Texas Instruments stock dips as Weebit Nano ReRAM license lands — what TXN investors watch next

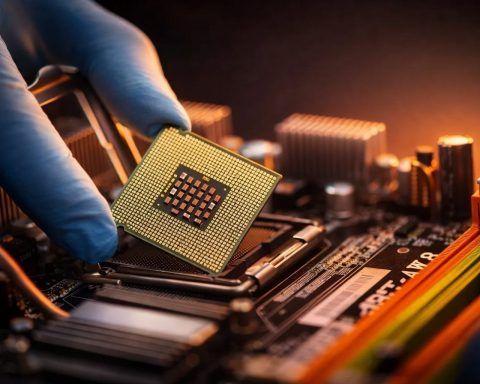

NEW YORK, December 29, 2025, 13:55 ET — Regular session Texas Instruments shares fell 0.8% to $175.49 in afternoon trading on Monday after Weebit Nano said it licensed its resistive random access memory (ReRAM), a type of non-volatile memory that retains data without power, to the chipmaker. “We are excited to collaborate with Weebit Nano to integrate ReRAM memory technology into our process technologies and products,” Amichai Ron, senior vice president of TI Embedded Processing, said. Weebit The deal matters because chipmakers are looking for alternatives to embedded flash memory as they pack more features into smaller chip designs and