Top Stocks to Buy Today in India: ITC, Tata Steel, Dr Reddy’s, Coal India, Ajanta Pharma and More (24 December 2025)

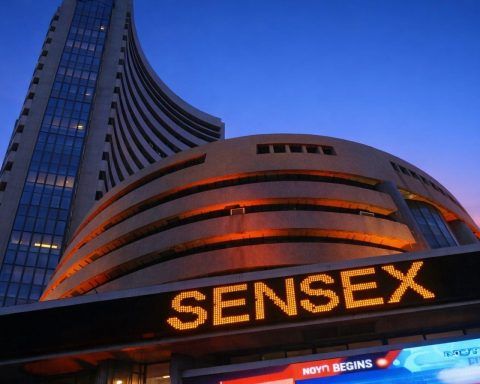

Mumbai, December 24, 2025: Indian equities opened with a mild uptick on Wednesday as strong US growth cues supported risk appetite, but the session stayed choppy as IT stocks weighed and holiday-thinned volumes kept moves contained. In early trade, the Nifty 50 hovered near the 26,200 zone and the Sensex was around 85,600, with most sectors edging higher even as tech stocks slipped. Reuters As the day progressed, the mood turned more cautious. By late afternoon, benchmark indices had slipped into the red, with pharma, IT and select FMCG heavyweights dragging, even as autos, healthcare and infrastructure names provided pockets