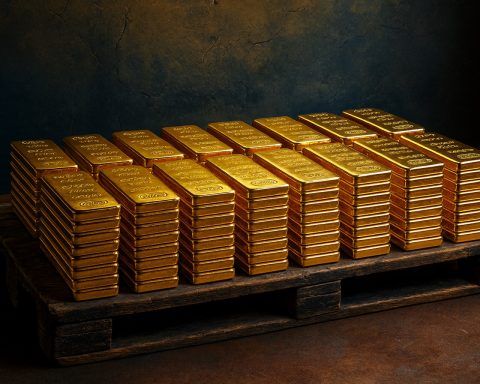

Gold Prices Rally to New Records in Early October 2025

Gold prices surged in early October 2025, repeatedly hitting new all-time highs above $4,000 per ounce as investors sought safe-haven assets amid mounting global uncertainty. From October 1 to 11, the gold spot price climbed steadily (London PM fix and New York futures both setting records), with U.S. December futures briefly topping the $4,000 mark on October 7 and again on October 10reuters.comreuters.com. After a strong rally in late September, spot gold accelerated into October – for example, futures soared to $4,014.6 on October 7reuters.com and to $4,059.05 on October 8reuters.com. When profit-taking and easing volatility entered on Oct. 9