NEW YORK, December 30, 2025, 03:18 ET — Market closed.

- QBTS closed up 3.4% on Monday, outpacing other U.S.-listed quantum-computing peers.

- Traders are watching Fed minutes due Tuesday afternoon for clues on the rate outlook and risk appetite.

- D-Wave’s next visible catalysts include CES Foundry (Jan. 7–8) and its Qubits 2026 user conference (Jan. 27–28).

D-Wave Quantum Inc shares rose 3.4% on Monday to close at $26.15, after swinging between $25.02 and $26.75. About 32.3 million shares traded.

The move keeps the spotlight on pure-play quantum computing stocks into the final trading days of the year, when thin liquidity can magnify price swings. D-Wave was up about 201% year-to-date, Investors.com reported, and it pegged the stock’s average true range — a measure of typical daily movement — at about 10%. Investors

A fresh macro test lands Tuesday afternoon, when the Federal Reserve is scheduled to publish minutes from its Dec. 9–10 meeting at 2 p.m. ET. The minutes are the central bank’s detailed record of what policymakers debated, and they can shift rate expectations that often steer risk-sensitive stocks. Federal Reserve

D-Wave has whipsawed since a late-December burst, jumping about 20% on Dec. 22 and reaching a high around $32.39 before sliding in subsequent sessions, including an 8.1% drop on Dec. 26. Investing.com

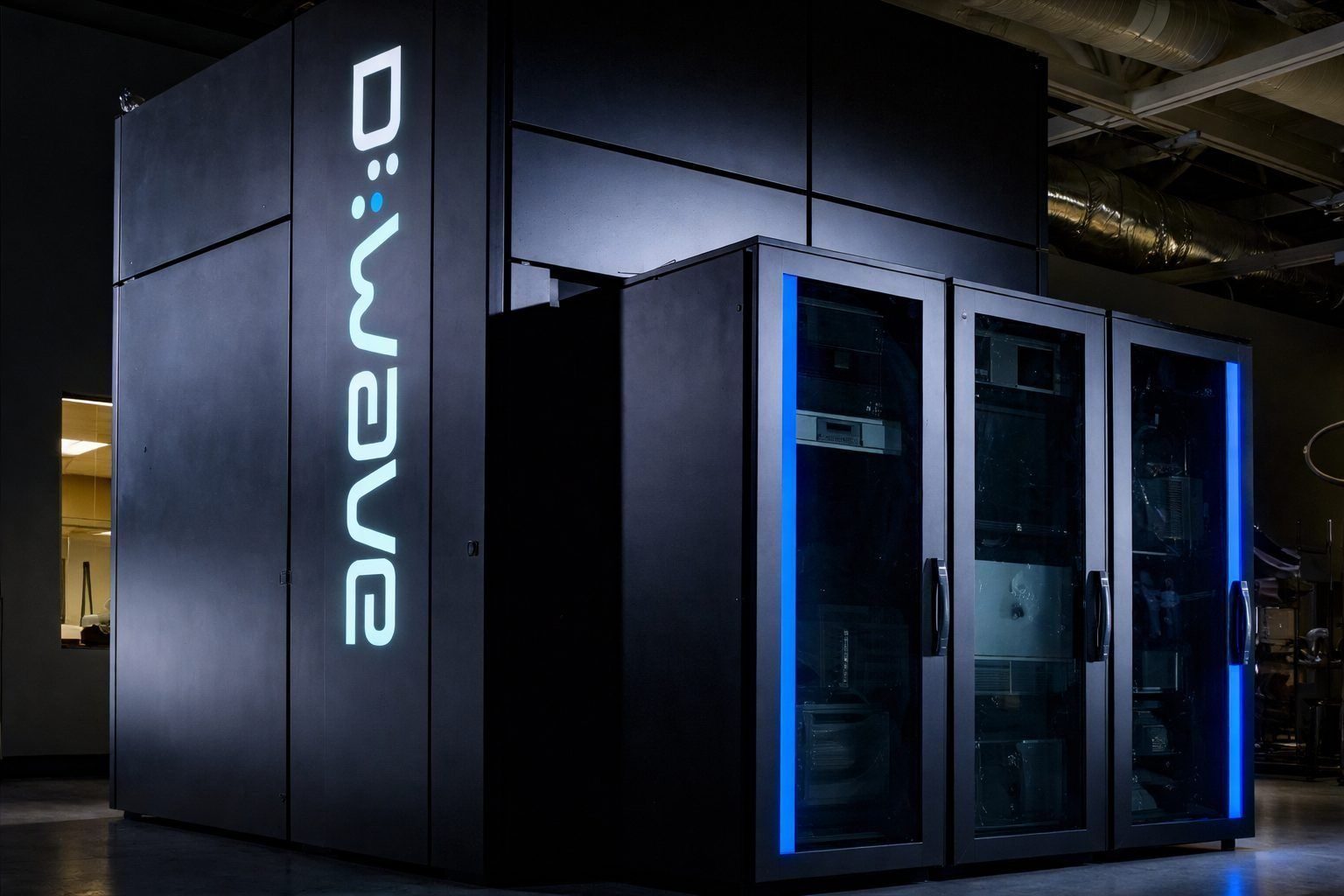

Company news has centered on early-2026 showcases. D-Wave said it will participate in CES 2026 as a sponsor of the CES Foundry on Jan. 7–8 in Las Vegas, where it plans to highlight customer use cases for its annealing quantum systems — machines aimed at optimization problems such as scheduling and routing. D-Wave Quantum

“Showcasing quantum computing at CES … signals that the technology is quickly moving into the mainstream,” said Murray Thom, D-Wave’s vice president of quantum technology evangelism. D-Wave Quantum

A Dec. 8 SEC filing showed D-Wave’s Qubits 2026 user conference will be held Jan. 27–28 in Boca Raton, Florida, featuring talks from executives, customers, industry leaders and scientists. The company said the event will highlight how its hybrid quantum-classical solvers — software that mixes quantum and conventional computing — are being used today. SEC

Other U.S.-listed quantum names were mixed in late Monday quotes: IonQ was down 1.6%, Rigetti Computing slipped 0.4%, and Quantum Computing Inc fell 0.8%.

The divergence underscores how quickly flows can rotate inside a small, high-beta corner of the market, where narratives can move faster than fundamentals. For investors, the hard test remains commercial traction — turning pilots into recurring revenue — rather than one-off demonstrations.

Before the Dec. 30 regular session, traders will be watching whether QBTS holds above $25, near Monday’s low, and whether it can clear Monday’s $26.75 high. Those levels sit in a stock that has already shown it can travel a long way in a short time.

Macro risk sits front and center: the Fed minutes are due at 2 p.m. ET, and MarketWatch said weekly U.S. jobless claims are scheduled for Wednesday because markets will be closed for New Year’s Day on Thursday. MarketWatch