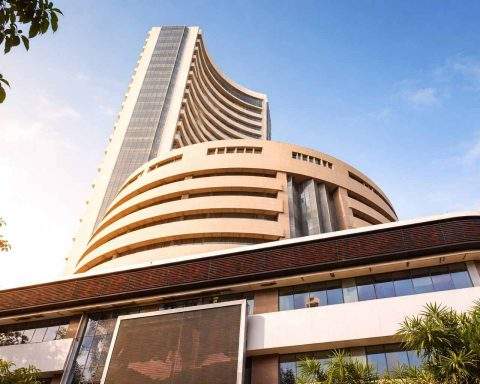

Rupee hits record low, Nifty and Sensex stay shaky after Tuesday’s market rout

Indian shares fell again Wednesday, with the Nifty 50 down 0.22% and Sensex off 0.25% in early trade. The rupee hit a record low of 91.2950 per dollar amid capital outflows and risk-off sentiment. Tuesday’s selloff erased nearly 9.5 lakh crore rupees in market value. Investors are watching earnings and U.S. tariff moves.