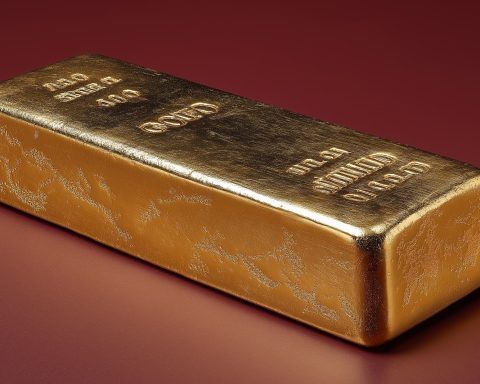

Gold Smashes Past $4,000 as Safe-Haven Demand Fuels Record ETF Inflows

Gold’s Record Surge Amid Turmoil Gold’s break above the $4,000 barrier marks a psychological and historic milestone for the precious metal. In early trading on Tuesday, October 7, U.S. gold futures jumped to $4,003/oz – the first time ever crossing the $4k thresholdwtop.com – while spot gold traded near record highs around $3,960 per ouncewtop.com. This extends an extraordinary rally that began last year and accelerated through 2025. Gold prices are now up roughly 47–50% year-to-date, after already climbing 27% in 2024reuters.comreuters.com. By comparison, stocks and other assets have lagged far behind, making gold one of the best-performing assets of the yeartheguardian.comtheguardian.com. In fact, bullion is on track