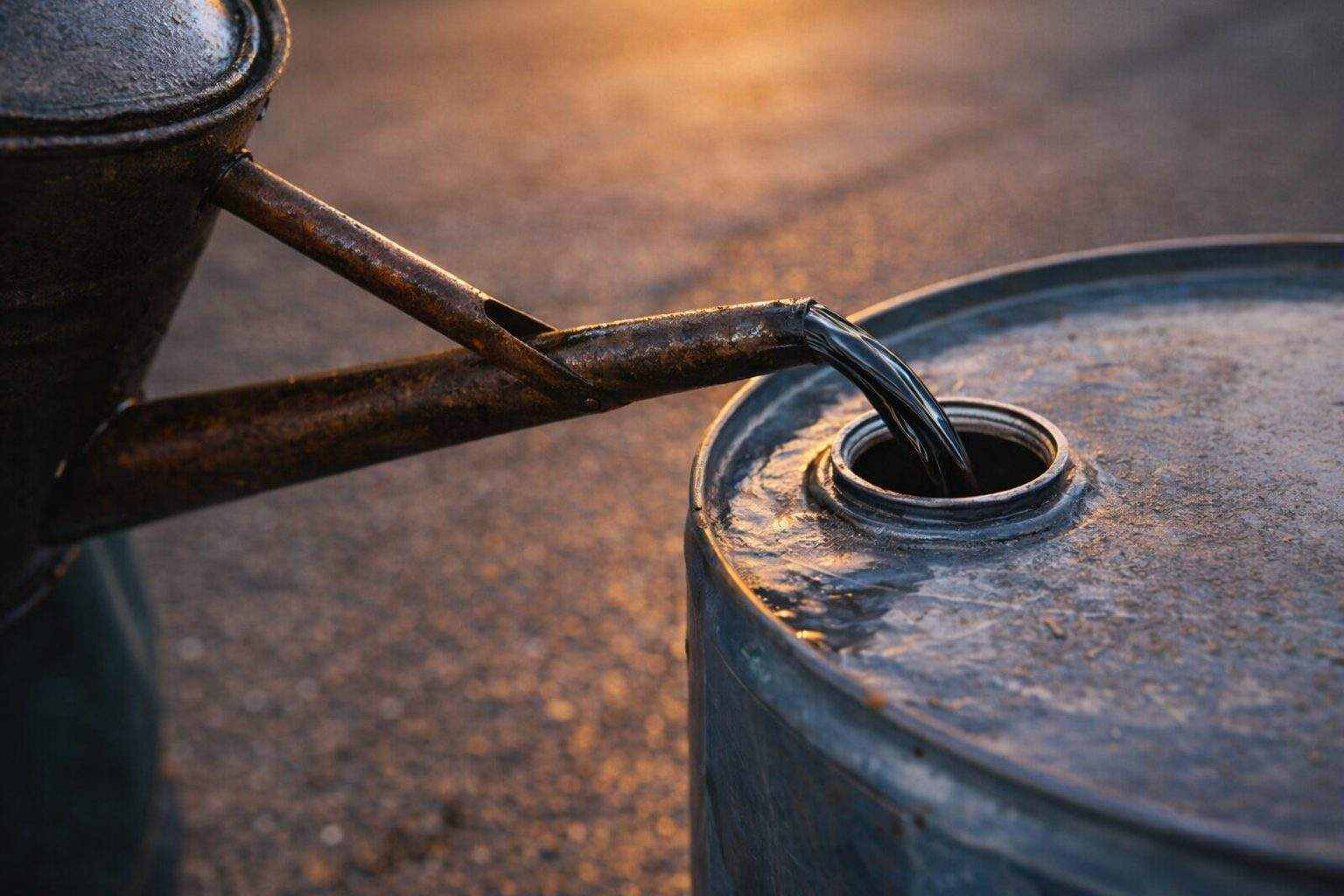

- Brent crude edged up roughly 0.6%, trading close to $68 a barrel as activity remained subdued.

- Traders juggled the prospect of resumed U.S.-Iran nuclear talks with the potential for extra OPEC+ barrels starting in April.

- Holiday-thinned liquidity capped much of the action, though geopolitics continued to steer sentiment.

Brent crude futures ticked up on Monday, staying close to the $68 mark. Traders were bracing for U.S.-Iran negotiations, which could end up altering the supply picture. (Reuters)

Timing is key here: geopolitical risk premiums are baked in, yet OPEC+ could push more barrels into the market next quarter. Holiday-thinned liquidity only amplifies the impact—minor headlines go a long way.

Brent climbed 41 cents, or 0.6%, to $68.16 a barrel as of 1508 GMT, Reuters reported. U.S. WTI added 43 cents to reach $63.32, but with the Presidents’ Day holiday on Monday there’s no settlement for the contract. (Reuters)

PVM’s Tamas Varga points to concerns over possible supply hiccups tied to U.S.-Iran tensions as a key factor steadying oil prices. (Reuters)

The U.S. and Iran are set for a second meeting in Geneva on Tuesday to discuss Tehran’s nuclear program, with Washington indicating readiness for a prolonged military effort should talks collapse, according to Reuters. Iran, for its part, has threatened possible retaliation targeting U.S. bases if attacked. (Reuters)

SEB analysts put the Brent outlook all over the map depending on the outcome of the talks. “Increased Iranian tension could drive Brent to $80 a barrel. Fading tension would drop it back to $60 a barrel,” they wrote. (Reuters)

The supply side isn’t standing still. OPEC+ is looking at restarting output hikes in April—after holding off during the first quarter, according to three sources from the group who spoke to Reuters. Eight members are scheduled for a meeting on March 1. (Reuters)

With Brent hovering close to $68, traders have been hesitant to jump into rallies—a wariness driven by persistent chatter about a potential glut later this year, according to Reuters. That possible policy shift is keeping the market on edge. (Reuters)

Chinese refiners are poised to take in a record volume of Russian oil this February, traders and ship-tracking data told Reuters, as discounts lure in fresh buying. India, on the other hand, has trimmed purchases, pulling back under pressure from the U.S. (Reuters)

Friday’s finish showed just how delicate things remain. Brent added 23 cents, ending the day at $67.75. Softer U.S. inflation numbers lent a hand, but traders weren’t letting up on monitoring OPEC+ moves and the latest headlines out of Iran, according to Reuters. (Reuters)

Dennis Kissler, senior vice president of trading at BOK Financial, called the inflation data favorable for lower rates, but he pointed to a looming supply issue: “The negative is going to be that OPEC could possibly increase production a little further.” (Reuters)

That could turn on a dime. A credible U.S.-Iran breakthrough would knock the risk premium out of crude, and if OPEC+ actually moves to boost supply from April, bullish bets would hinge entirely on demand — which hasn’t been the narrative lately.

Tuesday brings the Geneva sit-down between U.S. and Iranian officials. Not far behind, OPEC+ producers will meet on March 1, an event that could shape April’s output plans. (Reuters)