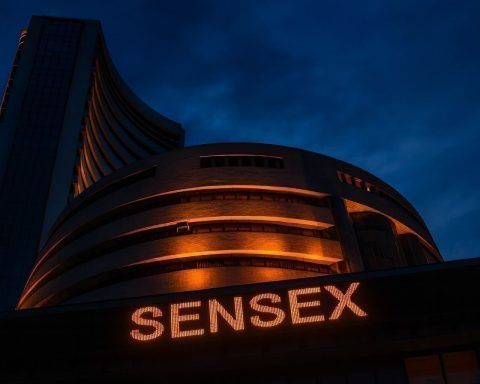

India’s Big Bank Debate and Kerala’s Stray Dog ABC Drive: Key Updates and What’s Next (December 12, 2025)

India’s policy conversation today is being shaped by two very different—but equally high-stakes—questions of scale and capacity: Can the country build banks big enough to finance its next decade of growth? And can cities and states build systems strong enough to curb stray dog attacks while staying humane and legally compliant? On Friday, December 12, 2025, fresh reporting and commentary put both issues back in the spotlight—one from the world of banking consolidation and M&A finance, and the other from the urgent, street-level reality of dog-bite incidents and animal birth control (ABC) programmes. Free Press Journal+4Moneycontrol+4The Economic Times+4 The big