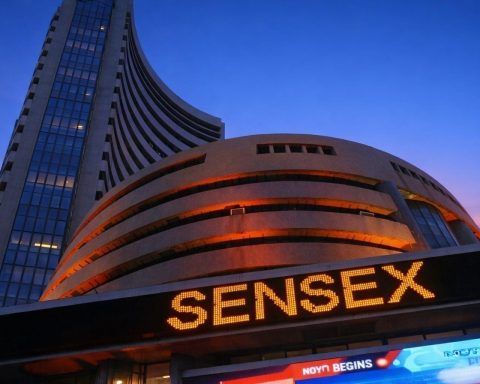

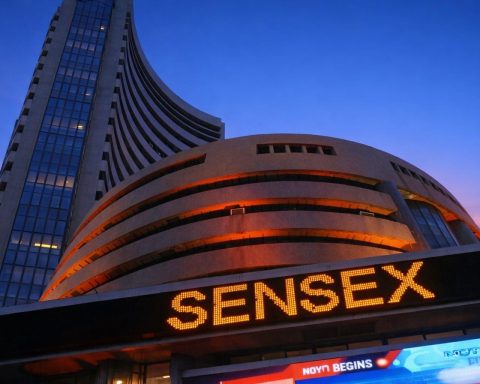

India stock market today: Nifty dips for third day as tariff jitters weigh; jewellers shine

Nifty 50 closed at 26,140.75, down 0.14%, and Sensex at 84,961.14, down 0.12% on Wednesday. Autos and oil & gas stocks fell, while IT and jewellery shares rose, with Titan hitting a record high. Reliance Industries dropped 4.5% after warning of no Russian crude deliveries in January. Investors remain cautious amid renewed U.S. tariff threats over India’s Russian oil purchases.