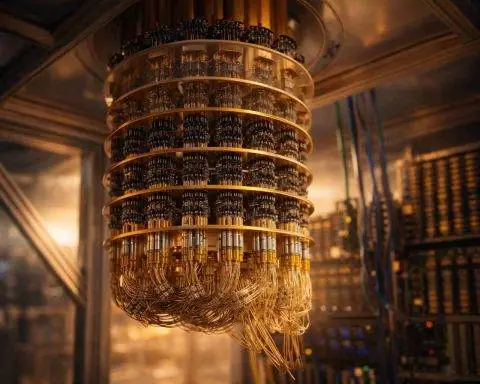

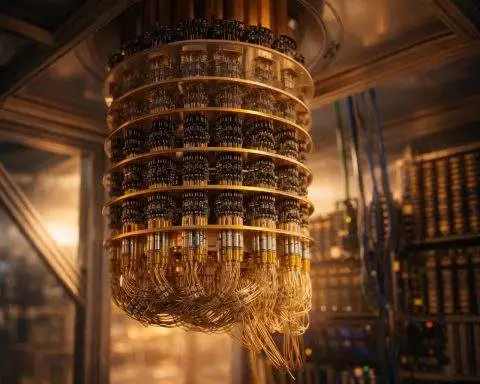

IonQ stock jumps nearly 22% after results; 2026 revenue outlook and SkyWater deal in focus

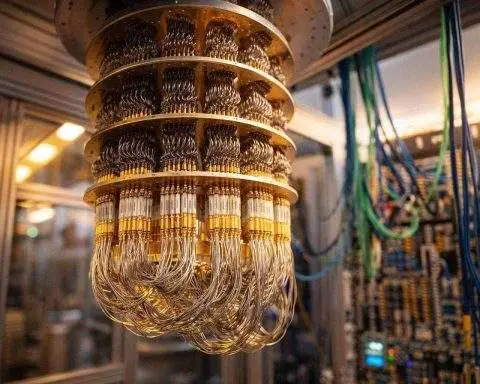

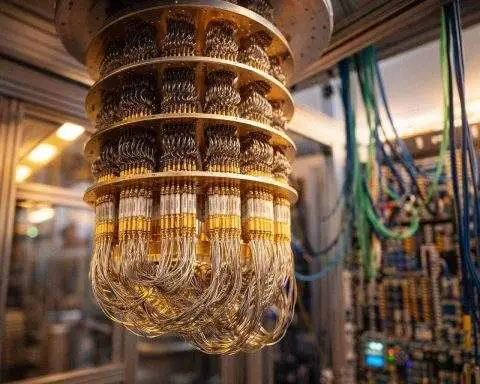

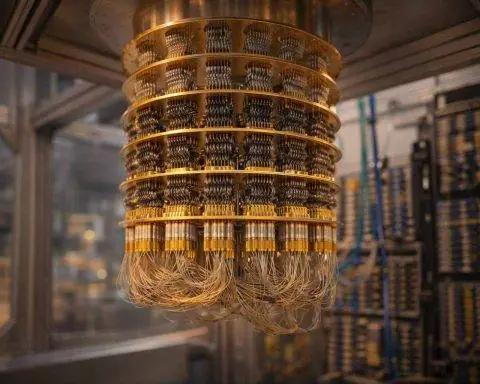

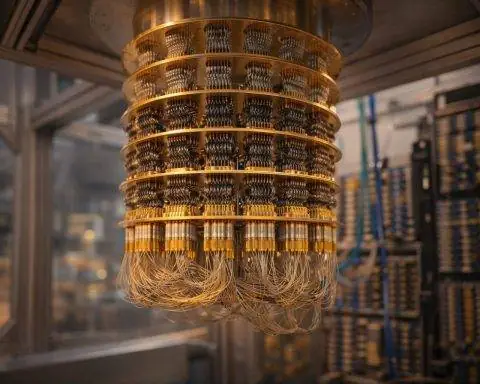

IonQ shares jumped 21.7% to $40.88 after reporting fourth-quarter revenue of $61.9 million and a 2026 forecast above expectations. Trading volume reached 66.4 million shares. The company aims for an operational 256-qubit system by late 2026 and announced quantum-secured links in Romania. Wall Street targets diverged, with price estimates ranging from $35 to $100.