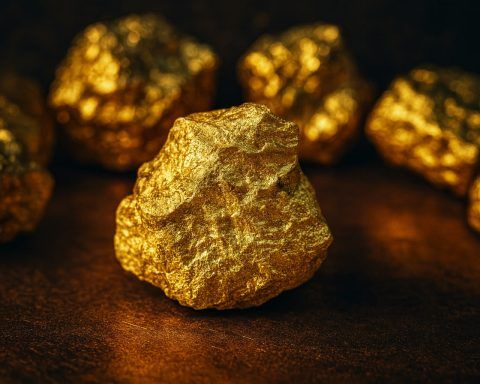

Gold Price Today, 19 November 2025: XAU/USD Near $4,100 as Markets Await Fed Minutes & Jobs Data

Gold prices are back on the rise today, Wednesday, 19 November 2025, with spot XAU/USD trading around $4,090–$4,120 per troy ounce, as investors shift into safe‑haven assets ahead of key Federal Reserve minutes and a delayed U.S. jobs report. Trading Economics+4Reuters+4RTTNews+4 Key Takeaways – Gold Price Today (19.11.2025) Live Gold Price Today: Around $4,100 per Ounce Across major price feeds, gold is trading near $4,100 per troy ounce on 19 November 2025: Different platforms update at slightly different times and use varying benchmarks (bid, ask, or mid), which is why the exact number can differ. But the message is clear: