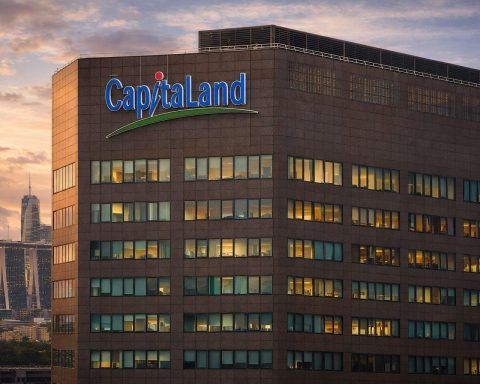

CapitaLand Investment share price jumps into earnings week as 9CI closes at S$3.12

CapitaLand Investment shares closed up 1.3% at S$3.12 on Friday, outperforming the STI, which fell 0.83%. CapitaLand Integrated Commercial Trust reported a 16.4% rise in second-half distributable income to S$449 million and a 9.4% increase in distribution per unit. Full-year results for CapitaLand Investment are due Feb. 11. Markets are closed for the weekend.