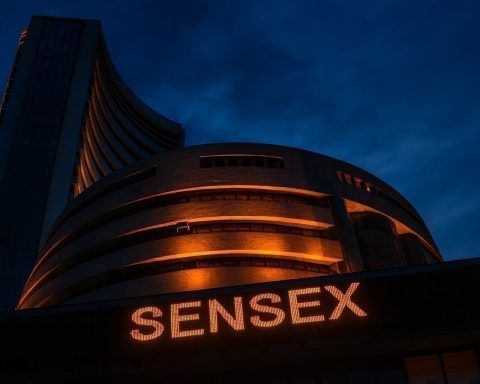

India Stock Market Week Ahead (Dec 15–19, 2025): Nifty Back Above 26,000, Rupee at Record Lows, WPI & Trade Data, IPO Listings in Focus

New Delhi, Dec 13, 2025 — Indian equities head into the new week with a familiar push-and-pull: domestic rate-cut optimism and improving risk appetite on one side, and rupee weakness, foreign outflows, and India–US trade uncertainty on the other. The Nifty 50 ended Friday at 26,046.95 and the Sensex at 85,267.66, extending a Fed-fuelled rebound that helped trim weekly losses — but not erase them. The Economic Times+1 With India’s November CPI inflation at 0.71% (still below the RBI’s 2%–6% comfort band) and the rupee printing fresh record lows near 90.55/$, investors will be watching whether lower inflation translates into expectations of more RBI easing — and whether currency stress starts dictating