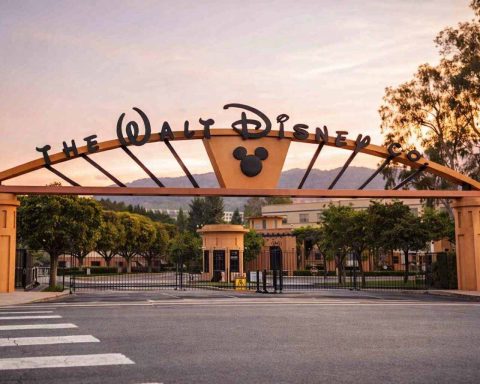

Disney stock drops on CEO succession focus: what DIS investors watch next week

Disney shares fell 2% to $110.98 Friday, underperforming the broader market. A proxy filing confirmed the board plans to name a new CEO in early 2026 and set the annual meeting for March 18. CEO Bob Iger’s 2025 compensation totaled $45.8 million. The next major events are the Fed’s Jan. 28 decision and Disney’s earnings report on Feb. 2.