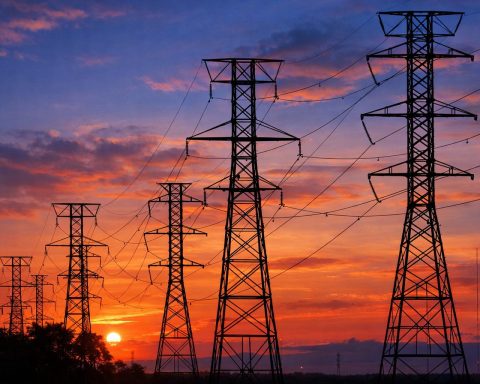

Constellation Energy stock sinks nearly 7% as PJM price-cap push keeps traders cautious ahead of earnings

Constellation Energy shares fell 6.7% to $250.46 Wednesday on heavy volume after Washington pressed PJM to cap power prices and speed up grid connections for data centers. The drop came despite Constellation’s recent $7 billion Calpine acquisition, which made it the largest U.S. electricity producer. Other wholesale power stocks also declined, while NextEra Energy rose 1.3%.