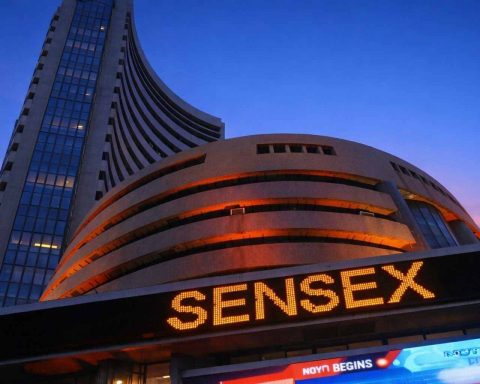

How to Invest in the Indian Stock Market for Beginners — What Today’s Nifty Move Tells You

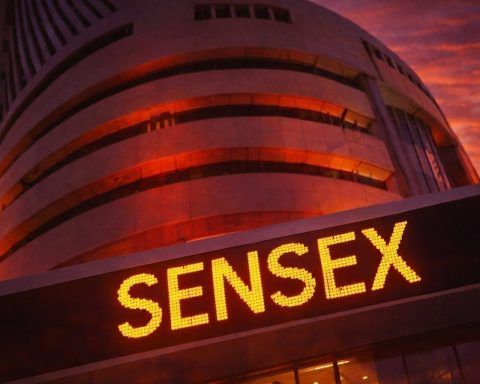

India’s Nifty 50 rose 0.17% and Sensex gained 0.21% Tuesday, led by a 1.9% jump in Infosys after its Anthropic AI deal, while Reliance Industries fell. Adani Enterprises surged 2.7% on a $100 billion data center plan. Nifty IT climbed 1% after last week’s slide; metal stocks dropped. Quarterly profit growth for Nifty 50 firms reached 7.5% year-on-year.