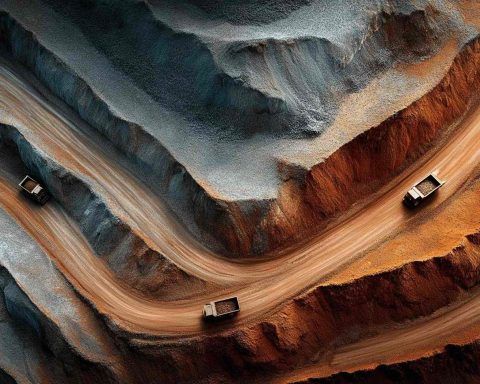

Albemarle (ALB) Soars as Lithium Prices Spike and Argus Lifts Target to $140 – What Investors Need to Know Today (17 November 2025)

Albemarle stock (NYSE: ALB) jumped around 8–9% on November 17, 2025, as lithium prices hit a one‑year high and Argus raised its price target to $140. Here’s what’s driving the move, how Wall Street is reacting, and what it could mean for investors. Albemarle stock is on fire today Albemarle stock has been in rally mode for days, but today’s move stands out even in a strong November run. German market outlet wallstreet‑online describes today’s advance as a “kräftiger Gewinn” (strong gain), pointing out that: wallstreet-online.de In other words, today is not a random pop – it’s part of a