Sibanye Stillwater stock jumps 7% on record platinum and HSBC upgrade — what to watch next week

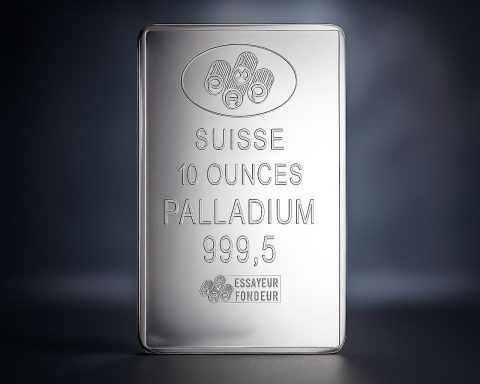

Sibanye Stillwater’s ADR jumped 7.16% to $19.45 on the NYSE Friday, following a broker upgrade and platinum’s surge to a record $2,684.43 an ounce. The company’s Johannesburg shares rose 6.29% to 77.79 rand. HSBC raised its price target to $24.80. Sibanye will hold a strategy update Jan. 29 and report year-end results Feb. 20.