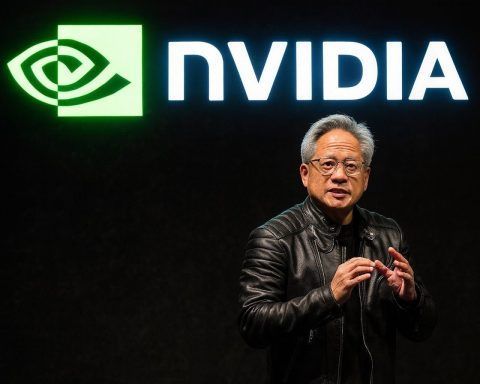

Nvidia Stock News Today (November 29, 2025): AI Bubble Debate, Google TPU Threat and What $NVDA at $177 Really Means

After another wild month for artificial intelligence shares, Nvidia Corporation (NASDAQ: NVDA) goes into the final stretch of 2025 with its stock in a tug‑of‑war between spectacular fundamentals and mounting skepticism. Nvidia just reported record quarterly revenue and remains the dominant supplier of AI accelerators. Yet fresh headlines about Meta exploring Google’s custom AI chips, short sellers invoking Enron, and a high‑profile debate over whether AI is in a bubble have pushed NVDA into a sharp November slump. NVIDIA Investor Relations+1 This article rounds up the key Nvidia stock stories published on November 29, 2025 and what they mean for