Freeport-McMoRan stock climbs as copper hits a fresh record — what to watch next for FCX

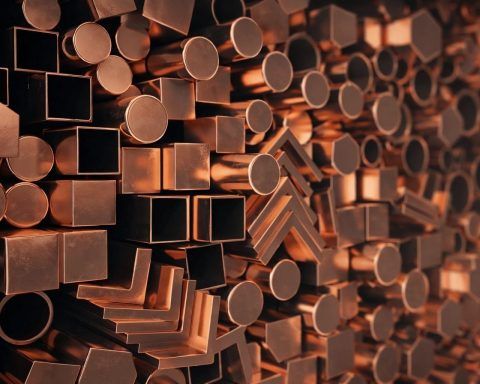

New York, Jan 14, 2026, 14:27 EST — Regular session Freeport-McMoRan shares climbed roughly 2% Wednesday afternoon, boosted by another jump in copper prices that kept the miner close to its yearly peak. The stock hit $60.50, up 1.9%, and briefly touched $61.13 earlier in the session. This matters because FCX has turned into a fast route for equity investors betting on copper, a metal now behaving less like a basic industrial commodity and more like a scarce financial asset. Each additional dollar in copper prices can swiftly reshape profit calculations for miners sitting on large, long-term copper deposits. Copper’s