- In June 2025 the French government announced a €1.35 billion capital injection into Eutelsat, via the Agence des participations de l’État, with €717 million to be injected and Bpifrance’s 13.6% stake absorbed, lifting France’s holding to 29.99%.

- France becomes Eutelsat’s largest shareholder as a result of the stake transfer, solidifying the 29.99% holding.

- The move is designed to create a European satellite champion to counter Starlink and to secure sovereign access to space infrastructure amid geopolitical tensions.

- Eutelsat was founded in 1977, pioneered Europe’s direct-to-home TV in the 1990s, merged with OneWeb in July 2022, and the deal closed on September 28, 2023 to form the current Eutelsat Group.

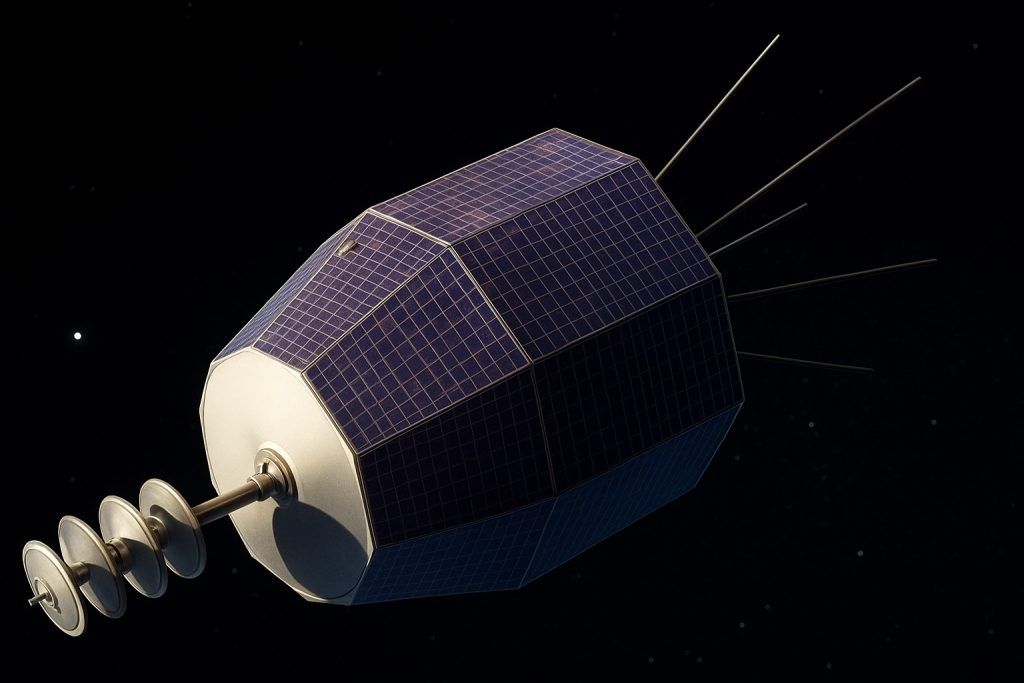

- The merged company operates roughly 30 GEO satellites and over 600 OneWeb LEO satellites, enabling multi-orbit capability.

- The June 2025 financing includes up to €2.2 billion in additional funding to support the expanded LEO fleet and related capex.

- Other anchor investors include Bharti Space at about 18.7%, CMA CGM at 7.8%, and the FSP fund at 5.2%, with Britain on 10.9% reportedly considering joining.

- France’s defense agency DGA signed a 10-year framework contract with Eutelsat worth up to €1 billion for military satellite communications via OneWeb.

- Eutelsat is part of the EU IRIS² program alongside SES and Hispasat, targeting a sovereign broadband constellation by around 2030 with about 1,000 satellites.

- On June 20, 2025, Eutelsat’s shares jumped about 28% on the day and were up roughly 60% for the year, reflecting market reaction to the recapitalization.

In June 2025 the French government announced a €1.35 billion capital injection into Eutelsat, Europe’s leading satellite operator marketscreener.com. Under the plan, the state (via its Agence des participations de l’État) will invest €717 million and absorb France’s existing 13.6% stake (held by the state bank Bpifrance), boosting its holding to 29.99% marketscreener.com spacenews.com. This deal makes France Eutelsat’s largest shareholder and is explicitly aimed at building a “European satellite champion” to rival U.S. players like Starlink marketscreener.com marketscreener.com. Officials stressed it ensures “sovereign access” to space infrastructure amid geopolitical tensions marketscreener.com defensenews.com. In French Finance Minister Eric Lombard’s words, satellite connectivity is a “strategic issue” for Europe’s digital sovereignty marketscreener.com reuters.com.

Historical Context: Eutelsat and the OneWeb Merger

Eutelsat traces back to 1977, when it was created to operate Europe’s first generation of communications satellites eutelsat.com. Over decades it grew into a global satellite broadcaster and internet provider. By the 1990s Eutelsat had pioneered Europe’s direct-to-home (DTH) TV and digital broadcast services, expanding its GEO fleet to dozens of satellites. In July 2022 Eutelsat agreed an all-share merger with Britain’s OneWeb (an existing LEO broadband startup) reuters.com, and on Sept. 28, 2023 the deal closed to form the new Eutelsat Group reuters.com. At that point Reuters ranked Eutelsat as the world’s third-largest satellite operator by revenue reuters.com.

The merger dramatically broadened Eutelsat’s portfolio: it now operates roughly 30 geostationary satellites plus over 600 OneWeb low-orbit satellites spacenews.com marketscreener.com. This multi-orbit capability is unique in Europe presse.economie.gouv.fr. Eutelsat had originally projected that combining with OneWeb would lift annual sales to about €2 billion by 2027 marketscreener.com. However, management soon found it needed a much larger LEO constellation than thought: it now estimates “more than three times” the number of satellites, requiring up to €2.2 billion in additional financing marketscreener.com spacenews.com. In short, Eutelsat is transforming from a traditional GEO broadcaster into a full-fledged multi-orbit broadband provider aligned with Europe’s push for satellite independence marketscreener.com.

France’s Stake Increase via Bpifrance and Strategic Rationale

France’s new investment leverages an existing state holding. Bpifrance, the French public investment bank, already owned 13.6% of Eutelsat spacenews.com. Under the June 2025 deal, the state-run Agence des participations de l’État (APE) will inject €717 million into Eutelsat and acquire Bpifrance’s 13.6% stake marketscreener.com. This will raise France’s total ownership to 29.99% marketscreener.com. Other anchor investors – including India’s Bharti Space (now ~18.7%), France’s CMA CGM (7.8%) and the French insurers-backed FSP fund (5.2%) – will also subscribe to the raise marketscreener.com spacenews.com. Talks are underway about Britain (which still holds 10.9%) joining the rights issue, but no commitment was announced marketscreener.com marketscreener.com.

This action was explicitly sold as a strategic move. The French press release emphasized that Eutelsat is “the only European operator with simultaneous presence in GEO and LEO”, and that reinforcing its capital supports Europe’s “industrial and digital sovereignty” presse.economie.gouv.fr marketscreener.com. Defense commentators note the broader goal is a “sovereign European alternative to Starlink” defensenews.com. President Macron, speaking at the Paris Air Show 2025, stressed that Eutelsat – as a non‑U.S./non‑Chinese LEO provider – is “a matter of sovereignty” and urged European partners to invest reuters.com. In parallel, France’s defense procurement agency (DGA) signed a 10‑year, up-to-€1 billion framework contract with Eutelsat (via its OneWeb constellation) for military satellite communications defensenews.com. Eutelsat is also part of the EU’s IRIS² program (with SES and Hispasat) to build a sovereign broadband constellation defensenews.com. All of this underscores that France’s capital injection is as much a geopolitical signal as a financial one.

Financial, Geopolitical and Technological Implications

Financially, the €1.35 billion raise – half of which France is funding – shores up Eutelsat’s balance sheet. The company had been “debt-laden” (roughly four times EBITDA) reuters.com and had acknowledged heavy upcoming capex (needing ~€2.2 billion more for the OneWeb fleet) marketscreener.com. The new equity will reduce leverage and improve financing flexibility: Eutelsat itself noted that fresh capital can help pay down debt and secure loans on better terms (including export credit) spacenews.com. JP Morgan analysts, however, caution that even after the raise Eutelsat’s net debt will remain around 3–4× EBITDA in the medium term reuters.com, posing a challenge to aggressive LEO expansion.

Geopolitically, this deal is laden with symbolism. It comes amid broader EU concerns about dependence on non-European space assets. European governments had grown wary of U.S.-owned satellites, especially after Trump-era trade and security policies, and have been reluctant to rely solely on Starlink for critical infrastructure marketscreener.com. By recapitalizing Eutelsat, France aims to keep a strategic space capability under European control. Macron and other leaders have explicitly tied the move to digital sovereignty, arguing that Europe must build its own space infrastructure rather than import it reuters.com marketscreener.com. This parallels initiatives like IRIS² – a €10+ billion EU public-private program to deploy a sovereign multi-orbit broadband network by 2030 – in which Eutelsat plays a key role defensenews.com.

Technologically, the funding helps Eutelsat pursue its multi-orbit roadmap. Eutelsat plans to spend up to €2.2 billion on new LEO satellites to sustain the OneWeb network, including ordering 100 more from Europe’s Airbus spacenews.com. Its GEO satellites (around 30 spacecraft) continue to provide broadcast and fixed-services, but the focus is on hybrid GEO-LEO services. The recapitalization also supports investments in ground infrastructure and satellites for IRIS², and potentially hybrid military/commercial networks (as hinted by France’s Nexus defense program with OneWeb). In short, France’s investment de-risks key technological projects for Eutelsat and by extension Europe’s space sector.

Market Reaction and European Impact

The announcement sent shockwaves through markets. On June 20, Eutelsat’s Paris-listed shares jumped dramatically: Reuters reported they “soared” on the news, ending the day up about +28% (and roughly +60% for the year) reuters.com reuters.com. Investors cheered the prospect of state backing and the vision of a stronger European satcom champion. The move also revived debate in Brussels and Paris on space funding: Macron used the moment to urge more EU investment in space infrastructure reuters.com. In effect, France’s policy decision has set a new benchmark: Europe is signaling it will back strategic tech in space, altering competitive dynamics in the satellite and telecom sectors.

For the European aerospace and telecom industries, the stakes are high. A newly recapitalized Eutelsat could compete more aggressively for EU contracts and partnerships (e.g. IRIS², warfighter connectivity) and provide a counterweight to American giants. Some analysts caution that large investors – and even other governments – may now revisit their positions. (Britain’s government, still holding 10.9%, is reportedly in talks about participating marketscreener.com, and other European satellite firms may seek collaborations or mergers to keep pace.) In any case, France’s commitment makes Eutelsat a de facto flagship for European space ambitions, likely increasing pressure on Brussels to bolster the continent’s satellite and telecom supply chains.

Challenges and Future Prospects for Eutelsat

Eutelsat still faces major challenges despite the backing.

- Debt and Funding Gap: Even with €1.35 billion raised, Eutelsat must finance a huge satellite build-out (up to 440 new LEO sats) and other capex. Its leverage will stay high – JP Morgan notes net debt will be ~4× EBITDA even in 2026 reuters.com.

- Competitive Pressure: SpaceX’s Starlink dominates LEO broadband (over 7,000 active sats as of 2025 marketscreener.com breakingdefense.com, millions of users) and has massive scale and low prices. Amazon’s Kuiper is just launching (27 sats in orbit so far) but plans ~3,200 satellites breakingdefense.com. Catching up in service coverage or cost will be difficult.

- Execution Risks: Eutelsat has warned that delays in ground stations and regulatory approvals could push its full global LEO service into late 2026 or beyond spacenews.com. Technical hurdles (space debris mitigation, network integration) remain non-trivial.

- Investor Scrutiny: Some shareholders and analysts remain wary. A June 2025 note commented that even a €1.35B rights issue may be “insufficient to support a truly competitive LEO strategy” reuters.com, and shareholders have seen the stock fall ~50% since the merger announcement reuters.com.

On the upside, if Eutelsat succeeds in these investments, it could reap significant rewards. It is well-positioned to capture European and government customers (e.g. military, remote broadband) who want a “non-American” satellite option reuters.com. The state offtake (e.g. defense contracts) provides a revenue floor, and partnerships on EU projects (IRIS²) promise future growth. Eutelsat’s management, led by CEO Eva Berneke, argues that solid fundamentals (engineering know-how, existing contracts, committed customers) underpin a sustainable business when fully funded presse.economie.gouv.fr. The government and Eutelsat have framed this capital infusion as an investment in Europe’s digital infrastructure – one that could pay off through new services, innovation, and industrial jobs.

Comparison with Starlink, Kuiper and Other Players

By contrast to Eutelsat, the U.S. and other players dominate the new LEO broadband market:

- SpaceX Starlink (USA): Starlink leads by far. It has launched ~7,000+ satellites (as of mid-2025 marketscreener.com) and serves millions of users worldwide. It pioneered low-latency internet from space and has military and enterprise contracts. Starlink’s scale and low pricing pose a major challenge to any rival.

- Amazon Kuiper (USA): Amazon is just getting started. It orbited its first 27 operational satellites in April 2025 breakingdefense.com and must field over 1,600 by mid-2026 under FCC license. Amazon plans roughly 3,200 total satellites breakingdefense.com. Kuiper will take years to reach meaningful coverage, and it remains to be seen if it can compete on price or reliability.

- OneWeb (UK/India, now part of Eutelsat): OneWeb’s ~650-satellite network is now owned by Eutelsat, so it isn’t a separate competitor. Initially backed by Bharti and SoftBank, OneWeb provides broadband (often via partner resellers). It has less coverage than Starlink and had struggled financially before the Eutelsat tie-up.

- SES (Luxembourg): Europe’s other large satcom operator (600+ GEO satellites) focuses on TV/video and secure communications from GEO. SES is participating with Eutelsat in the IRIS² program defensenews.com, but it has not committed to a standalone broadband LEO constellation (unlike Eutelsat).

- EU IRIS² (EU consortium): This is a planned multi-orbit EU broadband project (public-private) intended as a sovereign alternative. Eutelsat (with SES and Hispasat) was selected to help build and operate IRIS² defensenews.com. If completed by ~2030, IRIS² (with ~1000 satellites envisioned) could complement or overlap with Eutelsat’s ambitions. France’s move to reinforce Eutelsat can be seen as dovetailing with IRIS² rather than competing with it.

Strategic Significance for EU Sovereignty in Space and Broadband

France’s Eutelsat investment is a flashpoint in Europe’s broader quest for space autonomy. By making Eutelsat a “European champion,” the EU gains a major satellite asset under friendly control. It helps ensure that strategic data links (from disaster relief to defense) can use a European system, reducing reliance on U.S. companies. As Reuters emphasized, governments are keen for non-U.S. alternatives after recent geopolitical frictions marketscreener.com. The move also signals to other sectors (telecom, tech, cloud) that the EU is willing to back key infrastructure. In this way, bolstering Eutelsat’s balance sheet is part of a comprehensive strategy: strengthening Europe’s tech sovereignty in orbit, fostering a homegrown space industry, and guaranteeing a secure broadband backbone (complementing fiber) across the continent.

Together, these factors make the €1.35 billion recapitalization more than a financial transaction: it is a political-economic statement that space and broadband are strategic national interests for France (and increasingly for the EU). How effectively Eutelsat can leverage this support – overcoming its challenges to deliver new satellites and services – will determine whether Europe finally gains a credible counterweight to SpaceX and the like. For now, the deal has undeniably put Europe’s space ambitions in the spotlight and reshaped the competitive landscape.

Sources: Reuters (June 19-20, 2025) marketscreener.com marketscreener.com; French Finance Ministry press release (Jun 19, 2025) presse.economie.gouv.fr marketscreener.com; SpaceNews, Defense News, and other industry reports spacenews.com defensenews.com reuters.com breakingdefense.com. Each citation corresponds to the lines quoted above.