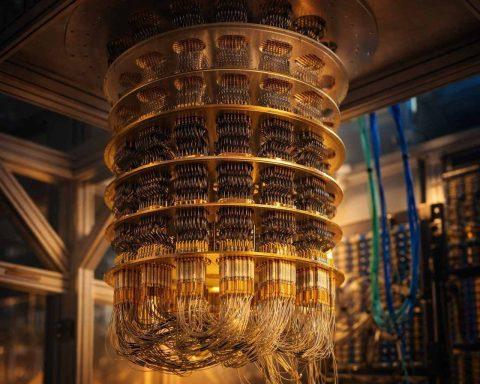

D-Wave Quantum (QBTS) stock drops after hours as quantum shares wobble — what to watch next

D-Wave Quantum shares fell 7.4% to $23.75 in after-hours trading Monday, erasing earlier gains above $26. Other quantum-computing stocks, including IonQ and Rigetti, also dropped sharply. The declines came ahead of D-Wave’s Qubits conference in Florida this week, where investors expect updates on its product roadmap and customer progress. IonQ announced a $1.8 billion deal to acquire SkyWater Technology.