New York, January 28, 2026, 17:02 (EST) — After-hours

- Spot gold surged roughly 4%, edging close to $5,400 an ounce following new highs

- The Fed paused on rate changes, shifting focus to the timing of the next cuts

- Traders are eyeing upcoming U.S. inflation and jobs reports for the next market move

Gold prices jumped on Wednesday, staying close to $5,400 an ounce. The rally extended a record streak as investors continued snapping up the metal despite the Federal Reserve’s decision to hold rates steady.

The rally matters now because it’s looking less like a one-off spike and more like a shift in positioning. Gold has climbed over 25% this year, and the market is probing just how much risk capital remains on the sidelines.

It’s policy, not jewellery demand, driving the moves. Since gold yields no interest, cheaper borrowing costs make holding bullion more attractive compared to cash or bonds.

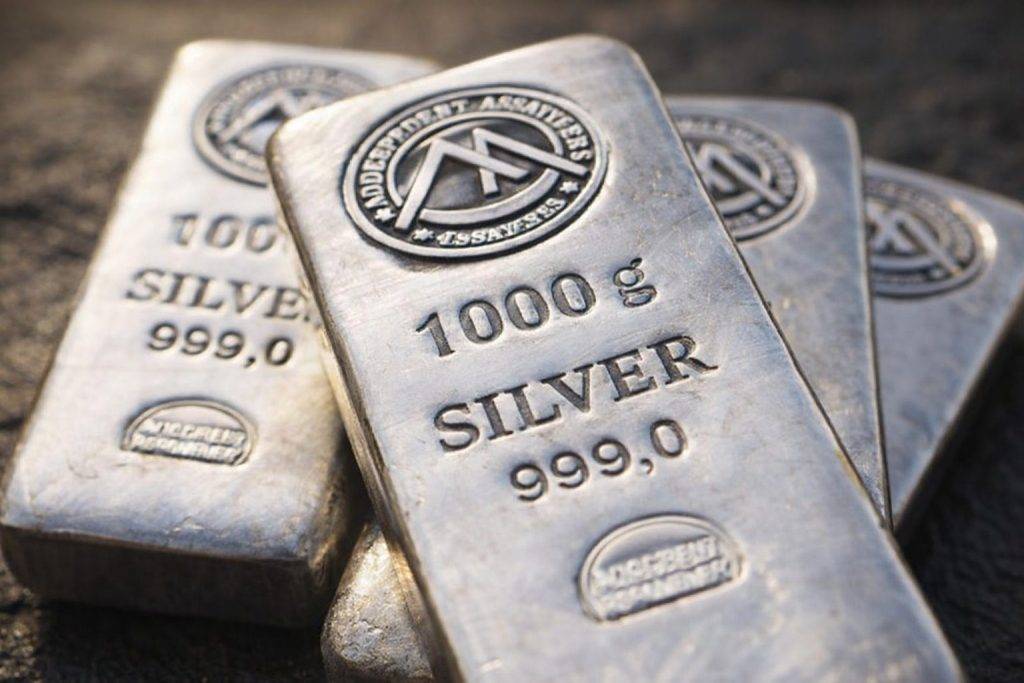

Spot gold surged 4% to $5,393.19 an ounce by 4:08 p.m. ET, while Comex February futures jumped 4.3%, closing at $5,303.60. Peter Grant, VP and senior metals strategist at Zaner Metals, said the precious metals rally “has kind of taken on a life of its own,” but noted gold looks “overbought,” a technical red flag signaling a possible pullback. Independent trader Tai Wong remarked that “precious metals simply don’t care that the Fed is clearly in hiatus mode.” Meanwhile, spot silver climbed 3.3% to $116.69, platinum rose 2.5% to $2,707.67, and palladium soared 7.2% to $2,073.50. Standard Chartered flagged some silver indicators suggesting a short-term correction could be coming. Reuters

Fed Chair Jerome Powell acknowledged that inflation is still “somewhat elevated,” even as officials noted the job market is showing signs of stabilising, following the central bank’s decision to keep its benchmark rate steady at 3.50%-3.75%. Treasury yields ticked higher after the announcement, while interest-rate futures delayed bets on the next cut to the June 16-17 meeting. Reuters

Talk of corporate buying is starting to surface. Tether CEO Paolo Ardoino revealed the stablecoin issuer aims to keep 10%-15% of its portfolio in physical gold. The company already holds roughly 130 metric tons and is adding about two tons weekly. “The world is not in a happy place at this moment… everyone is scared,” Ardoino said in a video interview. Reuters

That momentum pushing bullion higher this month could just as quickly flip. If yields tick up, the dollar gains strength, or headlines quiet down, those packed long positions might unravel fast, sparking swift profit-taking.

The bid remains stubborn for now. Traders highlight steady dip-buying and a market ready to overlook a Fed that isn’t rushing into rate cuts.

The next catalysts are imminent. Friday brings U.S. producer price data, then the February 6 employment report, a key indicator of whether the economy’s cooling enough to nudge the Fed toward rate cuts. The Fed’s upcoming meeting is set for March 17-18. bls.gov