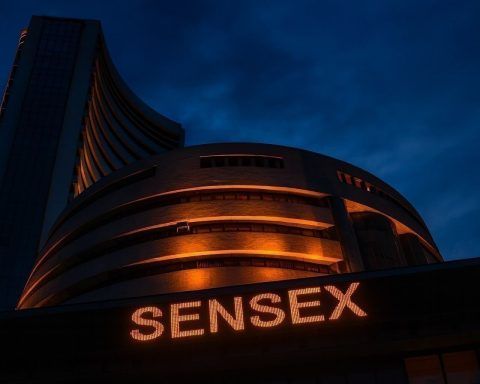

Indian Stock Market Today, December 9, 2025: Sensex Sinks 700 Points, Nifty Slips Below 25,750 as Fed Jitters and Tariff Fears Rattle Dalal Street

Indian equities extended their sharp slide for a second straight session on Tuesday, December 9, 2025, with the Sensex and Nifty 50 under pressure from global risk-off sentiment, heavy foreign investor selling, a weakening rupee and fresh worries over potential US tariffs on Indian rice.The Logical Indian+ 4The Economic Times+ 4Free Press Journal+ 4 Market snapshot: Sensex and Nifty today Mid‑cap and small‑cap indices underperformed again, dropping roughly 1–1.5% , signaling that the sell‑off has been wider than just the headline indices.Free Press Journal+ 1 Five big reasons the Indian stock market is falling today 1. US Federal Reserve anxiety