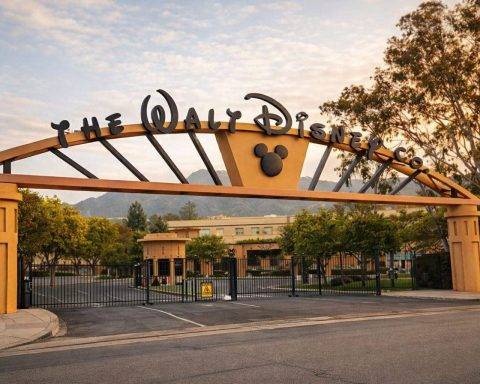

Disney stock closes higher after CEO pick, but the next date on Wall Street’s calendar is March 18

Disney shares rose 2.7% to $107.05 after naming Josh D’Amaro as next CEO, with Bob Iger staying as adviser through 2026. Quarterly revenue climbed 5% to $25.98 billion, but free cash flow fell $2.28 billion after heavy parks investment. The parks unit drove over 70% of operating profit last quarter. Disney warned of a $110 million hit from the YouTube TV carriage suspension.