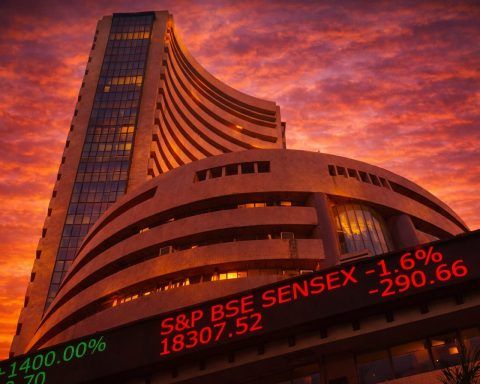

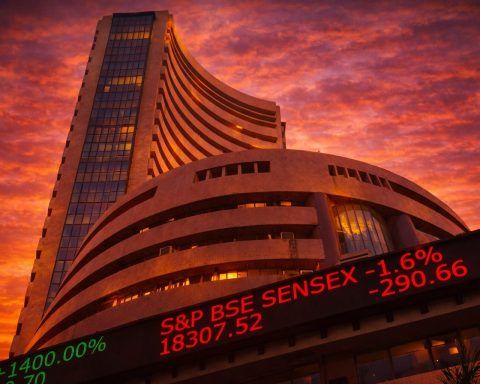

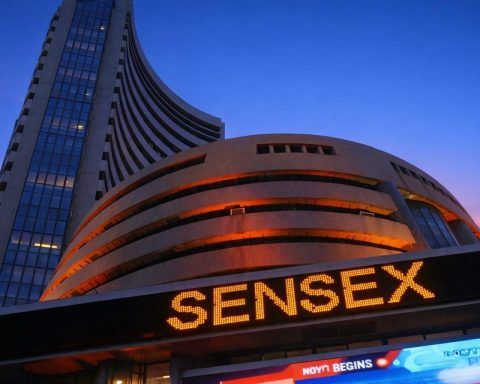

India stock market today: Sensex slides 1.3%, Nifty breaks 25,250 as selling spreads beyond IT

The Sensex plunged 1,065.78 points to 82,180.47 and the Nifty 50 fell 353 points to 25,232.50 on Tuesday, with mid- and small-cap indices down over 2%. Foreign investors sold Indian shares worth 32.63 billion rupees Monday. The rupee slipped past 91 to the dollar, near record lows. Realty, IT, and financial stocks led losses as traders watched earnings and global trade tensions.