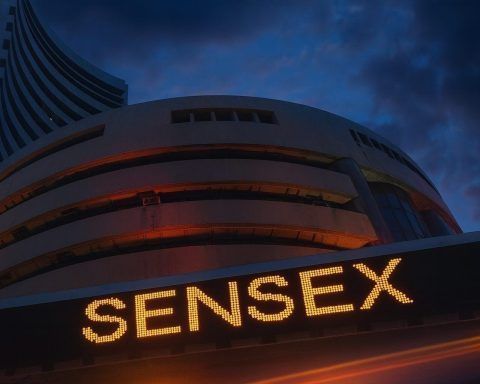

Indian Stock Market Today, 10 December 2025: Sensex, Nifty Extend Losing Streak Ahead of Fed; Meesho Soars Over 50% on Debut

Indian equities ended lower for the third straight session on Wednesday, 10 December 2025, as traders cut risk ahead of a crucial US Federal Reserve policy decision and continued foreign outflows weighed on sentiment. The S&P BSE Sensex slipped 275 points (‑0.32%) to close at 84,391.27, while the NSE Nifty 50 fell 81.65 points (‑0.32%) to settle at 25,758. Business Standard+2Trendlyne.com+2 Broader markets underperformed, midcaps and smallcaps saw deeper cuts, and yet, India’s IPO party rolled on as Meeshoand Aequs made strong market debuts despite the weak headline indices. Nasdaq+2Trendlyne.com+2 Key takeaways from the Indian stock market today (10 December 2025) How Sensex and Nifty traded today The Indian stock market opened on a mildly