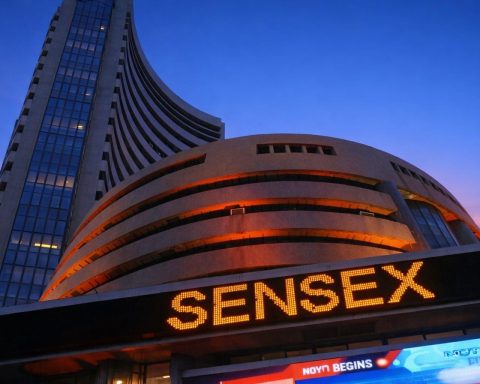

India stock market today: Sensex, Nifty snap three-day run as January ends with sharp monthly drop ahead of Budget

Indian shares posted their steepest monthly drop since February 2025, with the Nifty 50 down 3.1% in January and the Sensex off 3.5%. The rupee closed at a record low of 91.9825 per dollar after a 2.3% monthly slide. Metals and banking stocks led declines, while foreign outflows and uncertainty over a U.S. trade deal pressured markets. Nestle India shares rose 4% on strong earnings; Ambuja Cements and South Indian Bank slumped.