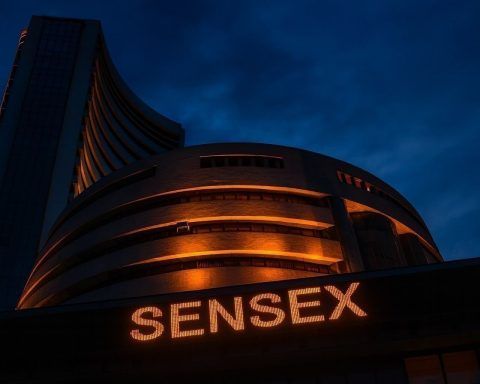

India Stock Market Today, December 1, 2025: Sensex & Nifty Hit Record Highs as GDP Beat, RBI Decision and Rupee Slide Take Centre Stage

India’s stock market kicked off December 1, 2025 with fireworks: the Sensex and Nifty 50 opened at fresh lifetime highs, powered by blockbuster GDP numbers and expectations of easier global interest rates. But by mid-session, gains had cooled, the rupee had slipped to a record low, and all eyes had shifted to the Reserve Bank of India’s (RBI) policy meeting later this week. Goodreturns+2Bloomberg+2 Below is a full breakdown of where the market stands today, the macro forces driving sentiment, and what leading analysts are forecasting for Nifty, Bank Nifty and key sectors. Record-Breaking Start to December: New Highs for Sensex, Nifty and Bank