Dec. 18, 2025 — U.S. markets, early afternoon (about 1:50 PM ET at the time of writing).

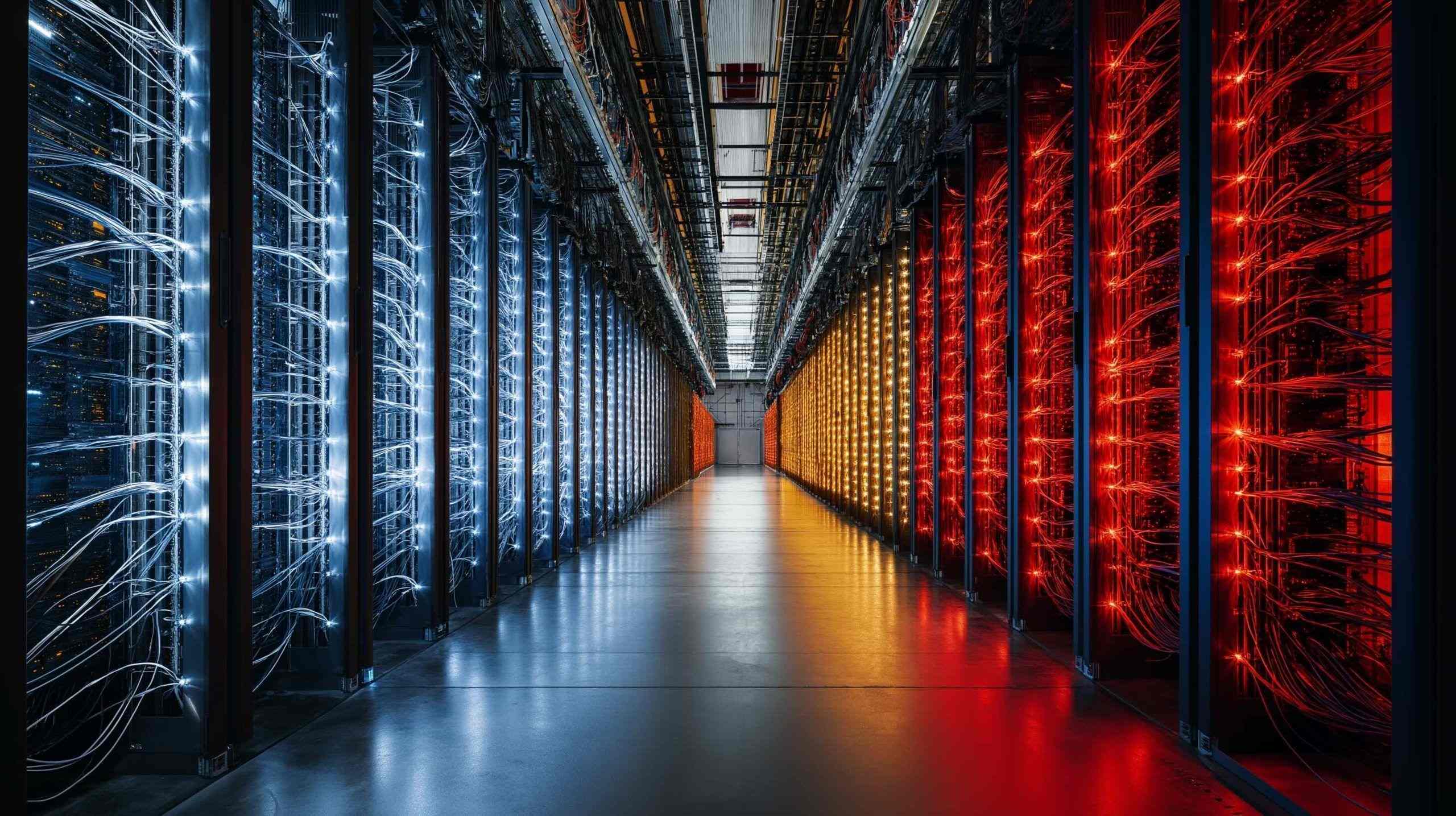

U.S.-listed data center stocks are back in focus today as investors rotate into (and selectively out of) the companies that power the AI buildout: memory and accelerators, high-speed networking, server OEMs, data center REITs/operators, and the “picks-and-shovels” layer of power, cooling, and grid infrastructure.

The tape is being driven by two cross-currents:

- A macro tailwind after an unexpectedly soft inflation print—though the data came with caveats tied to the recent U.S. government shutdown. Reuters+1

- A micro catalyst from Micron, whose outlook revived confidence that AI data center demand is still accelerating—at least for memory and the supply chain directly attached to hyperscale spending. Reuters+1

Below is what matters most for data center investors today (12/18/2025)—the headlines, analyst takes, and the forecasts that are moving U.S. data center stocks at midday.

Midday market snapshot: risk appetite improves, but the “AI trade” stays selective

Stocks broadly climbed after the November CPI came in cooler than expected, helping lift rate-cut expectations. Reuters reported CPI up 2.7% year over year (vs. economists’ 3.1% forecast), but also noted the reading was heavily affected by technical distortions from a 43‑day government shutdown that disrupted data collection; BLS also canceled October’s CPI and unemployment releases. Reuters+1

By midday, major indexes were near session highs, with the Nasdaq up about 1.9% and the S&P 500 up about 1.2% in MarketWatch’s live coverage—an important backdrop for high-beta data center and AI infrastructure names. MarketWatch

Data center stock prices today: who’s leading (and lagging) at midday

As of roughly 1:35 PM ET (latest trade timestamps in the data below), several bellwether data center beneficiaries were higher, led by memory, cooling/power infrastructure, and electrification plays:

- Micron (MU): +13.7% to $256.49

- Nvidia (NVDA): +2.3% to $174.93

- AMD (AMD): +2.1% to $202.20

- Broadcom (AVGO): +1.2% to $329.94

- Vertiv (VRT): +3.5% to $155.02

- GE Vernova (GEV): +4.9% to $644.31

- Constellation Energy (CEG): +6.1% to $361.92

- Vistra (VST): +3.6% to $165.78

- Quanta Services (PWR): +2.3% to $423.96

Meanwhile, parts of the data center REIT/operator space were mixed to lower:

- Digital Realty (DLR): -0.7% to $147.36

- Equinix (EQIX): -0.3% to $745.95

And in the server/enterprise hardware layer:

- Dell (DELL): -2.6% to $124.58

- HPE (HPE): -0.3% to $23.945

- Arista (ANET): +2.4% to $125.27

- Marvell (MRVL): +3.7% to $84.74

- Cisco (CSCO): +2.0% to $77.54

These moves reflect a familiar pattern in AI infrastructure: investors pay up for the bottleneck, and right now the bottlenecks are HBM (high-bandwidth memory), power delivery, cooling, and grid capacity.

Micron is today’s “AI data center read-through,” and Wall Street is treating it like a demand reset

The biggest single catalyst in U.S. data center stocks today is Micron’s blowout earnings and outlook, which directly speaks to AI server buildouts because HBM is a key input into AI accelerators.

Reuters reported Micron forecast quarterly revenue above estimates as the company cited strong demand from data centers driven by cloud providers’ spending, and noted Micron is adjusting production to focus more on AI data center demand. Reuters+1

Barron’s highlighted how far expectations moved after the print: Micron posted $13.6B revenue vs. $12.9B expected, EPS $4.78 vs. $3.96 expected, and guided to a revenue midpoint of $18.7B vs. $14.3B expected. Barron’s

The crucial data-center-specific line item: HBM. Reuters quoted Micron’s CEO warning that HBM supply may meet only about half to two-thirds of demand next year, reinforcing the idea that data center demand is strong enough to keep supply tight. Reuters

That’s why the “AI complex” stabilized quickly. Barron’s explicitly tied Nvidia’s rebound to Micron’s results easing fears about AI spending durability, while also flagging persistent HBM tightness as a real constraint. Barron’s

What this means for data center investors today:

- Strong Micron guidance is being interpreted as validation that hyperscalers are still buying, not just talking. Reuters+1

- Tight HBM supply keeps pricing power and urgency high—supportive for the high-performance AI server supply chain that depends on these memory stacks. Reuters

Oracle: the most important “data center financing” story in the market is still unresolved

Even with the Micron-driven rebound, investors are still wrestling with a key question: Can mega-scale AI data centers be financed smoothly as capex ramps?

Oracle is central to that debate because it is positioned as a major AI infrastructure supplier to OpenAI—but it’s also the name that sparked funding jitters this week.

- MarketWatch reported Oracle slid after concerns that a partner (Blue Owl) stepped back from funding a $10B Michigan data center project, even as Oracle and its partner disputed the claim and analysts argued the market reaction looked overdone. MarketWatch+1

- Axios’ local reporting described the Michigan project as facing financial uncertainty, citing an FT report about Blue Owl’s exit (which the developer disputes), alongside community and regulatory friction around power supply approvals. Axios+1

Reuters Breakingviews took the macro version of that argument further: it framed Oracle’s AI strategy as aggressively debt- and capex-heavy, noting capex could reach $35B by May 2026 and highlighting risks tied to the pace and funding of its AI data center ambitions. Reuters

Why this matters for the whole data center stock universe: Oracle’s situation is being treated as a test case for whether the AI buildout stays primarily hyperscaler-funded, or increasingly shifts toward private credit, project finance, and infrastructure partners—with all the financing risk that implies. MarketWatch+1

Power and grid capacity are becoming the market’s “second derivative” data center trade

The next major theme hitting data center stocks today isn’t silicon—it’s electricity.

Reuters reported that prices in the biggest U.S. power grid capacity auction hit a new record, signaling higher utility bills and underscoring the supply crunch as AI data center demand rises. Reuters

That is helping explain the strength in power generation and electrification-exposed stocks that investors increasingly group into the data center trade—names like Constellation Energy, Vistra, and GE Vernova.

Barron’s also captured a key nuance: these power-adjacent “AI beneficiaries” can be volatile because the market is now pricing not only data center expansion, but also whether future AI chips reduce power consumption, potentially dampening the growth rate of electricity demand. Barron’s

A separate (but related) signal today: Investor’s Business Daily reported FuelCell Energy surged after emphasizing AI data centers as a target market, reflecting how “behind-the-meter” and alternative power solutions are being pulled into the data center narrative as grid constraints tighten. Investors.com

Data center REITs and operators: mixed tape today, but fresh bullish coverage for Digital Realty

Unlike the chip-and-infrastructure layer, data center REITs are more rate-sensitive and often trade on leasing spreads, development pipelines, and capital costs.

A notable bullish catalyst today: Investing.com reported Goldman Sachs initiated coverage of Digital Realty (DLR) with a Buy rating and a $188 target, highlighting a development pipeline of $6.4B / 730 MW under construction (including JV share) expected to come online in 2026. Investing.com+1

Yet the stock was still lower at midday, underscoring how investors are weighing long-duration development stories against today’s macro uncertainty and capital market sensitivity.

On the operator side, Equinix put out a fresh, very “Discover-friendly” corporate update today: it said it was positioned as a Leader in the IDC MarketScape: Latin America Datacenter Services 2025–2026 assessment, and emphasized its footprint and sustainability posture—270+ data centers in 36 countries, including 19 data centers across 5 Latin American countries. Equinix Newsroom

Equinix also highlighted operational efficiency and renewable coverage in the region—pointing to an average reported PUE as low as 1.39 and stating all Equinix data centers in Latin America have 100% renewable energy coverage. Equinix Newsroom

Why REIT/operator investors care today: as communities push back on new builds and grids tighten, “licensed-to-operate” advantages—power access, network density, and sustainability credibility—can translate into better leasing and pricing power. Equinix Newsroom+2Investors.com+2

Dell’Oro’s new forecast today: data center capex is still accelerating—and the scope is widening

One of the most important “big picture” datapoints in the data center stock ecosystem dropped today from Dell’Oro Group.

Dell’Oro said worldwide data center capital expenditures rose 59% year over year in 3Q 2025, marking the eighth consecutive quarter of double-digit growth, and noted the AI cycle is broadening beyond early training-focused deployments. Delloro

Key lines for public-market investors:

- Dell’Oro said the top four U.S. cloud providers—Amazon, Google, Meta, and Microsoft—continue to raise 2025 capex expectations, and added that Oracle is on track to double its data center capex as it expands capacity for the Stargate project. Delloro

- It also said the global data center capex growth outlook was raised through 2026, signaling that “AI data center stocks” may be less about a single-year surge and more about a multi-year capex regime. Delloro

- Dell’Oro noted accelerated server spending surged in the quarter, driven by the ramp of NVIDIA Blackwell Ultraplus custom accelerators across hyperscalers and sovereign/neo-cloud deployments. Delloro

- In server OEM revenue, Dell’Oro said Dell led, followed by HPE and Lenovo, while white-box vendors captured most shipments. Delloro

This matters for today’s tape: it supports why investors are comfortable bidding up memory, accelerators, networking, and physical infrastructure even as individual names (like Oracle) face financing scrutiny.

The “backlash” factor: local opposition and electricity-rate politics are becoming investable risks

Data center investing in 2025 isn’t only about demand—it’s also about permission, power, and public scrutiny.

- Investor’s Business Daily reported a growing U.S. backlash against data center construction tied to grid strain and electricity costs, while also citing forecasts that global data center construction spending could surge sharply into 2030. Investors.com

- The Guardian documented intense local opposition to a Michigan mega-project linked to OpenAI/Oracle efforts, with residents arguing about land use, environmental impact, and power costs. The Guardian

Even for investors who avoid political narratives, these stories are increasingly material because they can affect:

- project timelines,

- interconnection approvals,

- cost of power, and

- ultimately, the profitability of leasing capacity.

What to watch next: the four questions likely to steer data center stocks into year-end

Heading into the final stretch of 2025, today’s news flow sets up four investor checkpoints for the data center trade:

1) Does HBM stay the choke point?

Micron’s supply comments suggest constraints persist—supportive for pricing power, but a risk for AI server delivery schedules. Reuters+1

2) Can AI data center capex keep expanding without triggering a financing accident?

Oracle’s situation is the market’s real-time stress test for project finance confidence. MarketWatch+2Reuters+2

3) Will grid constraints become the dominant limiter?

Record capacity auction prices reinforce that electricity is no longer a “given,” which can rerate both utility/power equipment winners and data center operators with advantaged sites. Reuters+1

4) Do rates cooperate?

CPI helped today, but the shutdown’s distortion means rate expectations may remain volatile—especially relevant for REIT-style data center stocks with long-duration cash flows. Reuters

Bottom line for investors watching U.S. data center stocks today

The midday story in U.S. markets on Dec. 18, 2025 is that data center stocks are recovering in layers:

- Silicon and memory are getting the strongest bid, led by Micron’s outlook and the read-through to AI server demand. Reuters+1

- Physical infrastructure and electrification are participating as markets confront the reality that AI data centers are, increasingly, a power-and-cooling problem as much as a compute problem. Reuters

- Data center REITs/operators are mixed today, but fresh bullish coverage and operator updates underscore that power access, network density, and sustainability positioning can still create winners—especially if community and grid constraints intensify. Investing.com+1

Prices and percentage moves are intraday and can change quickly. This article is market commentary, not investment advice.