Crypto Market Carnage: Bitcoin Crashes from Record Highs as Tariff Bombshell Wipes Out $20B

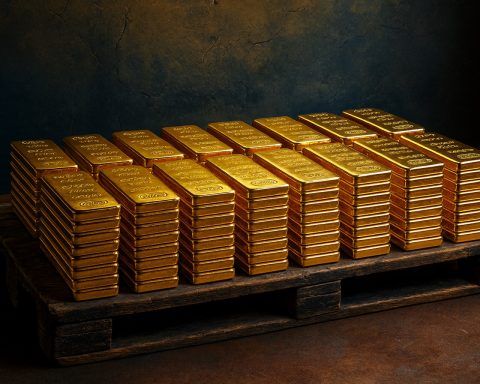

Record “Uptober” Rally Fueled by Safe-Haven Demand Early October 2025 saw cryptocurrency and gold prices surge to record highs, driven by a wave of safe-haven demand. Bitcoin – often dubbed “digital gold” – spiked above $125,000 for the first time ever on October 5, marking a new all-time high for the flagship crypto ts2.tech. This rally (playfully nicknamed “Uptober”) coincided…